NAND Flash Market Bulletin - Nov. 5, 2025

Last Modified

2025-11-05

Update Frequency

Weekly

Format

NAND Flash prices surged amid tight supply. Industry investment focuses on advanced tech: hybrid bonding, process upgrades. Overall bit growth limited.

Key Highlights

- NAND Flash prices surged in contract/spot markets; supply extremely tight, expected to rise.

- Manufacturers limited wafer release; holders hoarded stock, causing scarcity.

- Industry capex shifts to advanced tech: hybrid bonding, process migration.

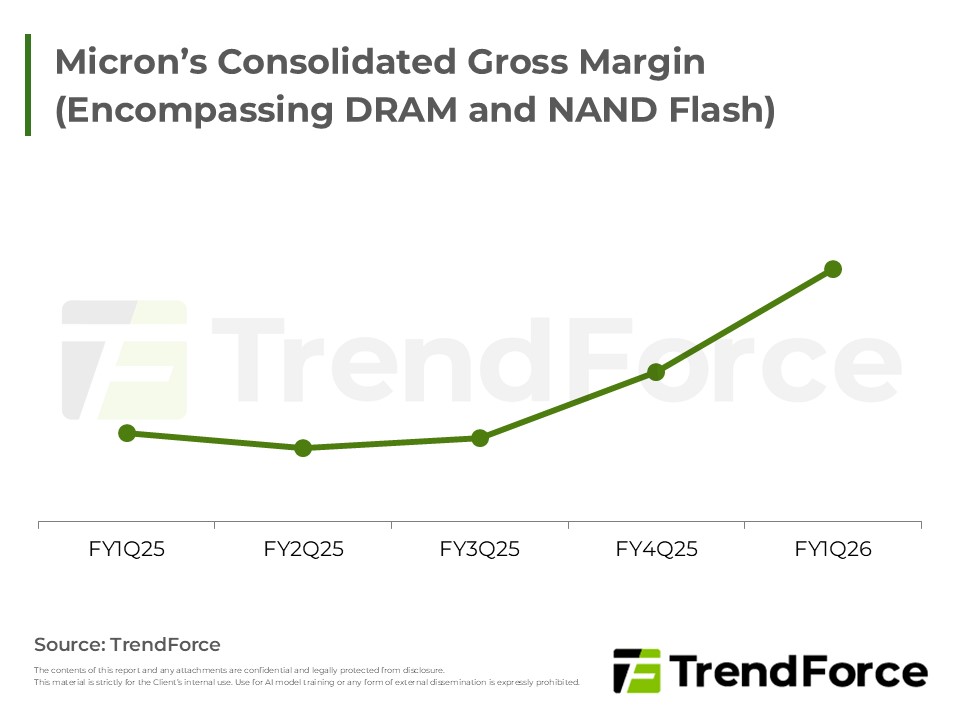

- Kioxia/SanDisk, YMTC aggressively expand; Micron boosts investment.

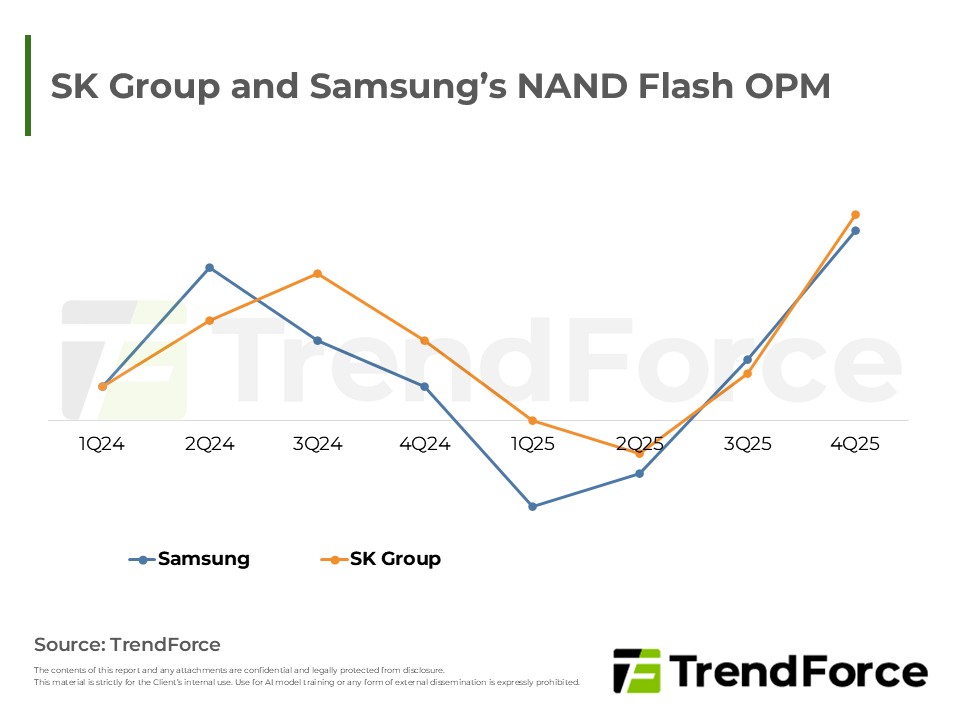

- Samsung, SK hynix/Solidigm cut NAND capex, prioritize HBM/DRAM.

- Increased investment, but limited future bit growth.

Table of Contents

- Market Update

- TrendForce’s View

- Major NAND Flash Suppliers’ Respective Capital Expenditure Figures

<Total Pages: 2>

Category: NAND Flash

Spotlight Report

-

AI Reshapes Memory: Market Revenue to Peak by 2027

2026/01/20

Semiconductors

PDF

-

Micron to Acquire PSMC’s Tongluo P5 Fab to Contribute to DRAM Supply for 2027

2026/01/18

Semiconductors

PDF

-

DRAM Monthly Datasheet Jan. 2026

2026/01/15

Semiconductors

EXCEL

-

HBM Industry Analysis - 1Q26

2026/02/04

Semiconductors

PDF

-

NAND Flash Monthly Datasheet Jan. 2026

2026/01/14

Semiconductors

PDF

-

1Q26 Memory Price Forecast

2025/12/30

Semiconductors

PDF

NAND Flash Market BulletinRelated Reports

Download Report

Membership

Spotlight Report

-

AI Reshapes Memory: Market Revenue to Peak by 2027

2026/01/20

Semiconductors

PDF

-

Micron to Acquire PSMC’s Tongluo P5 Fab to Contribute to DRAM Supply for 2027

2026/01/18

Semiconductors

PDF

-

DRAM Monthly Datasheet Jan. 2026

2026/01/15

Semiconductors

EXCEL

-

HBM Industry Analysis - 1Q26

2026/02/04

Semiconductors

PDF

-

NAND Flash Monthly Datasheet Jan. 2026

2026/01/14

Semiconductors

PDF

-

1Q26 Memory Price Forecast

2025/12/30

Semiconductors

PDF