Micron Stops Future Mobile NAND Flash Development, Focuses on High-Margin Sectors

Last Modified

2025-08-19

Update Frequency

Aperiodically

Format

Micron has announced the halt of future mobile NAND Flash development, shifting focus to higher-margin areas like SSDs and HBM. This move addresses market competition and sluggish demand, reallocating resources to more profitable sectors, enhancing competitiveness.

Key Highlights

- Micron has announced the cessation of future mobile NAND Flash development due to weak market demand and slow growth.

- This includes halting UFS 5.0 plans, while maintaining current product supply; other NAND Flash product lines remain unaffected.

- Micron's conservative capacity planning helps concentrate resources on high-profit areas, boosting competitiveness.

- Decision factors include:

- Intensified competition in the mobile market, especially in China, due to local brands and government policies.

- Sluggish global smartphone shipments, reducing mobile NAND Flash margins.

- Desire to allocate resources to high-margin areas like client/enterprise SSDs and high-bandwidth memory.

- Micron's FY3Q25 financial report shows an increase in NAND Flash revenue, but declining margins, with SSDs being the main growth driver.

- The company's strategy focuses on high-value applications, avoiding the overly competitive mobile NAND Flash market, aiming to strengthen its position in the AI and data center markets.

Table of Contents

- Micron Announces Termination of Future Mobile NAND Flash Development, TrendForce Views It as an Inevitable Shift from Fierce Market Competition to High Profit Margins

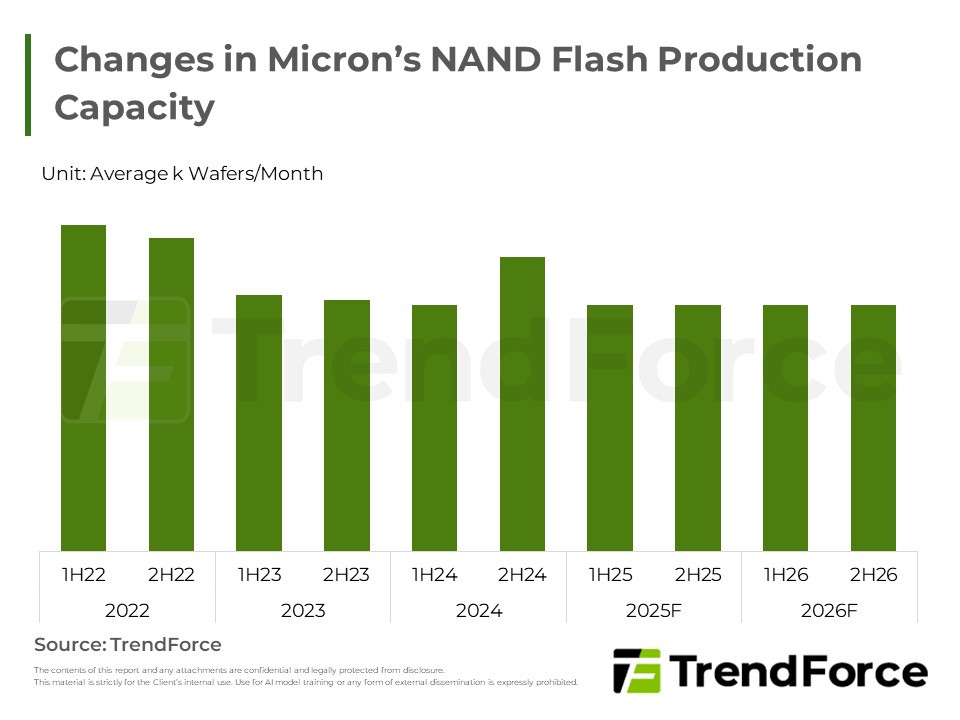

- Changes in Micron's NAND Flash Production Capacity

- Micron's Memory Business OPM Comparison Between DRAM and NAND Flash

- SSD Excels in Advantages and Became Centralized Point of NAND Flash Resources for Micron

<Total Pages: 6>

Category: NAND Flash , Semiconductors

Spotlight Report

-

AI Reshapes Memory: Market Revenue to Peak by 2027

2026/01/20

Semiconductors

PDF

-

Micron to Acquire PSMC’s Tongluo P5 Fab to Contribute to DRAM Supply for 2027

2026/01/18

Semiconductors

PDF

-

DRAM Monthly Datasheet Jan. 2026

2026/01/15

Semiconductors

EXCEL

-

NAND Flash Monthly Datasheet Feb. 2026

2026/02/11

Semiconductors

PDF

-

HBM Industry Analysis - 1Q26

2026/02/04

Semiconductors

PDF

-

1Q26 Memory Price Forecast

2025/12/30

Semiconductors

PDF

NAND Flash PlatinumRelated Reports

Download Report

USD $2,000

Membership

- NAND Flash Platinum

- Selected Topics

- Selected Topics-TF-0083_Micron Stops Future Mobile NAND Flash Development, Focuses on High-Margin Sectors

Spotlight Report

-

AI Reshapes Memory: Market Revenue to Peak by 2027

2026/01/20

Semiconductors

PDF

-

Micron to Acquire PSMC’s Tongluo P5 Fab to Contribute to DRAM Supply for 2027

2026/01/18

Semiconductors

PDF

-

DRAM Monthly Datasheet Jan. 2026

2026/01/15

Semiconductors

EXCEL

-

NAND Flash Monthly Datasheet Feb. 2026

2026/02/11

Semiconductors

PDF

-

HBM Industry Analysis - 1Q26

2026/02/04

Semiconductors

PDF

-

1Q26 Memory Price Forecast

2025/12/30

Semiconductors

PDF