Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] Samsung, SK hynix, Micron Reportedly Shift to Short-Term, Post-Settlement Deals for Big Techs

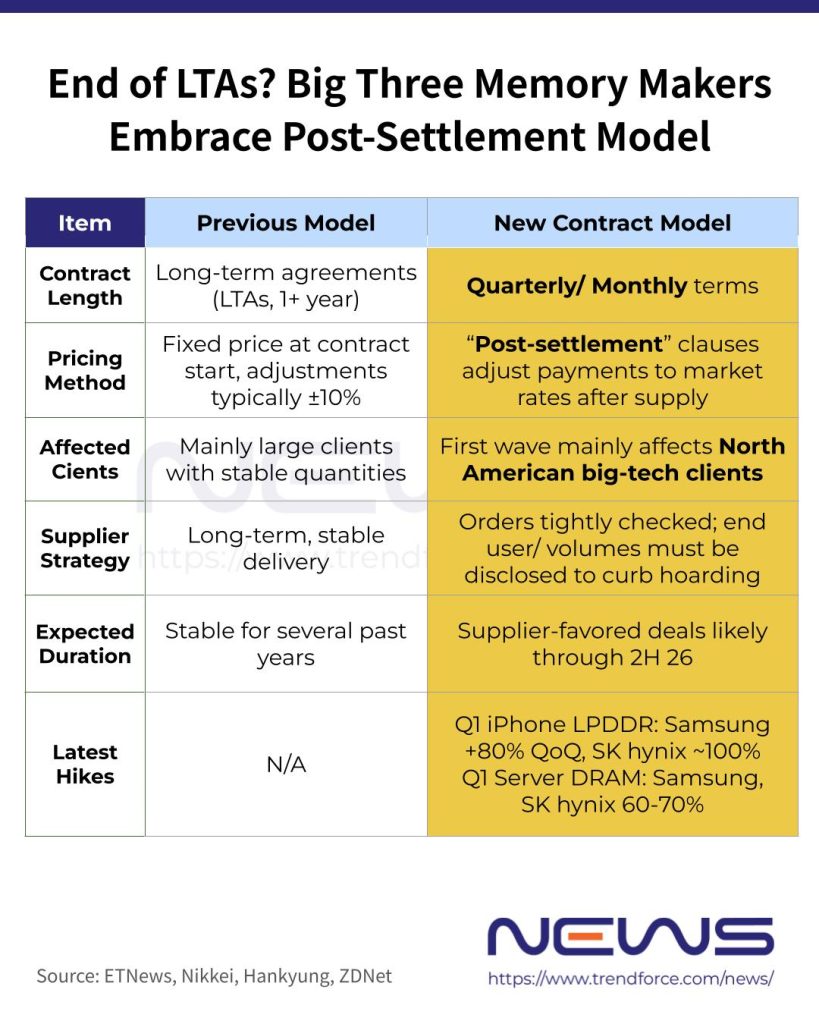

As memory giants grow reluctant to lock in long-term agreements (LTAs) with clients, a new type of deal is reportedly emerging. ETNews notes that Samsung, SK hynix, and Micron are shifting to shorter-term contracts, with some including “post-settlement” clauses that adjust prices based on market rates rather than fixed terms—mainly for North American big-tech clients.

ETNews explains that memory products like DRAM and NAND were traditionally priced at the start of a supply contract. Even if market conditions shifted, price adjustments were typically limited to around ±10% through quarterly negotiations, the report adds.

However, a new type of contract is now emerging: according to ETNews, payments are adjusted based on market prices even after supply ends, effectively capturing price gains. For example, if DRAM was contracted at 100 KRW for a year and the market price doubled by the end, an additional 100 KRW would be paid, as per the report.

Supplier-Favored Contracts to Stay Through 2H26

Alongside payment changes, contract lengths are also shifting. ETNews suggests that memory buyers are increasingly seeking 2-year or longer deals to secure stable supply for expanding AI infrastructure, but due to limited inventory and volatile prices, many contracts have shortened to quarterly—or even monthly—terms.

ETNews cites an industry source saying these supplier-favored agreements are likely to persist at least through the second half of the year, as memory price growth is expected to moderate.

Even tech giants with massive purchasing power aren’t immune to the surge. Industry sources cited by ZDNet noted that while Apple usually signs long-term memory supply agreements (LTAs), the current memory crunch meant pricing was locked in only through H1 2026—leaving room for further hikes as Apple prepares to launch its new flagship, the iPhone 18 later this year.

According to ZDNet, Samsung and SK hynix raised LPDDR prices for iPhone shipments in Q1—Samsung by over 80% quarter-on-quarter, SK hynix around 100%.

Meanwhile, major memory makers are tightening controls amid limited supply. Nikkei Asia reports that Micron, SK hynix, and Samsung are scrutinizing customer orders, asking for end-customer and volume disclosures to prevent hoarding or overbooking that could further disrupt the market.

Read more

- [News] Samsung, SK hynix and Micron Reportedly Rein In Orders to Curb Hoarding as Supply Tightness Persists

- [News] Samsung, SK hynix Reportedly Projected to Post Record-High NAND Margins of 40–50% in 1H26

(Photo credit: Micron)