Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

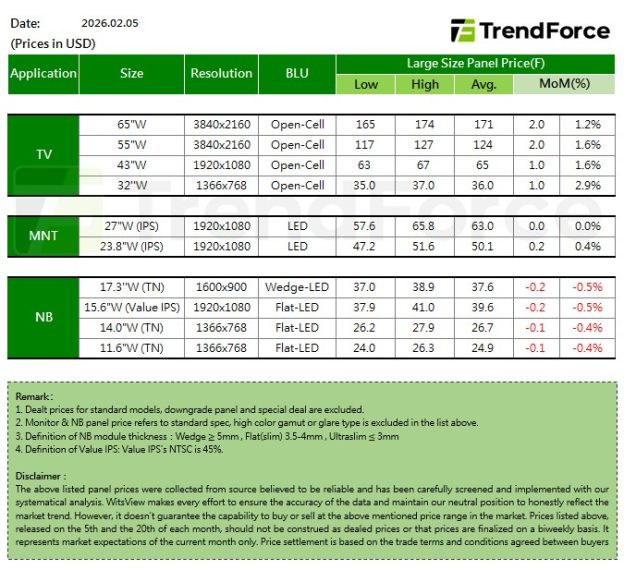

[Insights] Early February Panel Prices: TV & MNT Panels Up; Notebook Panels Down Across Sizes

.TV

In February, TV panel demand is expected to stay relatively stable, while panel makers plan five to seven days of capacity adjustments during the Lunar New Year. This is likely to lower average utilization by about 10% from January, helping keep supply and demand balanced and supporting higher panel prices. TV panel prices in February are therefore expected to rise across the board, with 32-inch, 43-inch, and 50-inch panels up USD 1, and 55-inch, 65-inch, and 75-inch panels up USD 2.

.MNT

Entering February, TV panel prices have firmly shifted into a broad uptrend. Meanwhile, MNT panel demand has exceeded expectations, with more rush orders from brand customers, prompting panel makers to actively prepare for MNT price hikes. After one to two months of Open Cell panel price hikes in southern China, panel makers are also expected to move more aggressively from February to raise MNT panel module prices. Supply of 23.8-inch FHD panels remains tight. As a result, February MNT panel pricing is expected to trend higher, with 23.8-inch FHD Open Cell panels forecast to rise by USD 0.3, 27-inch FHD Open Cell panels by USD 0.1, and 23.8-inch FHD panel modules likely to increase by USD 0.2.

.NB

Meanwhile, in February, tight supply and rising prices for memory and other semiconductor components have driven notebook brands to continue building panel inventory, but pressure to push panel prices lower remains strong. To preserve customer relationships and stabilize orders, panel makers have softened their pricing stance. As a result, notebook panels are showing a different price trend from the other two major applications. February laptop panel prices are expected to decline across all sizes, with TN models down USD 0.1 and IPS models down USD 0.2.