Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] China’s LED Industry Sees Broad Price Hikes; MLS and Kinglight Models Reportedly Up 5%–10%

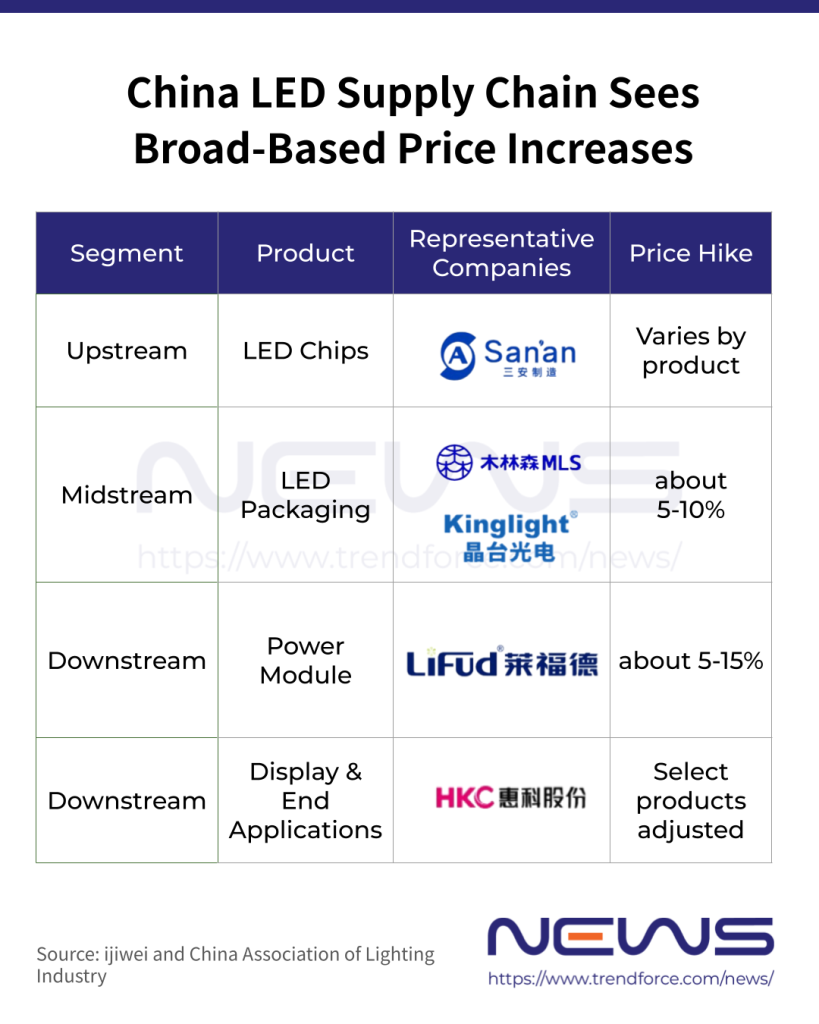

China’s LED industry is seeing price hikes across the entire value chain. According to ijiwei, the latest increases span upstream chips, midstream packaging, and downstream applications, with dozens of companies issuing price adjustment notices covering products such as LED light beads, PCB boards, commercial TVs, and lighting.

The report notes that this wave of price hikes reflects a structural shift driven by persistently rising raw material costs and years of prolonged low-price competition. As the report further points out, overall gross margins across China’s LED industry remained under sustained pressure in the first three quarters of 2025, making the latest price adjustments a necessary step for companies to manage rising cost pressures.

Over the past four years, average prices for LED products have fallen by a cumulative 30%–40%, a decline far exceeding the increase in raw material costs over the same period, resulting in sustained compression of industry profit margins, the report indicates.

LED Price Hikes Expand Across the Supply Chain

This round of price increases has spread across the entire value chain. The report notes that the packaging segment moved first, with companies such as MLS and Kinglight implementing price adjustments as early as August 2025. By December, all segments across the industry chain had followed suit.

As of now, dozens of LED companies, including Shenzhen MTC, HKC, MLS, Nationstar, and Sanan Optoelectronics, have issued price increase notices. Most adjustments are taking effect between mid-December 2025 and January 1, 2026, and the majority of new orders are already being executed under the updated pricing framework, the report adds.

Price Hike Magnitude and Cost Drivers

In terms of adjustment magnitude, the report notes clear structural differences across segments. Packaging and downstream products have generally seen price increases of 3% to 15%, with select models from MLS and Kinglight rising by around 5% to 10%. PCB boards have recorded price increases of up to 10% at some suppliers amid persistently high copper prices and tightening supply. Meanwhile, driven by rising memory prices and tight wafer capacity, certain power-related products have seen adjustments in the range of 8% to 15%, the report adds.

Sources cited in the report note that key materials such as gold, silver, and copper account for more than 70% of LED packaging costs. Sharp price increases have directly pushed up production costs for core components including silver paste, alloy bonding wires, and PCB boards, adding further operating pressure on packaging companies.

Margin Pressure and Market Shift

The latest wave of price increases in China’s LED industry reflects continued pressure on gross margins across the sector. Conditions have been even more challenging for small and mid-sized players. As the report further notes, many have struggled to pass on higher raw material costs, leaving gross margins generally below 20%.

At the same time, the industry is shifting toward higher-value segments. The report points out that while growth in the traditional general lighting market has slowed, areas such as Mini/Micro LED, automotive lighting, horticultural lighting, high-end commercial lighting, and smart lighting continue to open up new avenues for growth.

Read more

- PlayNitride to Acquire Lumiode, Accelerating Micro LED Development for Near-Eye Displays, Says TrendForce

- TCL CSOT’s Acquisition of Prima Deepens Vertical Integration in Micro/Mini LED Across Brand and Panel Makers, Says TrendForce

(Photo credit: HKC)