Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

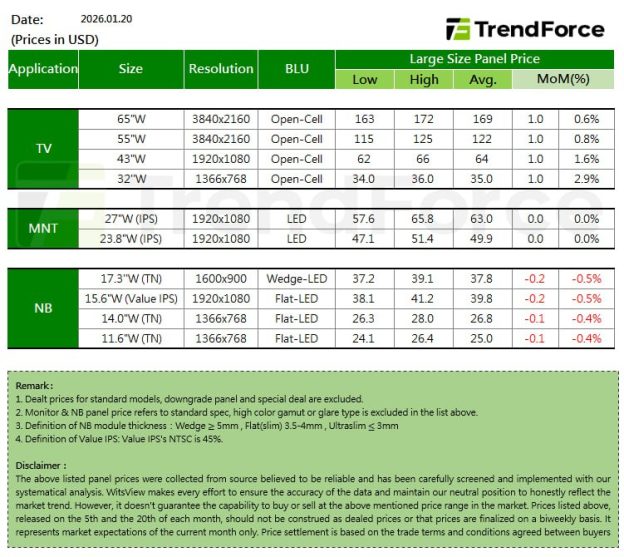

[Insights] Late-January Panel Prices: TV Panels Poised to Rise, Notebook Continue to Fall

.TV

In January, despite the impact of rising memory and component prices, some leading TV brand customers continue to actively build inventory, seeking to further expand market share by leveraging their relatively stronger access to memory and other components compared with smaller brands. As a result, TV panel demand has remained resilient during the traditionally weak first quarter.

In addition, panel makers have already planned corresponding production cuts in February, leaving overall TV panel supply and demand broadly balanced. This is expected to support a round of price increases for TV panels in the first quarter. Currently, TV panel prices are forecast to turn upward in January, with 32-inch, 43-inch, 55-inch, and 65-inch panels each set to rise by US$1.

.MNT

Although January is typically a slow season for LCD monitor panels, ongoing component price increases have prompted some brands to build inventory earlier to avoid rising procurement costs. As a result, demand for LCD monitor panels has strengthened ahead of the usual cycle. Meanwhile, TV panel prices have entered an upward trend, providing panel makers with a stronger foundation to support LCD monitor panel price increases. In January, open-cell panels are expected to lead the gains, with mainstream sizes such as 23.8-inch IPS and 27-inch IPS panels projected to rise by US$0.1–0.2, while LCD monitor module prices are expected to remain flat.

.NB

Entering January, although notebook demand is typically seasonally weak, rising memory prices have prompted notebook brands to step up inventory building in the first quarter, aiming to maximize shipments while component supplies remain available and ahead of expected increases in end-product pricing. This has boosted demand for notebook panels, even as brands push panel makers for greater price concessions. While panel makers are seeing stronger demand, concerns over customer relationships and uncertainty around panel demand beyond the second quarter have led them to soften pricing. As a result, notebook panel prices are expected to remain on a downward trend in January, with TN panels forecast to fall by US$0.1 and IPS panels by US$0.2.