Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] China Robotics Competition Intensifies in 2026; Top Firms Near RMB 1B in Orders; Shakeout Looms

China’s humanoid robotics sector is becoming increasingly competitive, with some companies now facing the risk of being forced out. According to Yicai, China currently has more than 100 humanoid robotics companies. After nearly three years of development, clear differentiation has emerged: leading players have secured greater funding and commercial orders, while companies lacking commercialization capabilities and facing financing difficulties are at risk of being eliminated, with some expected to exit the market as early as 2026.

Diverging capabilities in technology, commercialization, and financing are reshaping competition into distinct tiers. As the report notes, the Beijing Academy of Artificial Intelligence places Unitree Robotics, Zhiyuan Robotics, UBTECH Robotics, and Galbot in the first tier; Galaxea, LimX Dynamics, Xiaomi, and Meituan in the second tier; and Casbot, SenseTime, and XPeng in the third tier.

As the report indicates, among the first-tier companies, orders at the proof-of-concept stage are estimated to be approaching RMB 1 billion in total. In addition, UBTECH Robotics has already gone public, while several of the other firms are in the process of filing for IPOs.

By contrast, the report points out that some robotics manufacturers in the second tier and below are facing serious risks. The scale of investment and the technological thresholds required for humanoid robotics companies today are far higher. As a result, companies that have failed to secure commercial orders and are struggling to raise funding are expected to bear the greatest pressure.

Data and Model Constraints Challenge China’s Humanoid Robotics Makers

For China’s domestic humanoid robotics companies, the report notes that the biggest bottleneck remains the intelligence system. Building and training this system requires a suitable training environment, yet high-quality data for such training remains scarce.

In addition, humanoid robotics companies often lack the capability to independently develop large-scale foundation models. According to the report, development of such models is rapidly concentrating among a small number of major technology firms, such as Alibaba and ByteDance. Building foundation models is extremely costly, and the capital resources of humanoid robotics companies are far from sufficient to support such efforts on their own.

TrendForce forecasts 2026 as a pivotal year for the commercialization of humanoid robots, with global shipments expected to exceed 50,000 units, marking over 700% YoY growth. Meanwhile, TrendForce notes that China’s main challenge in 2026 will be maintaining a balance between making products affordable for the mass market and offering high-end differentiation, while also developing sustainable data and application ecosystems.

Read more

- Humanoid Robots to Become the Next US-China Battleground, with Price Differentiation and Tiered Applications as Emerging Trends, Says TrendForce

- Diverging Humanoid Robot Strategies: Japan Advances Core Components, While the U.S. and China Scale Full-System Applications, Says TrendForce

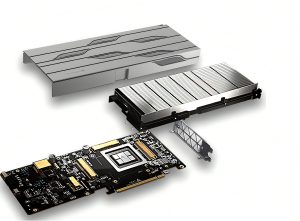

(Photo credit: UBTECH Robotics on LinkedIn)