Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

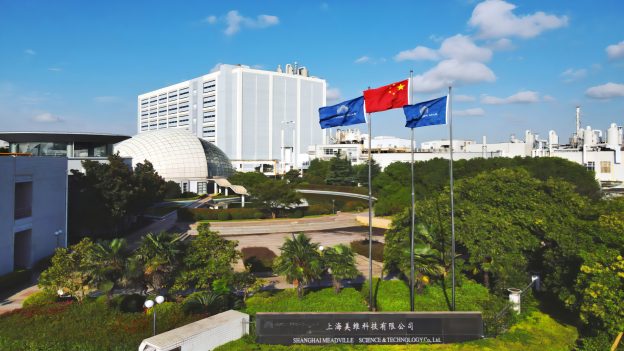

[News] China’s Big Fund Phase III Backs IC Substrate Maker AKM Meadville

Recently, Guotou Jixin (Beijing) Equity Investment Fund (Limited Partnership) (“Guotou Jixin”), an investment vehicle under the Phase III China Integrated Circuit Industry Investment Fund Co., Ltd. (the “Big Fund Phase III”), has taken an equity stake in IC substrate maker AKM Meadville (Xiamen).

According to Tianyancha, AKM Meadville completed an industry and commence registration change on December 11. While its former shareholder AKM Meadville (Panyu) exited, new shareholders joined, including Guotou Jixin, CN Investment, Guangzhou Industrial Investment Group (GIIG), North Industries Technology (NORINCO), Shenzhen Yuanzhi Xinghuo Private Equity Fund, and Guofengtou Xinzhi Equity Investment Fund. Among them, Guotou Jixin, CN Investment are both affiliated with the Big Fund Phase III.

Founded in 2019 with a registered capital of CNY 4.5 billion, AKM Meadville is a well-known Chinese manufacturer in the packaging substrate and high-end PCB segments. The company focuses on IC substrate, substrate-like PCB, high-layer-count and any-layer HDI, rigid-flex and flexible PCB, SMT and assembly service, as well as power battery module technologies. Its products are widely used in smartphones, consumer electronics, automotive electronics, and 5G application, positioning AKM Meadville to be among the world’s top 20 PCB manufacturers.

AKM Meadville is one of the relatively few companies that the Big Fund Phase III has invested in. Launched in May 2024, the Big Fund Phase III has a registered capital of RMB 344 billion, with a strategic focus on advanced manufacturing, high-end chip design, critical materials and equipment, and wide bandgap semiconductors—key “chokepoint” areas—while emphasizing the efforts to bolster industrial chains and achieve industrial chain coordination.

To date, the Big Fund Phase III has not made direct investments in semiconductor companies, instead deploying capital through its affiliated investment funds, with a limited number of outbound investments overall.

Data show that through Guotou Jixin, the Big Fund Phase III has invested in four companies, including AKM Meadville, Nantong Crystal, Quartecs, and Piotech’s subsidiary (Tuojing Jianke Semiconductor). In addition, via the National AI Industry Investment Fund, it has invested in Shanghai Oriental Chip Computing, a high-performance computing chip developer.

The investment in AKM Meadville not only signals the Big Fund Phase III’s recognition of the company’s technological capabilities, but also underscores its confidence in the long-term development of China’s IC packaging substrate industry.

At present, China’s IC substrate sector is led by players such as Shennan Circuits (SCC), Fastprint Technology, Redboard Technology, and AKM Meadville, all of which have demonstrated robust growth momentum.

In recent years, driven by the localization push alongside the rapid development of artificial intelligence and high-speed networking, PCB-related products have maintained a high level of market prosperity. In particular, segments such as 18-layer-and-above PCB and advanced HDI boards have seen burgeoning growth. In this context, the packaging substrate industry has gradually picked up, with leading companies delivering notable performance gains.

Financial reports show that in the first half of 2025, Fastprint reported revenue of CNY 3.426 billion, up 18.91% year on year, with net profit reaching CNY 28.83 million, a 47.85% increase. Net profit excluding non-recurring items rose 62.50% to CNY 46.74 million. SCC delivered revenue of CNY 10.453 billion, up 25.63% year on year, while net profit increased 37.75% to CNY 1.36 billion. Net profit excluding non-recurring items grew 39.98% to CNY 1.265 billion.

(Photo credit: AKM Meadville)