Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] Trump Approves H200 China Sales; U.S. Routing Reportedly Triggers 25% Revenue-Split Dispute

Trump has approved H200 sales to China, but the arrangement has raised concerns. According to The Wall Street Journal, the chips permitted for export must undergo a special U.S. security review before shipment. As a result, the H200s—manufactured primarily in Taiwan—would first be sent to the U.S. for national-security screening before being forwarded to China. The report adds that this unusual routing has prompted discussion about whether it is linked to the U.S. government’s requirement for a 25% share of the sale.

As the report indicates, citing sources, because the Constitution prohibits export taxes, officials must design the arrangement carefully to avoid it being characterized as one, and routing the chips through the U.S. allows the government to classify the 25% charge as an import tariff rather than an export tax.

Uncertainty Over Responsibility for the 25% Charge

Economic Daily News notes that the question of who will absorb the 25% revenue-sharing fee has drawn considerable attention. Sources cited by the report indicate that tariffs are typically borne by the buyer, meaning NVIDIA is expected to take on the associated costs, with contract manufacturers handling final assembly also likely to feel the impact. By contrast, the effect on upstream semiconductor suppliers is expected to be relatively limited.

Notably, since the chips are expected to be manufactured by TSMC, the foundry giant’s response has drawn attention. As noted by Economic Daily News, TSMC did not comment. The report adds that the company has previously stated at shareholder meetings and earnings calls that “the buyer bears the related costs,” and while such fees may more easily affect price-sensitive consumer products, TSMC has not yet observed any change in customer behavior.

Security Concerns and Enforcement Challenges

Meanwhile, South Korean outlet Maeil Business Newspaper notes that experts are skeptical about how much this measure actually enhances security, arguing that the real issue lies in where the chips ultimately end up in China and how they are used. Likewise, The Wall Street Journal notes that Trump said AI chips would be supplied only to approved buyers, though risks of smuggling and diversion have made such controls difficult to enforce.

TrendForce predicts that China’s high-end AI chip market will grow by over 60% in 2026. The Chinese government is likely to keep supporting local AI chip independence, helping top IC design companies benefit from government and corporate projects. Consequently, domestic AI chips might increase their market share to about 50%. At the same time, imported products like Nvidia’s H200 and AMD’s MI325 are expected to hold nearly 30% of the market.

Read more

- China’s CSPs and OEMs likely to Actively Procure H200, but Domestic AI Chip Development Continues to Accelerate, Says TrendForce

- [News] Trump Greenlights NVIDIA H200 Export to China: Chip Reportedly 6x H20 Power, with 25% Fee

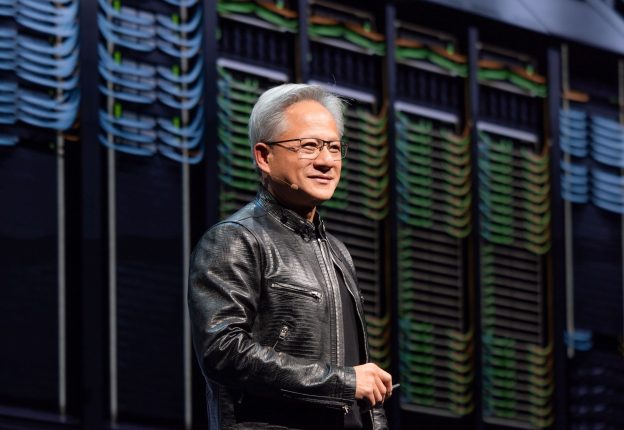

(Photo credit: NVIDIA)