Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] SMIC Reportedly Rations Output as China Faces Widening AI Chip Crunch

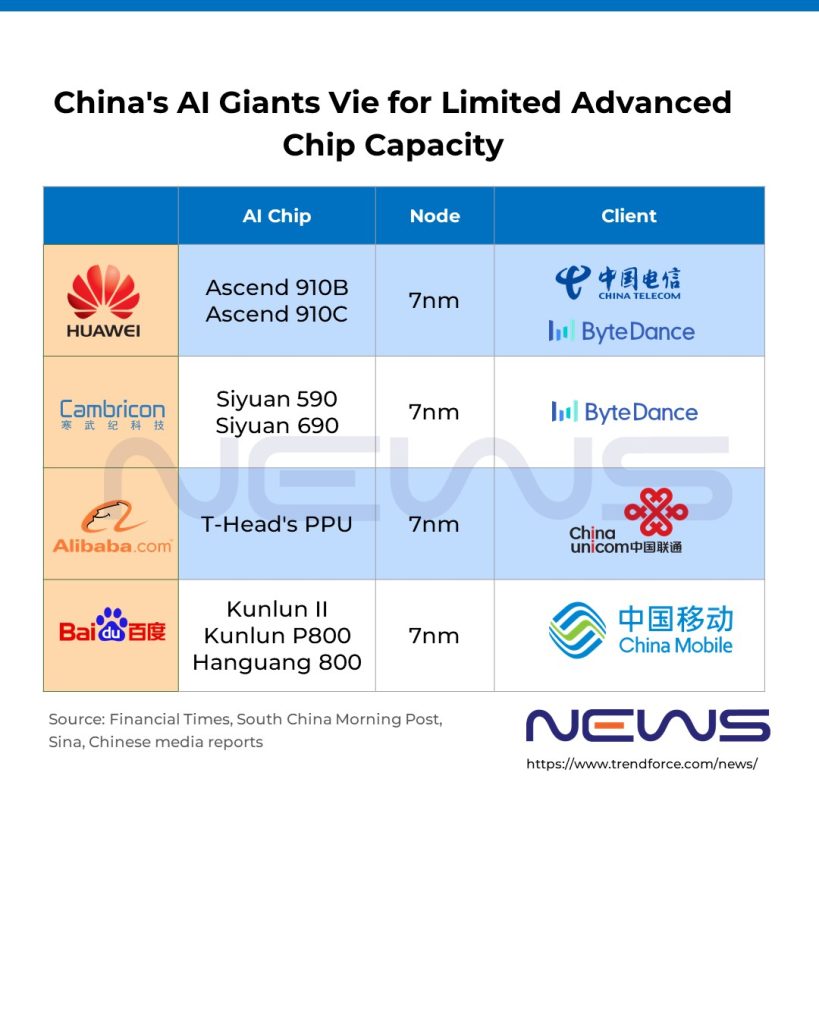

Beijing’s latest push for tech self-reliance might be backfiring. After reportedly ordering all state-backed data centers to use only domestic AI chips—effectively shutting out NVIDIA—China could now be facing a deepening chip crunch. According to The Wall Street Journal, the shortage has become so severe that authorities are rationing output at SMIC, directing its limited capacity toward Huawei, the nation’s AI flagship.

The report notes that China’s chip output remains hard to pin down, but even the rosiest projections lag far behind domestic demand. Citing Saif Khan, a former Biden administration official involved in export controls, The Wall Street Journal suggests that even if China multiplied its production estimates by five, it would still fall short of meeting domestic needs.

Huawei and Startups Race to Meet Surging AI Demand

Amid soaring AI training demand at domestic data centers, The Wall Street Journal reports that chipmakers are scrambling to meet the load. Huawei, for example, is combining thousands of chips into massive, power-hungry systems to support AI workloads. In July, the company debuted its CloudMatrix 384 at the 2025 World Artificial Intelligence Conference (WAIC)—a rack-scale AI system with 384 Ascend 910C processors linked via a fully optical, all-to-all mesh network, designed to compete with NVIDIA, according to Tom’s Hardware.

While major chipmakers preserve domestic foundry capacity, The Wall Street Journal reports that Chinese AI startups like Shanghai-based MetaX are turning to older, more accessible technologies—linking multiple smaller chips to compensate for limited computing power. However, the workaround comes with a downside: these multi-chip setups are highly power-hungry, sharply increasing electricity use. As the Financial Times noted in early November, local governments are stepping in with incentives to help tech giants such as ByteDance, Alibaba, and Tencent cope with soaring power costs following Beijing’s ban on NVIDIA AI chips.

Foundry Utilization Rates on the Rise

Amid soaring AI demand and tight chip supply, China’s top two foundries, SMIC and Hua Hong, are seeing utilization rates climb already. SMIC’s Q2 earnings release showed a 92.5% rate—up 2.9 points from Q1 and 7.3 points year-on-year, as the company is set to announce Q3 results this Friday. Hua Hong, meanwhile, pushed its utilization even higher, reaching 109.5% in Q3, up from a record 108.3% in Q2.

Read more

- [News] Huawei Unveils Ascend 950 with In-House HBM in 2026, Touts SuperPoD to Rival NVIDIA

- [News] China Reportedly to Triple AI Chip Output Next Year With Fabs Serving Huawei, Cutting NVIDIA Reliance

(Photo credit: FREEPIK)