Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] SMIC Posts Record $9.3B in 2025 Sales; 7nm Yields Reportedly Weigh on Margins

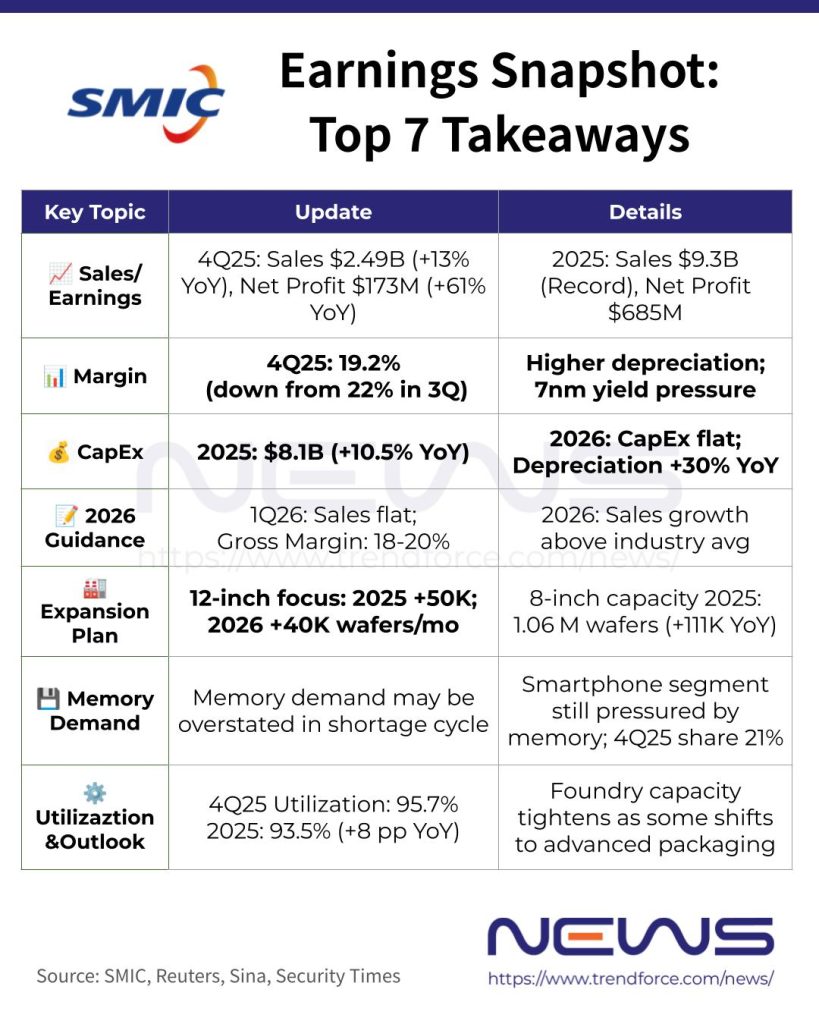

Amid market talk of potential price hikes of around 10%, China’s leading foundry SMIC released its 4Q25 and full-year 2025 results on Feb. 10. Citing chinastarmarket.cn and the company’s disclosure, fourth-quarter revenue came in at US$2.489 billion, rising 4.5% quarter on quarter and 12.8% year on year, while full-year sales climbed to a record US$9.327 billion, underscoring momentum from China’s push for chip self-sufficiency.

Net profit attributable to shareholders reached US$173 million in 4Q25, slipping 9.9% from the prior quarter but soaring 60.7% year on year, according to the report.

Despite strong sales and profit growth, SMIC’s gross margin slid to 19.2% in 4Q25, down from 22.0% in 3Q25 and 22.6% in 4Q24. Looking ahead, the company guides gross margin at 18%–20% for 1Q26, with revenue expected to remain broadly flat quarter on quarter.

Though chinastarmarket.cn, citing SMIC’s remarks, notes that the decline in gross margin was mainly due to higher depreciation expenses, Sina points to low yields at 7nm-equivalent nodes as the bigger hit to quarterly profitability.

Revenue Breakdown: ASPs, Mix, and End Demand

Sina, citing Dolphin Research, further notes that SMIC’s 4Q25 revenue increase came largely from higher average selling prices (ASPs), supported by a higher mix of 12-inch wafer shipments. Shipment volume rose just 0.6% quarter on quarter, while ASPs increased 3.8%, the report adds.

On business progress, China-related revenue accounted for nearly 90% of total sales in the quarter, Sina reports. Fueled by downstream stockpiling demand—particularly for smart, small-form-factor electronic devices—the consumer electronics segment grew 10% quarter on quarter, making it the primary growth engine for the period, the report says.

According to the revenue application breakdown cited by chinastarmarket.cn, consumer electronics drove 47% of 4Q25 sales, up from 43% in 3Q25, while smartphone revenue slid to 20%. Rising memory prices are set to keep the segment under pressure, as per Sina.

Capex and 2026 Expansion Plan

Security Times cites SMIC Co-CEO Zhao Haijun, reporting 2025 capex hit $8.1 billion—above early-year guidance—fueled by strong customer demand, shifting market conditions, and extended equipment lead times. Capex for 2026 is expected to stay roughly flat.

The report, citing Zhao, says that by year-end, SMIC’s 8-inch monthly capacity reached 1.059 million wafers—up about 111,000 from a year earlier. Total shipments were around 9.7 million wafers, with an annual average utilization rate of 93.5%, rising 8 points year-on-year.

Notably, the foundry giant plans to further ramp up its 12-inch capacity. Zhao, as per Security Times, revealed that the company added roughly 50,000 12-inch wafers of capacity in 2025 and plans further expansion this year. Current estimates suggest year-end monthly 12-inch wafer capacity will rise by about 40,000 compared with 2025, the report adds.

However, as new fabs start depreciation, total depreciation in 2026 is expected to rise around 30% year-on-year, the report notes.

Read more

- [News] AI Drives Mature-Node Prices: SMIC Reportedly Up 10%, Vanguard Estimated Up 4–8% From Q1

- [News] China’s Chip Consolidation Heats Up: Hua Hong Acquires 97.5% of Huali, Following SMIC’s Earlier Move

- [News] SMIC Announced Two Massive Capital Investment

(Photo credit: SMIC)