Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] TSMC Reportedly Set to Shift 80% of 8-Inch Output to Affiliate VIS, Doubling Its Capacity

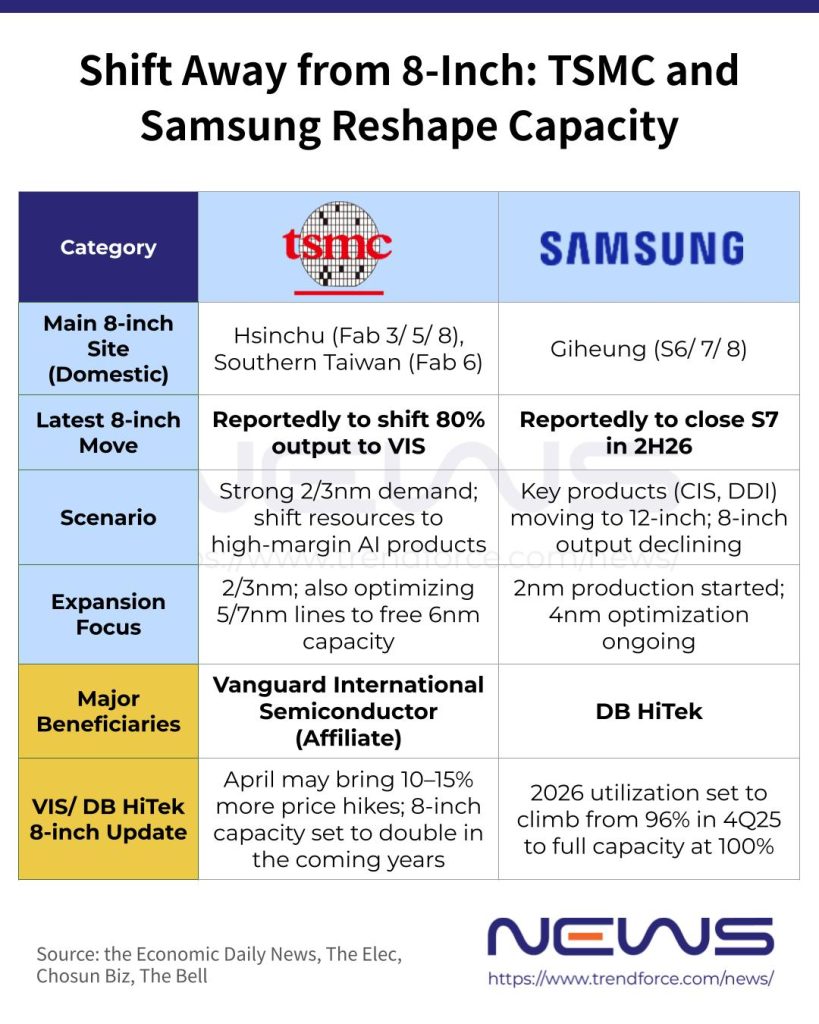

As TSMC accelerates its push into advanced nodes—led by 2nm and 3nm—to meet surging AI demand, the foundry heavyweight is quietly dialing back its 8-inch footprint. Citing IC design house sources, the Economic Daily News reports that TSMC currently runs about 5 million 8-inch wafers annually, with roughly 80% set to be gradually transferred to affiliate Vanguard International Semiconductor over the coming years.

As a result, the report expects Vanguard’s 8-inch capacity to double, providing a major boost to its operations. An earlier report from Liberty Times also suggested that Vanguard is running at full capacity and, after selective hikes in Q1, has notified customers of a second round of across-the-board foundry price increases from April, lifting prices by 10–15%.

TSMC’s 3nm Surge and Strategic Shift

The Economic Daily News reports that surging AI and high-performance computing demand is keeping TSMC’s sub-3nm nodes and advanced packaging in chronic short supply, while labor shortages, rising fab costs, longer build cycles, and limited floor space are adding pressure. In response, TSMC is reportedly optimizing its 6-inch and 8-inch mature-node operations, redirecting resources toward higher-margin, fast-growing AI businesses.

Beyond shifting 8-inch orders to VIS, TSMC is also optimizing 5nm and 7nm lines—freeing up 6nm capacity—to support the surging 3nm demand, the Economic Daily News notes. Its 3nm family is booming, with 2026 revenue expected to exceed NT$1 trillion and likely overtake 5nm this quarter as the top revenue driver, as backlogs stretch into 2028, the report adds.

VIS as Main Beneficiary

Under this framework, Vanguard International Semiconductor stands to be the biggest beneficiary. IC design houses cited by the Economic Daily News estimate TSMC’s annual 8-inch capacity at about 5 million wafers, with roughly 80% set to be transferred over time via order migration, tool transfers, and technology cooperation.

As noted by the report, TSMC has already sold 8-inch equipment to Vanguard twice in recent years, and with gallium nitride (GaN) technology licensing, Vanguard now operates both GaN-on-Si and GaN-on-QST platforms, further rounding out its mature-node portfolio.

The report adds that VIS currently operates five 8-inch fabs across Taiwan and Singapore, with average monthly capacity of about 286,000 wafers in 2025. Analysts cited by the report estimate that as TSMC’s capacity and equipment are gradually transferred, Vanguard’s annual 8-inch output could multiply over the coming years, lifting its market share and positioning it as a major global supplier in the 8-inch foundry segment.

TSMC is certainly not the only foundry player to winding down its 8-inch wafer output. The Elec reported in January that Samsung will shut down part of its 8-inch foundry operations within the year, as it pares back aging, low-margin processes and concentrates resources on advanced 12-inch nodes.

Industry sources cited by the report say Samsung will close its S7 8-inch fab in Giheung in the second half of 2026, while continuing to operate the remaining S6 and S8 fabs at the site.

Read more

- [News] Global 8-Inch Wafer Market Tightens: Samsung Giheung S7, TSMC Closures Put China Fabs in Spotlight

- [News] 8-Inch Foundries May Raise Prices 5–20%, Benefiting UMC, PSMC, Vanguard

(Photo credit: TSMC)