Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] Intel Reenters DRAM Race? A Closer Look at the Z-Angle Memory Collaboration with SoftBank

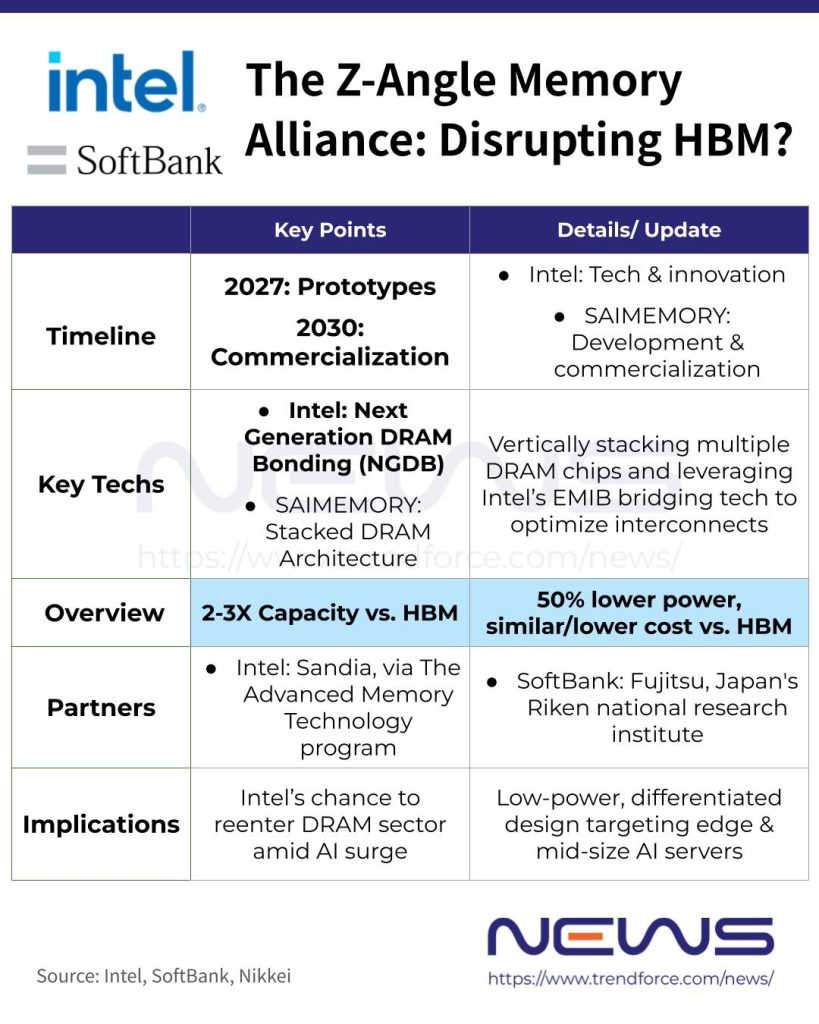

Intel’s memory ambitions are back in the spotlight after it announced on February 2nd the partnership with SoftBank’s subsidiary SAIMEMORY to develop Z-Angle Memory (ZAM). According to their press release, operations kick off in Q1 2026, with prototypes expected in 2027 and full-scale launch by 2030.

Under the partnership, Intel provides tech and innovation support, while SAIMEMORY leads development and commercialization. EE Times Japan, citing a SoftBank spokesperson, notes that the name “ZAM” refers to the Z axis, and the team is considering stacking the structure vertically. The report adds SoftBank plans to invest roughly 3 billion yen through prototype completion in fiscal 2027.

Interestingly, Wallstreet.cn highlights that this is far from Intel’s first foray into memory, as Team Blue rolled out the world’s first commercially successful DRAM in 1970 and once commanded nearly 90% of the global market, before mounting losses forced its exit in 1985.

Now, the big question is: what would drive its return, and what exactly is Intel’s Next-Generation DRAM Bonding (NGDB) and the new memory stacking method all about?

Technology Details Emerge

According to Intel, SAIMEMORY is working on a stacked DRAM architecture designed to outperform current HBM standards. The technology reportedly aims to boost memory capacity, slash power consumption, and enhance packaging capabilities, addressing key bottlenecks in scaling AI systems.

One of the technical foundations behind this effort stems from Intel’s long-standing collaboration with Sandia National Laboratories. Thus, a January update from Sandia National Laboratories offered a closer look at Intel’s Next-Generation DRAM Bonding (NGDB) technology.

Sandia explains that today, high-bandwidth memory often trades improved bandwidth for lower performance in other areas, like capacity. NGDB, on the other hand, aims to remove much of this tradeoff, bridging the gap between HBM and conventional DDR DRAM while delivering significantly better energy efficiency.

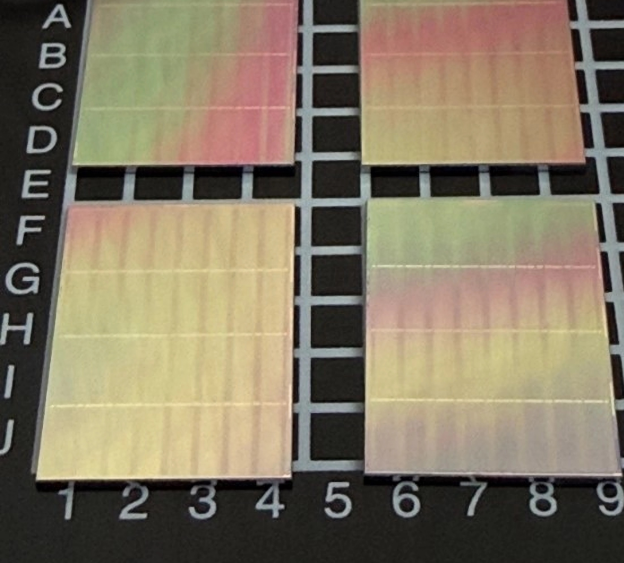

A cross-section of an NGDB test assembly shows the unconventional design: Intel has prepared four NGDB DRAM test assemblies for evaluation, with each unit built on a base layer and eight DRAM layers stacked vertically on top, according to a photo released by the company.

Sandia notes that the initiative involved the development of both a novel stacking approach and a new DRAM architecture. While early prototypes validated the assembly method as a way to overcome existing memory capacity constraints, the latest prototype demonstrates fully functional DRAM using the new stacking technique, according to Sandia.

“The demonstration confirms that NGDB technologies can be combined to deliver high-performance memory suitable for high-volume manufacturing,” said Gwen Voskuilen, principal member of technical staff at Sandia National Laboratories.

Intel’s Ambition

As highlighted by Wallstreet.cn, if collaboration with Sandia National Laboratories laid the groundwork, Intel’s partnership with SoftBank represents a major step forward in the DRAM race, signaling a clearer path to commercialization.

According to Nikkei, SAIMEMORY plans to produce memory with two to three times the capacity of HBM, cutting power consumption by up to half while keeping costs comparable or lower. Wallstreet.cn notes that by vertically stacking multiple DRAM chips and leveraging Intel’s EMIB bridging technology to optimize interconnects, the company targets doubling memory capacity over current high-end solutions (up to 512GB per chip), cutting power consumption by 40–50%, and achieving mass-production costs around 60% of HBM.

Though challenges persist, SAIMEMORY’s low-power, differentiated approach shows real potential for Intel, as noted by Wallstreet.cn. It could carve out a competitive edge in edge computing and small-to-medium AI servers, and even reshape the technological roadmap of the memory industry.

Amid this industry boom and mounting pressures—from a squeezed CPU market and foundry losses to lagging AI chip performance—Intel could view this as a critical opportunity to redefine its growth trajectory and stake a claim in the AI memory wave, Wallstreet.cn adds.

Read more

(Photo credit: Intel, Sandia National Laboratories)