Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] Supply Constraints Hit Intel Q1 Forecast; 14A Customer Demand Expected 2H26–1H27

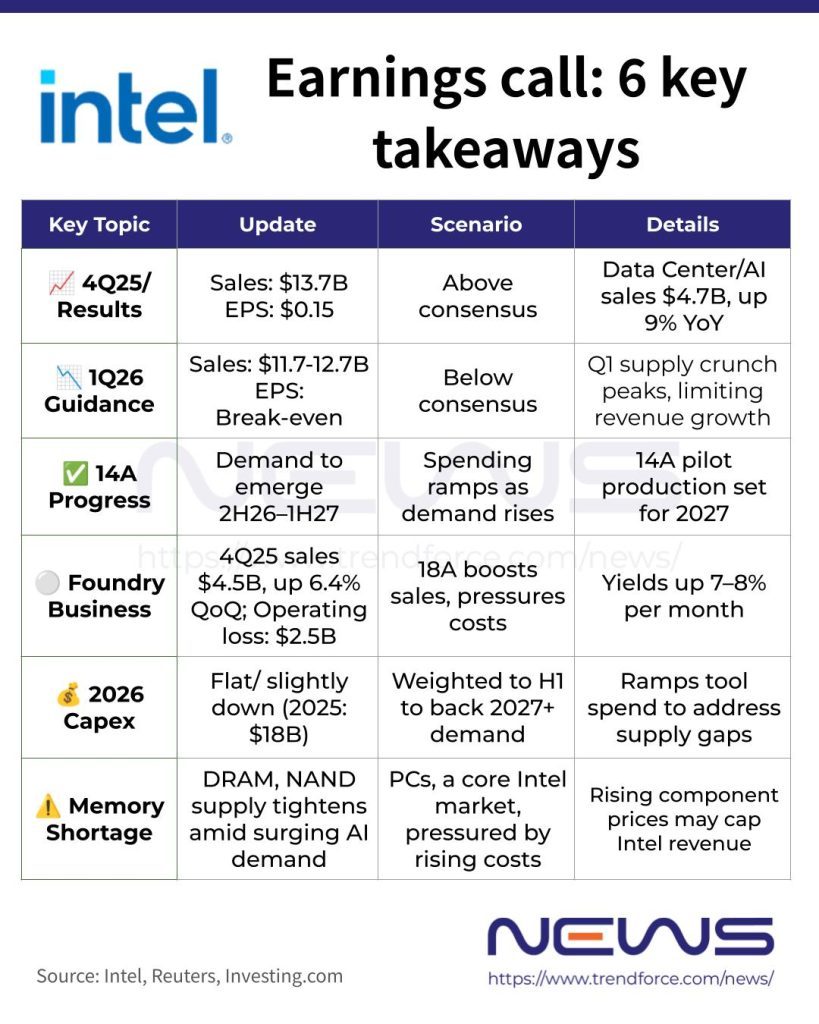

Amid strong market expectations, Intel reported a fourth quarter slightly above forecasts. However, transcripts from Investing.com and Reuters note that the chipmaker’s growth is being limited by its own supply, as it is struggling to keep up with strong demand for its server processors used in AI data centers. CFO David Zinsner noted that the company’s internal constraints are most acute in Q1, with revenue projected at $11.7–$12.7 billion, reflecting a softer seasonal quarter.

Reuters suggests that Intel’s Q1 guidance is below the LSEG-compiled consensus estimate of $12.51 billion. Meanwhile, Team Blue expects adjusted earnings per share to break even in the first quarter, compared with analysts’ expectations of adjusted EPS of $0.05.

(Credit: Intel)

Inventory Dips as Memory Shortage Clouds 2026 Outlook

According to Investing.com, CFO David Zinsner said that in the second half of 2025, Intel met strong product demand by drawing on extra wafer production and inventory. Entering 2026, that buffer is gone, and the shift toward server wafers—which began in Q3 2025—won’t exit the fab until late Q1, which has led to the conservative guidance this quarter.

Zinsner also highlighted the broader impact of the global memory shortage, which has pushed up component prices and raised costs for PCs, a core Intel market. He warned that supply for critical components like DRAM, NAND, and substrates has tightened amid surging AI infrastructure demand, keeping costs elevated. As a result, rising component prices could significantly limit Intel’s revenue upside this year, he added.

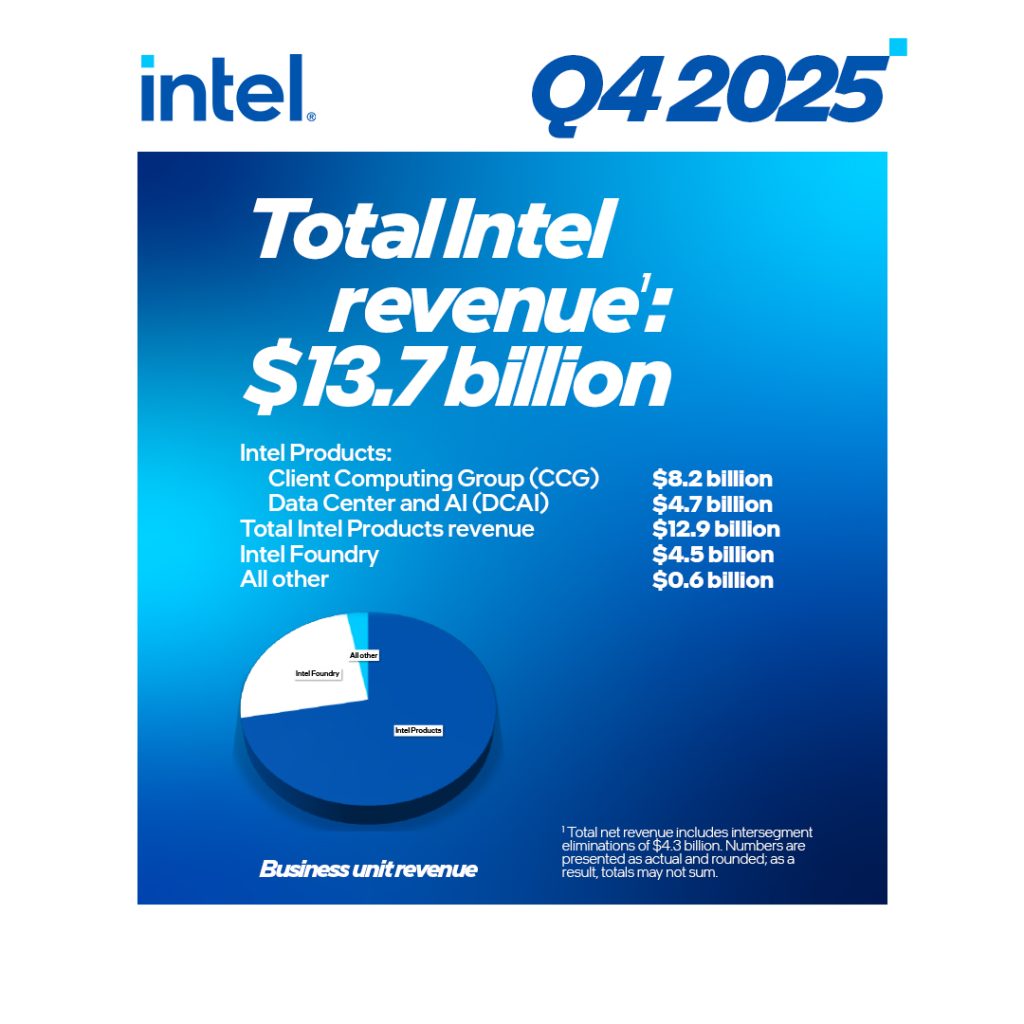

The company posted adjusted earnings of 15 cents per share in 4Q25, well above the 8-cent consensus, and revenue of $13.7 billion, slightly beating the $13.4 billion forecast compiled by LSEG, according to CNBC.

14A and Foundry Update

Another focus at Intel’s earnings call would be its 14A progress. Reuters, citing Zinsner, reported that CEO Lip-Bu Tan has taken a cautious approach to large-scale 14A investment, waiting until a major customer is secured before ramping spending. Notably, in the transcript from Investing.com, he revealed that customers for 14A are expected to emerge in the second half of 2026 and the first half of 2027, at which point broader spending will begin.

Zinsner also commented on yield improvements, saying that Intel is seeing 7–8% gains per month, with a focus on reducing variation, improving consistency, and lowering defect density to deliver high-quality wafers. These efforts are critical for PC clients like Panther Lake, as well as for ongoing 18A and 14A development, he added.

According to Zinsner, cited by Investing.com, Intel Foundry reported $4.5 billion in revenue for 4Q25, up 6.4% sequentially, boosted by a higher mix of EUV wafers, which grew from under 1% of shipments in 2023 to over 10% in 2025. External foundry revenue totaled $222 million, driven by U.S. government projects and the Altera deconsolidation, he said.

However, the foundry business posted a $2.5 billion operating loss during the period, $188 million wider than the previous quarter, largely due to the early ramp of the 18A process, he explained.

As per CNBC, CEO Lip-Bu Tan said earlier this month that Intel’s 18A—positioned against TSMC’s 2nm process—“over-delivered” in 2025, indicating the technology is mature enough for volume production, including Intel’s Core Ultra Series 3 CPUs.

Capex Plans

According to Investing.com, for 2026, Intel plans capital expenditures that balance efficiency with strong demand signals. CapEx is now expected to be flat to slightly down, weighted more toward the first half, supporting demand in 2027 and beyond, Zinsner said. The company reportedly planned a $18 billion CapEx in 2025.

Notably, Zinsner, as per Investing.com, also flag the direction of its 2026 CapEx. He said that Intel’s cleanroom capacity is solid, and the company is increasing spending on tools in 2026 to help address current supply shortfalls.

Read more

- [News] Intel Reportedly Reaffirms 14A Commitment as Lip-Bu Tan Hints at Possible Customer Interest

- [News] Intel’s Ohio 14A Project Gains Traction as Key Contractor Bechtel Reportedly Ramps Hiring

(Photo credit: Intel)