Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] Taiwan-U.S. Trade Deal Cuts Tariffs from 20% to 15%, Secures $250B Investment with TSMC at Center

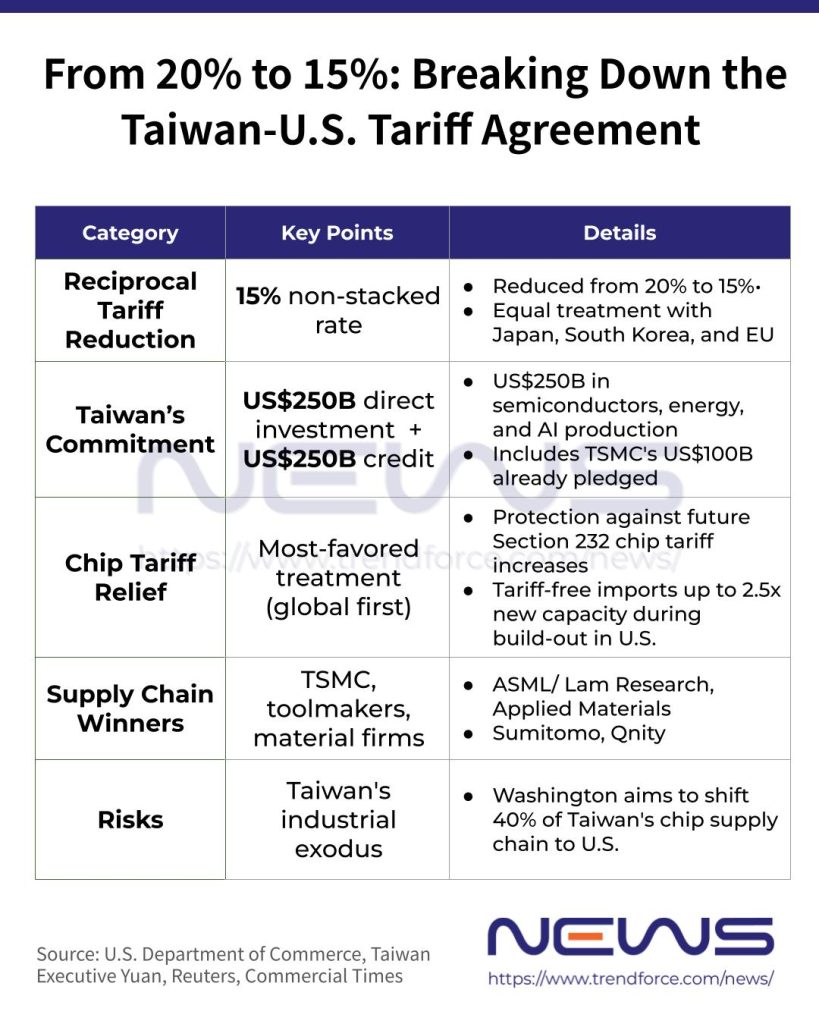

After months of negotiations, Taiwan and the U.S. on Jan. 15 (U.S. time) sealed a long-awaited deal that cuts broad tariffs on most Taiwanese goods exported to the U.S. from 20% to 15%, while Taiwanese chipmakers, including TSMC, stand to benefit from lower duties on semiconductors and related manufacturing equipment imported into the country, according to Reuters.

The concessions come with sizable commitments. In a fact sheet from U.S. Department of Commerce, Taiwanese companies are set to channel US$250 billion into boosting U.S. output across semiconductors, energy and artificial intelligence. Part of that total—US$100 billion—was already pledged by TSMC in 2025, with further investment expected, according to U.S. Commerce Secretary Howard Lutnick, cited by Reuters.

Notably, at yesterday’s earnings call, TSMC announced a record-breaking capital expenditure of up to $56 billion in 2026 and confirmed plans to further accelerate its U.S. investments after acquiring another sizable land parcel for new chip fabs, as highlighted by Nikkei.

To underpin the push, Taiwan will also provide up to US$250 billion in additional credit guarantees to accelerate future projects, the Trump administration said.

The deal could be a major win for Taiwan. According to a press release from the Executive Yuan, Taiwan has become the first country in the world to secure most-favored treatment for semiconductors and related products for companies investing in the U.S., while also gaining preferential Section 232 tariff treatment for automotive parts and lumber.

Winners Line Up

It is also worth noting that under the deal, U.S.-bound semiconductor makers can import chips and wafers up to 2.5 times their new capacity tariff-free during the authorized build-out phase, with shipments beyond that still receiving preferential tariff treatment, according to Reuters.

The report predicts that ramped-up U.S. chip production will boost the entire supply chain, creating new opportunities for TSMC and its major equipment makers like ASML, Lam Research, and Applied Materials. Smaller suppliers of specialty chemicals and materials, including Sumitomo and DuPont spinoff Qnity Electronics, are also expected to see rising demand, Reuters notes.

Risks and Uncertainty

However, in a CNBC interview on Thursday, Lutnick said the U.S. aims to shift roughly 40% of Taiwan’s semiconductor supply chain and production capacity to the U.S. He warned that companies that do not build in the U.S. could face tariffs of up to 100%. The policy, strengthened through the tariff deal, has also raised industry concerns about the potential long-term risk of Taiwan’s chip ecosystem gradually moving overseas.

TSMC is at the center of the agreement, though reports vary on the exact scale. The New York Times and The Wall Street Journal said the company plans at least five new fabs in Arizona, while Bloomberg reported at least four, on top of six existing fabs and two advanced packaging facilities already pledged in the state.

Commercial Times notes that as advanced process lines and R&D gradually shift overseas, Taiwan risks losing its dense concentration of engineers and its on-the-ground problem-solving edge. For example, ramping up 2nm production relies heavily on real-time coordination across departments and the supply chain; sending core talent abroad could dilute Taiwan’s technical momentum, the report adds.

Meanwhile, the outlook faces further uncertainty. Reuters reports that the U.S. Supreme Court is expected soon to rule on whether the president can impose broad tariffs without congressional approval. How a decision invalidating large portions of these tariffs might affect the Taiwan agreement or other Trump-era trade deals remains unclear.

Read more

(Photo credit: Howard Lutnick’s X)