Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] China’s Domestic Chip Equipment Adoption Beats 2025 Target at 35%, Led by NAURA, AMEC

China’s domestic chip equipment push is gaining momentum. According to Commercial Times, citing Jiemian News, data released in January by the China Semiconductor Industry Association show that the share of domestically manufactured semiconductor equipment used in China rose from 25% in 2024 to 35% in 2025, surpassing the 30% target set for 2025.

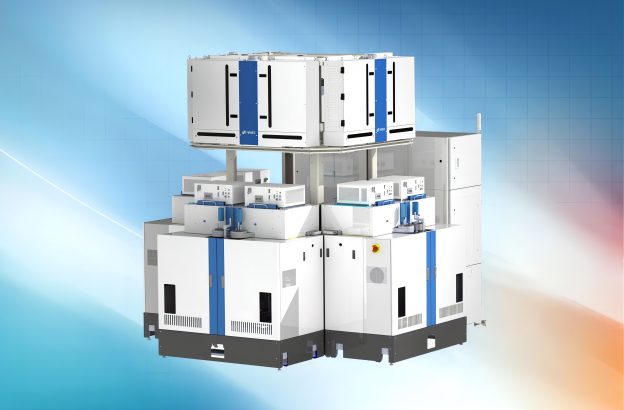

The report further notes that the domestic substitution rate for key tools such as etching equipment and thin-film deposition systems has already exceeded the 40% threshold. It also points to notable performance among several companies. As Jiemian News reports, AMEC’s 5nm etching tool has successfully entered validation on TSMC’s advanced process production lines.

In addition, NAURA’s oxidation and diffusion furnaces now account for more than 60% of the equipment deployed on SMIC’s 28nm production lines. The report adds that Piotech has doubled its share of plasma-enhanced chemical vapor deposition (PECVD) equipment at YMTC’s 3D NAND production lines, lifting its installed share to 30% from 15%. Meanwhile, ACM Research’s single-wafer cleaning tools have also secured orders from Hua Hong’s 12-inch 28nm production lines, with equipment utilization rates exceeding 90%, as Anue highlights.

By contrast, metrology and lithography equipment remain key technical bottlenecks, with domestic substitution rates of 25% and 18%, respectively, as Anue notes. However, both figures represent meaningful progress, having risen by around 10 and 6 percentage points, respectively, compared with 2022 levels.

Policy Support and Funding Drive China’s Domestic Equipment Push

Benefiting from the wave of domestic substitution, China’s local semiconductor equipment suppliers are seeing strong order momentum. Jiemian News says total order value has surged by about 80% compared with the same period in 2025, while NAURA’s order backlog is already scheduled through the first quarter of 2027.

This surge in growth is underpinned by proactive policy guidance from the Chinese government. Sources cited by Commercial Times note that by the end of 2025, China’s authorities required domestic chipmakers to source at least 50% of equipment for new capacity additions from local suppliers. While not publicly announced, the requirement has effectively become a key approval threshold for capacity expansion plans.

On the funding front, China is pursuing a dual-track strategy through the “Big Fund” and fiscal subsidies. According to Commercial Times, sources say authorities are preparing a subsidy program of up to RMB 500 billion to bolster domestic chip manufacturing capabilities. Public procurement data also show that in 2025, entities with official backing placed 421 orders for domestically produced lithography tools and related components, totaling about RMB 850 million.

Read more

- [News] China Reportedly Promotes Domestic Chip Tool Adoption Under 50% Rule, Pressuring Korean Suppliers

- [Insights] China’s Chip Equipment Industry Rides 2025 IPO Wave to Boost Localization

(Photo credit: AMEC)