Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

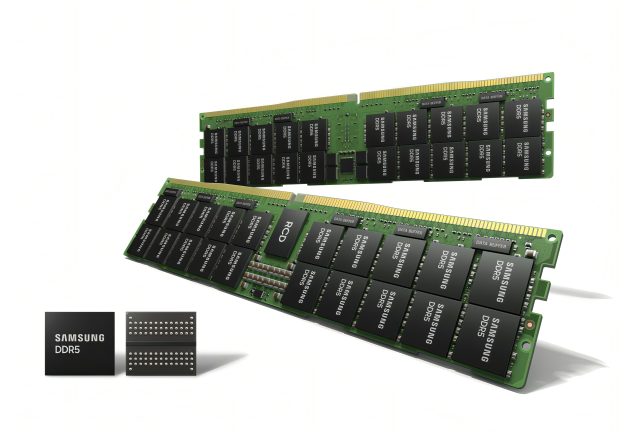

[News] China Memory Buyers Reportedly Fade as a Box of DDR5 Is Said to Cost as Much as a Shanghai Home

Memory prices continue to rise, as sharply higher quotes are reportedly dampening buyer interest in China. According to South China Morning Post, China’s spot market for memory chips is surging amid tight global supply, yet the rally presents a clear dilemma: prices are rising even as buyers are pulling back.

As the report notes, merchants at Huaqiangbei have reported sharp increases in memory chip prices since late last year, with DDR5—the latest generation of DRAM used in PCs, smartphones, and servers—among the most in-demand products.

The surge in memory prices has also become a widely discussed topic across China. As noted by Jiemian News, online discussions such as claims that “a single box of memory modules now costs as much as a home in Shanghai” have drawn significant attention. The report says that a single 256GB DDR5 server memory module from SK hynix or Samsung is priced at more than RMB 40,000, with some quotes reaching as high as RMB 49,999 per unit. With 100 modules per box, the total value approaches RMB 5 million, prompting industry observers to remark that such a box is now “worth more than many properties in Shanghai.”

The rally in China’s spot market reflects broader strain across the global memory supply chain, as leading manufacturers prioritize capacity for customers tied to booming demand for AI chips, South China Morning Post notes.

Against this backdrop, the market may see little relief ahead. According to TrendForce, conventional DRAM contract prices are forecast to rise 55–60% quarter-on-quarter in 1Q26, as the supply–demand gap continues to widen. U.S.-based cloud service providers (CSPs) are locking in capacity, forcing other buyers to accept higher prices. As a result, server DRAM prices are projected to surge by more than 60% QoQ.

TrendForce also notes that NAND Flash prices are expected to increase 33–38% QoQ in 1Q26. Meanwhile, NAND Flash demand is becoming increasingly polarized between consumer and AI applications, with enterprise SSDs emerging as the largest segment, while client SSD prices are forecast to rise by more than 40%.

Read more

- Memory Makers Prioritize Server Applications, Driving Across-the-Board Price Increases in 1Q26, Says TrendForce

- [News] Samsung’s Q4 Profit Soars 208% to Record 20 Trillion Won on Memory Rally and Foundry Turnaround

(Photo credit: Samsung)