Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

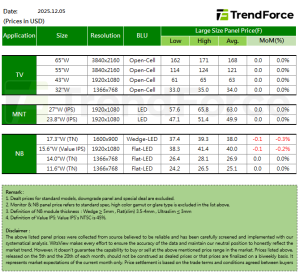

[Insights] Early January Panel Prices: TV Panel Prices Turn Upward, While Notebook Panel Prices Trend Lower

.TV

Entering January, procurement momentum at some TV brands remains relatively strong, supporting steady TV panel demand and allowing panel makers to maintain relatively high utilization rates. With the Lunar New Year falling in February, panel makers are planning production cuts during that period, which is expected to shift some demand to surrounding months. As a result, overall supply and demand should remain balanced, increasing the likelihood of an early-year uptick in TV panel prices. Currently, TV panel prices are expected to turn upward in January, with 32-inch, 43-inch, 55-inch, and 65-inch panels all set to increase by US$1.

.MNT

In January, LCD monitor panel demand remains in a seasonal low. However, with panel makers firmly maintaining price stability, mainstream panel prices continue to be supported despite weaker demand, and January prices are expected to remain broadly flat. From the first quarter onward, TV panel prices are set to enter an upcycle, which is expected to start stimulating LCD monitor panel demand. Combined with the impact of February production cuts, whether this will further drive LCD monitor panel prices to follow with price increases will be a key focus over the next one to two months.

.NB

In January, notebook panel demand is expected to weaken as some brands front-loaded purchases in the previous quarter, slowing demand momentum in the first quarter. Meanwhile, memory shortages and sharp price hikes are adding pressure, leading brand customers to intensify price-cut demands on other key components. With notebook panels still in oversupply, they are likely to take the brunt of this pressure, with both list prices and off-invoice incentives facing growing downside. As a result, notebook panel prices are expected to trend lower in January, with a slightly wider decline. TN models are expected to remain flat, while IPS models are forecast to fall by US$0.2.