Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[Insights] Early December Panel Prices: Brands Increase Orders, Suggesting TV Downtrend May End Early

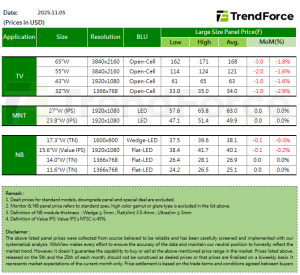

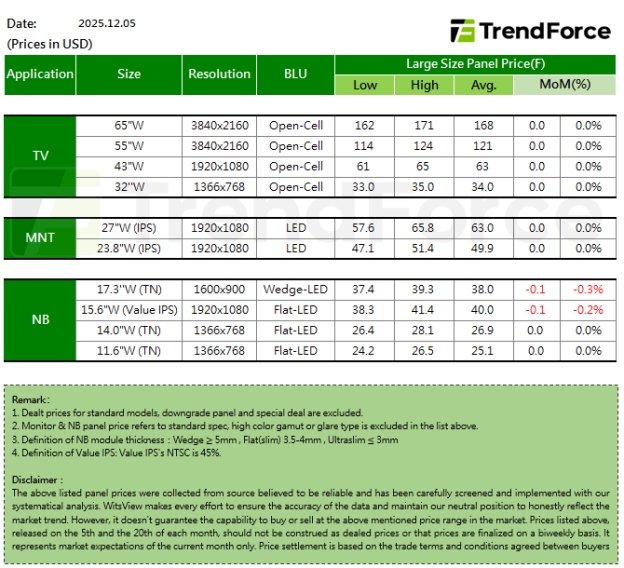

.TV

As the year draws to a close, demand for TV panels has not cooled; instead, it remains steady and relatively firm. The main reason is that some brand customers expect panel prices to have reached the bottom and have begun increasing orders, even preparing early for 1Q26 demand. This has allowed panel makers to maintain healthy production levels and utilization rates, while also creating an atmosphere for potential panel price increases.

Given the current supply–demand situation, the downward trend in panel prices may indeed end earlier than expected. The latest outlook suggests that in December, TV panel prices for sizes from 32 to 65 inches are expected to turn flat across the board.

.MNT

As for LCD monitor panel demand, moving into the fourth quarter, some brand customers have increased orders, but overall demand remains weak. Even so, panel makers are unwilling to offer major price concessions, and most brands accept stable pricing. As a result, December prices for LCD monitor panels are expected to stay flat across most sizes for both panel modules and Open Cell panels, with the exception of 23.8-inch VA Open Cell panels, which are forecast to fall by USD 0.2 due to more ample supply.

.NB

As December begins, notebook panel demand remains in line with expectations, and memory shortages and price increases have yet to significantly affect panel procurement. However, some brand customers are still pushing for deeper price cuts. This indicates that the previous use of unofficial discounts is no longer enough to satisfy customers, and panel makers—seeking to maintain relationships—will need to adjust official pricing. Currently, December notebook panel prices are expected to remain flat for low-end TN models, while IPS models are projected to decline by USD 0.1 to 0.2.