Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] Micron to End Crucial Consumer Memory by Feb 2026, Redirects Supply to Enterprise amid AI Surge

Amid a severe memory crunch driven by soaring demand from data centers and hyperscalers, Micron announced Wednesday that it will exit the consumer memory market. As Tom’s Hardware notes, the move signals a shift in production and investment toward enterprise-grade DRAM and SSDs to keep pace with the growing AI demand.

Micron’s business chief Sumit Sadana said the company is winding down its Crucial consumer business to focus supply on its largest strategic customers in fast-growing markets. Tom’s Hardware reports that after the end of its fiscal second quarter in late February 2026, Crucial consumer products will be discontinued, while Micron’s enterprise portfolio will remain available via commercial and server-focused channels.

Yonhap News reports that Crucial includes PC components, laptop DRAM, and consumer SSDs, while CNBC notes the 29-year-old brand serves DIY builders and upgraders with plug-in memory modules and personal-system SSDs.

Micron’s Strategic Shift

CNBC points out that while Micron hasn’t detailed Crucial’s revenue, the move highlights a bigger trend: the AI boom is tightening global memory supplies as tech giants invest hundreds of billions to build massive data centers over the next few years.

As CNBC notes, AI processors, including NVIDIA’s and AMD’s GPUs, consume huge volumes of cutting-edge memory. NVIDIA’s current-generation GB200 GPU, for instance, packs 192GB of memory per chip, while Google’s newest AI processor, the Ironwood TPU, also requires 192GB of high-bandwidth memory, the report adds.

Notably, Micron is a major supplier to AMD, providing 12H HBM3E memory for the company’s flagship MI350 chip, which boasts 288GB of high-bandwidth memory, according to the company’s press release.

As Reuters suggests, tech giants like Microsoft, Google, and ByteDance are racing to secure memory supplies from chipmakers including Micron, Samsung Electronics, and SK hynix amid tight supply.

Memory Giants Pull Back from Consumer Market

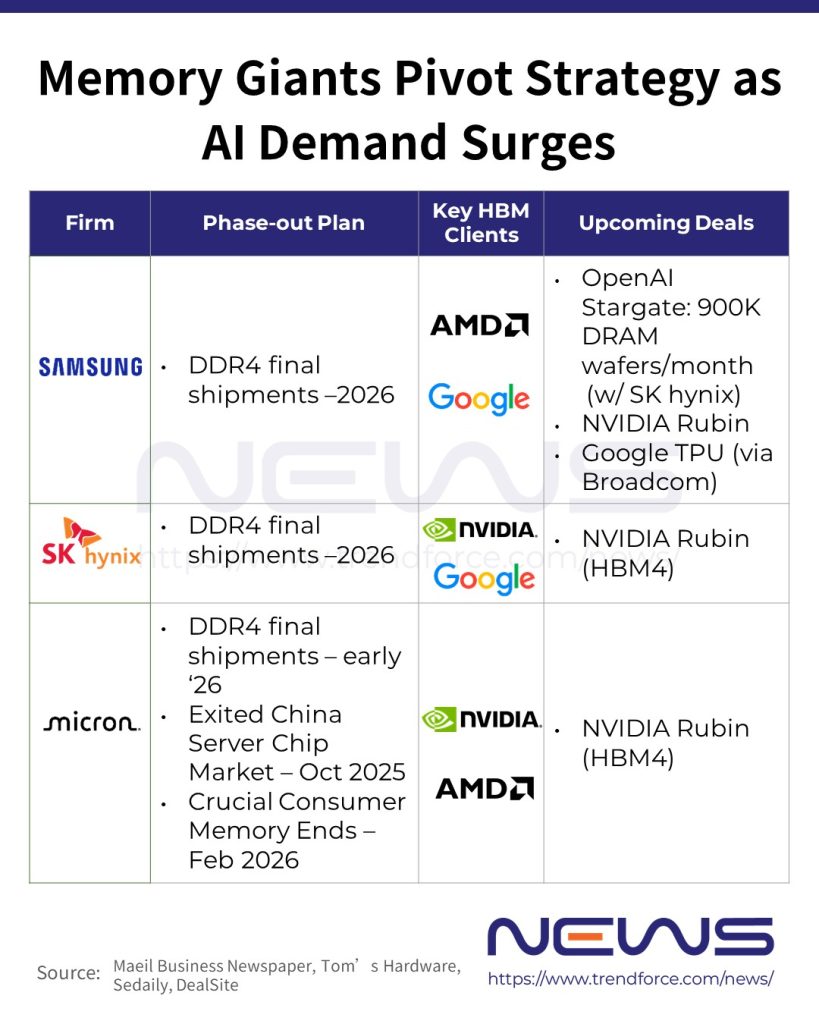

Micron’s latest decision isn’t the first among memory giants to cut back on consumer-grade chips. Samsung and SK hynix also plan to wind down DDR4 production, though South Korea’s Maeil Business Newspaper reports that both will continue manufacturing into next year. Reuters suggests that following suit, China’s ChangXin reportedly ended most of its DDR4 production, though the company declined to comment.

Intensifying Memory Crunch

Citing data from TrendForce, Reuters reports that average DRAM inventories—the memory widely used in computers and smartphones—fell to just two to four weeks in October, down from three to eight weeks in July and 13 to 17 weeks in late 2024.

A memory-chip executive told Reuters that the shortage could delay upcoming data-center projects. Expanding capacity takes at least two years, and manufacturers are wary of overbuilding, fearing chips could sit idle if the AI-driven demand surge slows, the report adds.

Read more

- [News] Micron’s New York Megafabs Reportedly Face 2–3 Year Delay, First Now Set for Late 2030

- [News] Micron Reportedly Exits China Server Chips; Samsung, SK hynix, and Local Makers Stand to Gain

(Photo credit: Micron)