Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] SMIC Posts 29% Year-on-Year Jump in Q3 Profit, Warns of Softer Q4 Margins

Amid China’s aggressive drive for chip self-reliance, leading foundry SMIC delivered stronger-than-expected third-quarter results, The Wall Street Journal reports. The company posted net profit of $191.8 million for the period—up 29% from a year earlier and comfortably ahead of the $161.2 million forecast by analysts, the report adds.

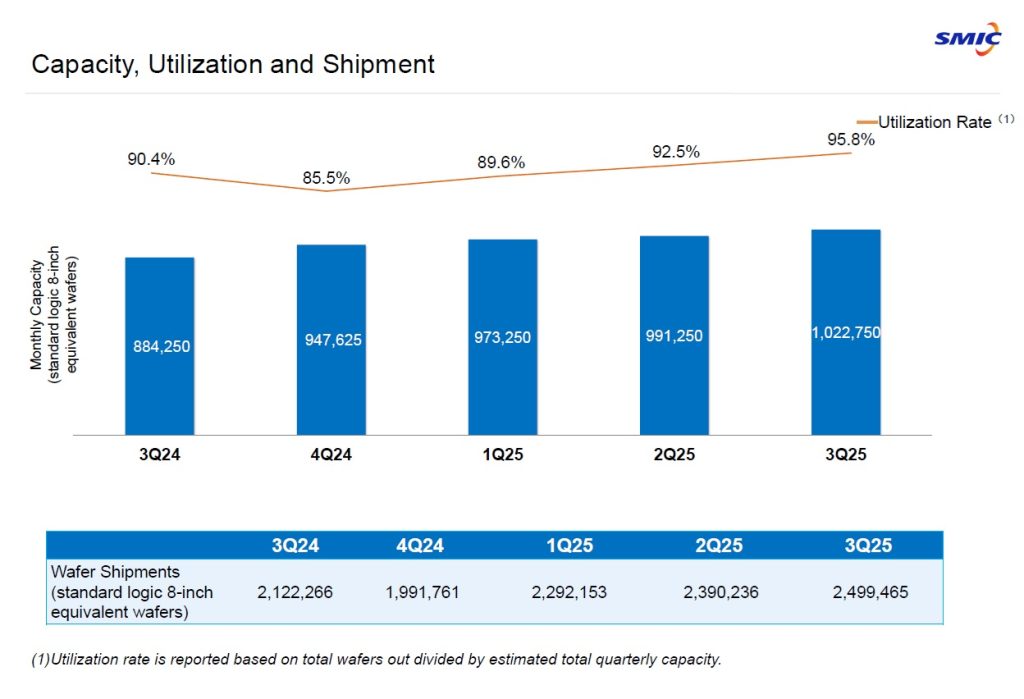

On the revenue side, third-quarter sales rose 9.7% to $2.38 billion, edging past the $2.35 billion market consensus and topping SMIC’s own forecast for 5%–7% sequential growth from the previous quarter’s $2.21 billion, The Wall Street Journal notes. The company’s press release also showed capacity utilization climbing to 95.8%, up 3.3 percentage points from Q2.

(Credit: SMIC)

Ijiwei also highlights SMIC’s Q3 revenue breakdown: China accounted for 86.2%, the U.S. 10.8%, and Eurasia 3%. By wafer size, 12-inch wafers made up 77% of revenue, while 8-inch wafers contributed 23%.

The Wall Street Journal, citing Co–Chief Executive Haijun Zhao’s remarks in August, suggests that demand is strengthening for analog chips—key components for mobile fast charging and power management—as Chinese suppliers rapidly capture share from overseas competitors. Zhao reportedly hinted that SMIC’s production capacity would remain insufficient to meet this demand at least through October.

On the other hand, SMIC’s advanced-node capacity also appears robust. The Wall Street Journal reported that after China ordered all state-backed data centers to use only domestic AI chips, a deepening shortage has prompted authorities to ration the foundry giant’s output, directing its limited capacity to Huawei.

Margin Concern

For the current quarter, SMIC projects sequential revenue growth of up to 2% and expects its gross margin to fall between 18% and 20%, well below Q3’s 22%.

Commercial Times notes that revenue momentum is expected to slow, with gross margins also coming under pressure in the fourth quarter.

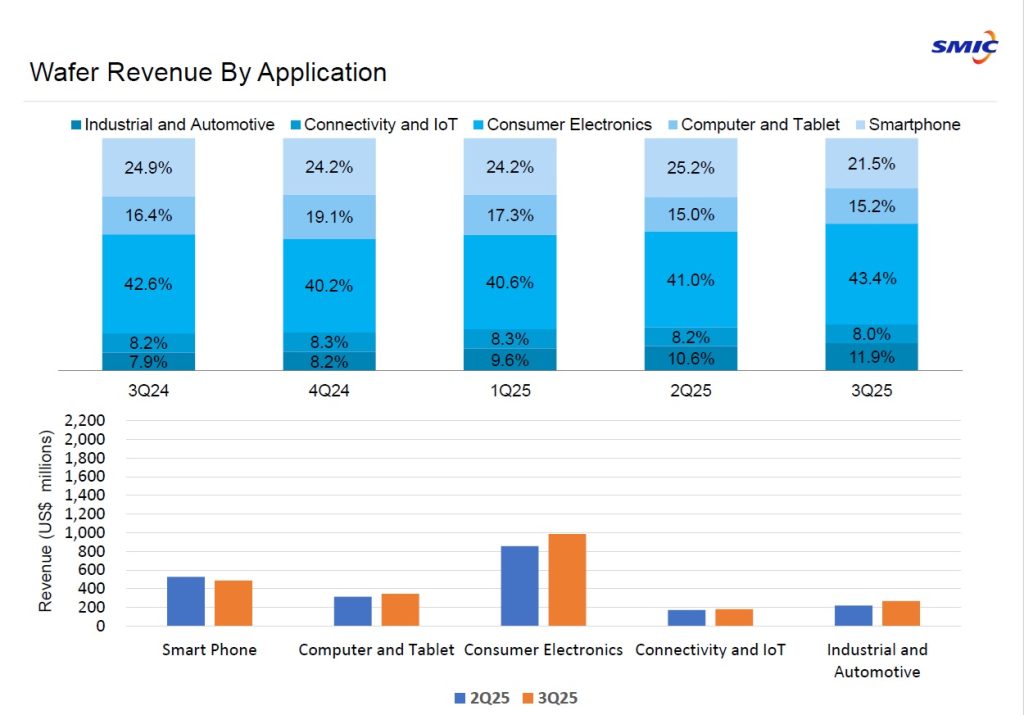

The report highlights a major shift in SMIC’s third-quarter end-market mix: consumer electronics rose from 41% to 43.4% of revenue, while smartphones fell from 25.2% to 21.5%. Analysts cited by the outlet say the change may help keep fabs highly utilized, but consumer-electronics chips typically have lower prices and margins than high-end smartphone components—likely contributing to the softer gross-margin forecast for Q4.

(Credit: SMIC)

Read more

(Photo credit: SMIC)