Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] Applied Materials Flags a 2026 China Fab Spending Drop Amid Tougher U.S. Export Rules

Chip equipment maker Applied Materials reported its Q4 results this week, with China sales taking center stage as tightening export controls raise questions about the company’s outlook. According to Reuters, Applied Materials said it expects spending on chipmaking equipment in China to fall in 2026 as tighter U.S. export controls limit its market access. Meanwhile, strong memory output tied to surging AI investments is likely to help partially offset the impact.

China Market Pressure and 2026 Outlook

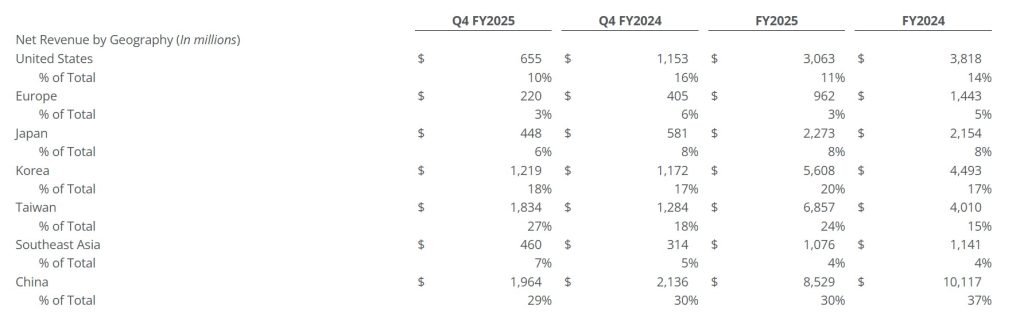

Restrictions on sales to China have weighed heavily on the company. According to the earnings call transcript cited by Investing.com, Applied Materials President and CEO Gary Dickerson said that multiple trade rule changes in 2025 have reduced the size of the company’s addressable market in China. As a result, China accounted for 28% of total systems and services revenue in fiscal 2025 and 25% in the fourth quarter.

Dickerson also noted during the call that the company expects wafer-fab equipment spending in China to decline in 2026. The company further emphasized that trade measures have significantly limited its access to the China market. According to the earnings call transcript, the impact of these restrictions was equivalent to roughly 10% of the China market in fiscal 2024 and more than double that amount in fiscal 2025.

Meanwhile, Reuters notes that while Applied Materials’ revenue from China has dropped from nearly 40% in recent years to the mid-20% range, Dickerson said foreign competitors are still able to reach Chinese customers that Applied Materials can no longer serve.

As Reuters notes, Dickerson said the company is no longer able to supply China’s memory chip sector or its mature-node chipmaking market because of tighter U.S. controls, though he does not anticipate major additional restrictions on shipments to China.

(Credit: Applied Materials)

Applied Materials Eyes Second-Half 2026 Demand Rebound

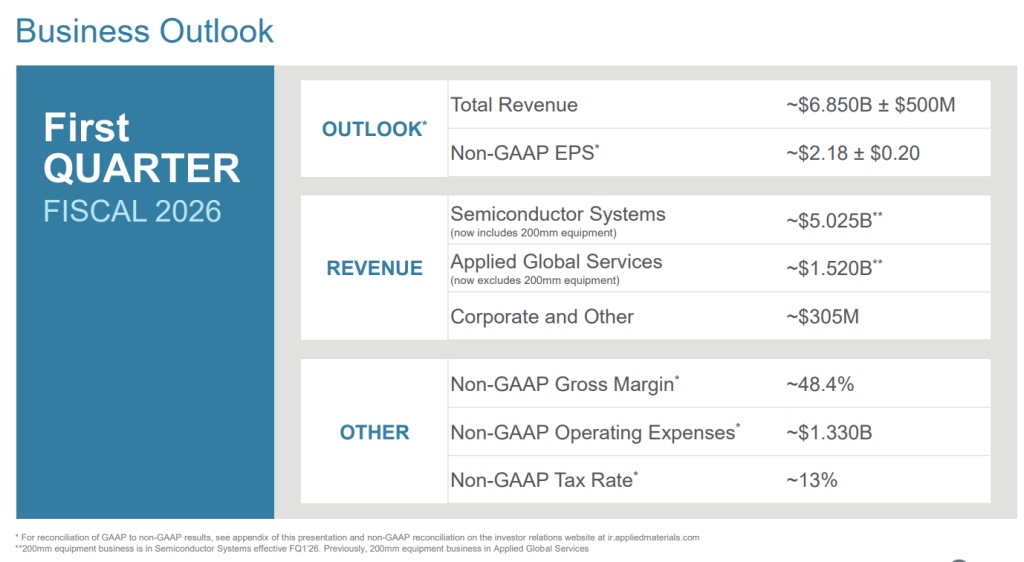

Applied Materials reported results for its fourth quarter and fiscal year ended Oct. 26, 2025, posting annual revenue of $28.37 billion, up 4% year over year, and quarterly revenue of $6.80 billion, down 3% from a year earlier.

Although the company’s fourth-quarter revenue declined from a year earlier, Bloomberg reports that the chip-equipment maker expects demand to strengthen in the second half of 2026. Chief Financial Officer Brice Hill said the company is preparing its operations and service organizations to be ready to support higher demand beginning in the latter half of calendar 2026.

(Credit: Applied Materials)

Read more

- [News] Latest U.S. Export Curbs on Chinese Blacklisted Subsidiaries Could Cost Applied Materials $710M

- [News] Applied Materials Reportedly Flags Minimal Effect of U.S. Incentives, Offers Nuanced View on China

(Photo credit: Applied Materials)