Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

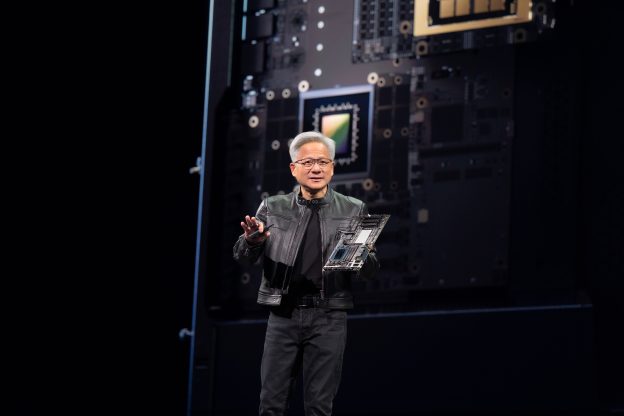

[News] NVIDIA Reportedly Adds 300K H20 Orders on China Demand Surge — TSMC, Memory Makers in Focus

With U.S. approval to restart H20 sales in China, buzz around NVIDIA’s inventory is ramping up. Fueled by strong demand from Chinese buyers, the AI chip giant reportedly placed a 300,000-chip order with TSMC last week, Reuters reports.

According to sources cited by the report, the new TSMC order adds to an existing stockpile of 600,000 to 700,000 H20 chips, boosting NVIDIA’s inventory even further.

During his Beijing visit this July, NVIDIA CEO Jensen Huang said restarting the H20 supply chain would take nine months, CNBC reports. He also emphasized that production will only resume once enough orders are confirmed, the report adds. Reuters suggests that NVIDIA has asked Chinese buyers to submit fresh documents, including client order forecasts, before purchasing H20 chips.

According to TrendForce’s estimate, NVIDIA sold about 1 million H20 chips in 2024, with this year’s target remaining roughly the same. Yet, TrendForce’s latest supply chain survey shows upstream suppliers haven’t seen increased demand, while NVIDIA’s main focus remains meeting this year’s original goal of 900,000 to 1 million units. Below is a quick update on TSMC and the potential impact on H20’s HBM suppliers.

TSMC 4nm Maxed Out

As insiders have noted, TSMC’s 4nm lines are running at full throttle, leaving little room for rush orders. According to Commercial Times, NVIDIA’s H20—built on TSMC’s 4nm node (5nm family) with CoWoS-S packaging—still faces a capacity crunch, and even SHR (super hot rush) orders struggle to get prioritized.

According to another previous report from Central News Agency, TSMC Chairman C.C. Wei said at the July 17 earnings call that 5nm capacity remains tight—and 3nm is even more constrained. To ease the crunch, TSMC is helping customers shift 5nm production to 3nm while reallocating 7nm equipment to support 5nm lines. With 85–90% of the tools being compatible, the move is expected to boost manufacturing flexibility, the report noted.

Ripple Effect on HBM Suppliers

If the additional H20 order request proved to be true, NVIDIA’s decision to expand H20 shipments is expected to benefit HBM suppliers. As per ZDNet, SK hynix is reportedly considering additional production of its 8-layer HBM3E products.

The report suggests that originally, the H20 was equipped with HBM3, but earlier this year, NVIDIA switched to the more advanced 8-layer HBM3E to enhance performance. As a result, it requested additional supply from SK hynix and Micron, the report notes.

According to Business Post, SK hynix revealed during the Q2 earnings conference on the 24th that the company has been a key supplier of HBM for the H20 chip prior to export restrictions and is confident in its ability to respond quickly.

Notably, the South Korean memory giant announced at last week’s earnings call that it will boost 2025 spending to keep pace with the expanding HBM market. While the company hasn’t disclosed the exact increase, The Elec suggests that the company’s 2025 capex is set to surge 30% compared to earlier forecasts.

Read more

- [News] NVIDIA’s H20 Production Faces Challenges? Inventory Reportedly Holds Amid Full TSMC N4 Capacity

- [News] NVIDIA’s China H20 Sales to Resume After U.S. Commitment, Samsung Poised to Gain from HBM3 Supply

(Photo credit: NVIDIA)