Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[Insights] Panel Prices in Early May: NB, MNT Prices Hold Firm Ahead of Tariff Calls

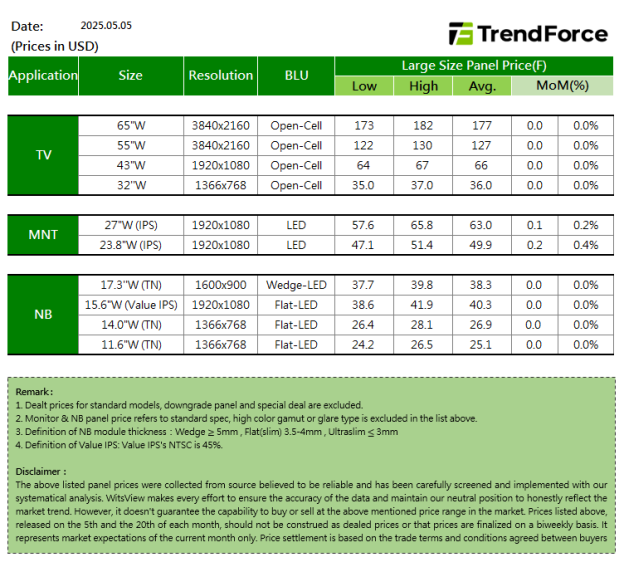

TrendForce discloses the latest panel prices for early May, with details as follows.

- TV

As May begins, weakening demand for TV panels has become increasingly evident. Some brand customers have begun leveraging this opportunity to pressure panel makers for further price concessions. Aware of the softening demand, panel makers have implemented production cuts during the Labor Day holiday.

The industry’s average utilization rate for May is expected to decline by around 6%–7% compared to April. By adjusting supply to meet lower demand, panel makers hope to ease downward price pressure. Overall, TV panel prices are expected to remain flat throughout May.

- MNT

Meanwhile, MNT panel demand remains relatively strong in May, supported by the impact of tariff-related factors, helping to sustain upward momentum in panel shipments and prices.

However, with TV panel demand weakening in the second quarter and prices leveling off, the upward trend in MNT panel prices may also begin to slow.

Current estimates indicate that price increases in May are beginning to narrow. Open-cell MNT panel prices are expected to rise by USD 0.2, while module prices for 21.5-inch and 27-inch panels are projected to increase by USD 0.1. The 23.8-inch panel, supported by stronger demand, is expected to rise by USD 0.2.

- NB

Entering May, tariff-related factors continue to provide some support, but because brand customers vary in how extensively they’ve set up production in Southeast Asia, there is limited room to rapidly expand overall capacity within the 90-day exemption period. As a result, the pull-in momentum for notebook (NB) panels has not surged but remains steady.

Meanwhile, panel makers—concerned about a possible sharp drop in demand after the exemption period ends—have become more proactive in securing orders. To retain clients and compete for greater market share, panel makers are expected to adopt more flexible pricing strategies, creating a dynamic that differs from the MNT panel market.

For now, NB panel prices in May are expected to remain flat overall. At the same time, panel makers are expected to negotiate with brand customers, offering better pricing in exchange for larger order volumes.