Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] Applied Materials Guides April Quarter Above Estimates; Sees 20%+ Semi Growth in 2026, DRAM Leads

Despite booking a $252 million penalty tied to illegal equipment shipments to China, Applied Materials still delivered a confident outlook. According to Bloomberg, the company projected fiscal second-quarter revenue of about $7.65 billion — well above analysts’ consensus of $7.03 billion for the April quarter.

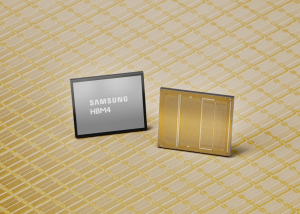

CEO Gary Dickerson, as per Bloomberg, highlighted surging demand for high-bandwidth memory (HBM), a critical enabler of AI computing, as a key growth driver. The largest U.S. chip equipment supplier expects its semiconductor systems business to expand by more than 20% in 2026, the report adds.

Reuters, citing Dickerson, reports that DRAM is set to be the fastest-growing segment in 2026, fueled by accelerating adoption of 3D chiplet stacking — a key packaging technology underpinning AI processor production.

Bloomberg adds that memory equipment demand is emerging as a standout driver, as its major customers such as Samsung and Micron ramp capacity to ease tight supply conditions. Among them, etch and deposition tools critical for DRAM production are set to benefit, as robust orders from AI-driven chipmakers continue to build, according to Bloomberg Intelligence.

Financial Highlights: China Still Matters

Applied Materials said it expects second-quarter earnings of roughly $2.64 per share, ahead of the $2.29 consensus estimate, Bloomberg reports, adding that in the first quarter, revenue dipped 2% to $7.01 billion — a smaller decline than analysts had feared. Earnings for the period ended Jan. 25 came in at $2.38 per share, surpassing projections of $2.21, Bloomberg suggests.

Notably, despite ongoing export curbs, China remains a cornerstone market for the company. Company data show China accounted for 30% of revenue in 1QFY26 — the largest regional share — ahead of Taiwan (25%), Korea (21%) and the U.S. (9%).

Prior to the announcement yesterday, which pinning down a $252 million penalty for Applied Materials for delivering chipmaking tools to SMIC, the company is also grappling with tighter U.S. export curbs. Bloomberg notes that in October, Applied Materials cautioned that expanded restrictions on China could reduce fiscal 2026 revenue by about $600 million. The Santa Clara, California-based company additionally announced plans to cut around 4% of its global workforce, the report adds.

Read more

- [News] US Reportedly Hits Applied Materials with $252M Penalty for Illegally Sending Chip Equipment to SMIC

- [News] Applied Materials Flags a 2026 China Fab Spending Drop Amid Tougher U.S. Export Rules

(Photo credit: Applied Materials)