Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] AMD 1Q Sales to Slip Despite $100M MI308 China Boost, Next-Gen AI Chips Set for 2H Ramp

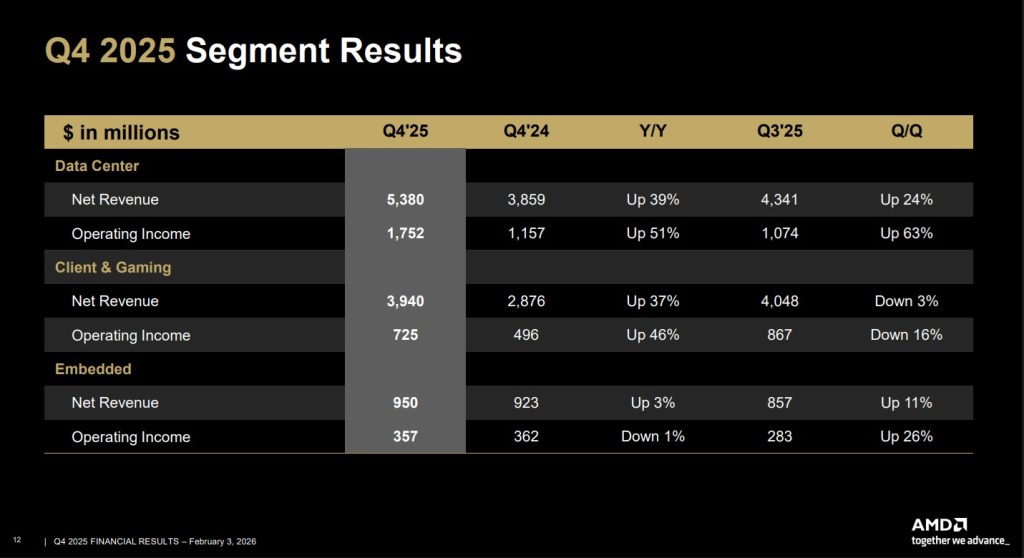

As leading chipmakers led by NVIDIA continue to ride the AI boom and press suppliers such as TSMC for more capacity, AMD struck a more cautious tone. At its Feb. 3 earnings call, the company forecast a modest decline in first-quarter revenue, even as stronger-than-expected AI chip shipments to China delivered a temporary boost, Reuters reports.

AMD expects first-quarter 2026 revenue around $9.8 billion, including about $100 million from MI308 AI chip sales to China. The midpoint signals roughly 32% year-on-year growth but a 5% drop from the prior quarter, with non-GAAP gross margin forecast at 55%.

As noted by Reuters, if the one-off China boost is excluded, AMD’s data-center business would have missed expectations, in contrast to NVIDIA’s track record of consistently strong guidance.

The report adds that while CEO Lisa Su said demand for AMD’s next-generation flagship AI servers—including orders from OpenAI—is expected to pick up in the second half of 2026, those sales are not included in the first-quarter outlook, leaving other products, especially CPUs, to carry most of the growth in the coming months—highlighting a potential risk for near-term revenue.

China AI Sales Spotlight

While NVIDIA’s H200 orders in China attracts attention, AMD also provided some updates for its MI308 AI chips in the market. Nikkei reports that its revenue for the quarter ended Dec. 27 surged 34% year on year to $10.3 billion, including $390 million in sales from the MI308 AI chip in China—revenue that had not been factored into prior guidance.

As the second Trump administration tightened rules, forcing AMD and NVIDIA to obtain export licenses for China-specific AI chips, CEO Lisa Su told Nikkei that the $390 million in revenue came from orders placed by Chinese customers “very early in 2025,” with shipments completed in the October–December quarter after the company secured an approved export license through coordination with the U.S. administration.

Looking ahead, AMD plans to ship another $100 million of MI308 chips to China in the quarter ending March but is not counting on additional China revenue, citing market uncertainty, Nikkei reports. Late in 2025, U.S. President Trump said the U.S. would allow exports of more advanced AI chips, including AMD’s MI325 and NVIDIA’s H200, the report adds.

According to Nikkei, Su said AMD has already applied for export licenses for the MI325 and is continuing to engage with customers to gauge demand.

Risks Persist

Beyond China’s market uncertainty, Reuters warns that AMD’s growth still leans heavily on a handful of key customers. An analyst cited in the report noted that expansion is concentrated in large deployments and select regions, with China sales large enough to materially impact quarterly results.

According to CNBC, the chipmaker has recently unveiled several marquee customers, including ChatGPT developer OpenAI and Oracle. AMD is also set to begin shipping its new integrated, server-scale AI platform, Helios, later this year, the report notes, adding that Su said the company is in “active discussions” around additional sales of Helios systems as well as MI450 chips.

Read more

- [News] Trump Targets NVIDIA H200, AMD MI325X with 25% Tariff; U.S. Infrastructure Spared

- [News] Samsung Reportedly Set to Begin Official HBM4 Shipments to NVIDIA and AMD in February

(Photo credit: AMD)