Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] China’s GPU Trio Rise as NVIDIA Retreats — Decoding Moore Threads, MetaX, and Cambricon

As South China Morning Post reported, NVIDIA CEO Jensen Huang recently spotlighted China’s chipmaking progress and manufacturing muscle, noting the country is merely “nanoseconds behind” the U.S. He also acknowledged in May that, amid U.S. export restrictions, NVIDIA’s share in China has slipped to 50% from a dominant 95% four years ago, according to Reuters.

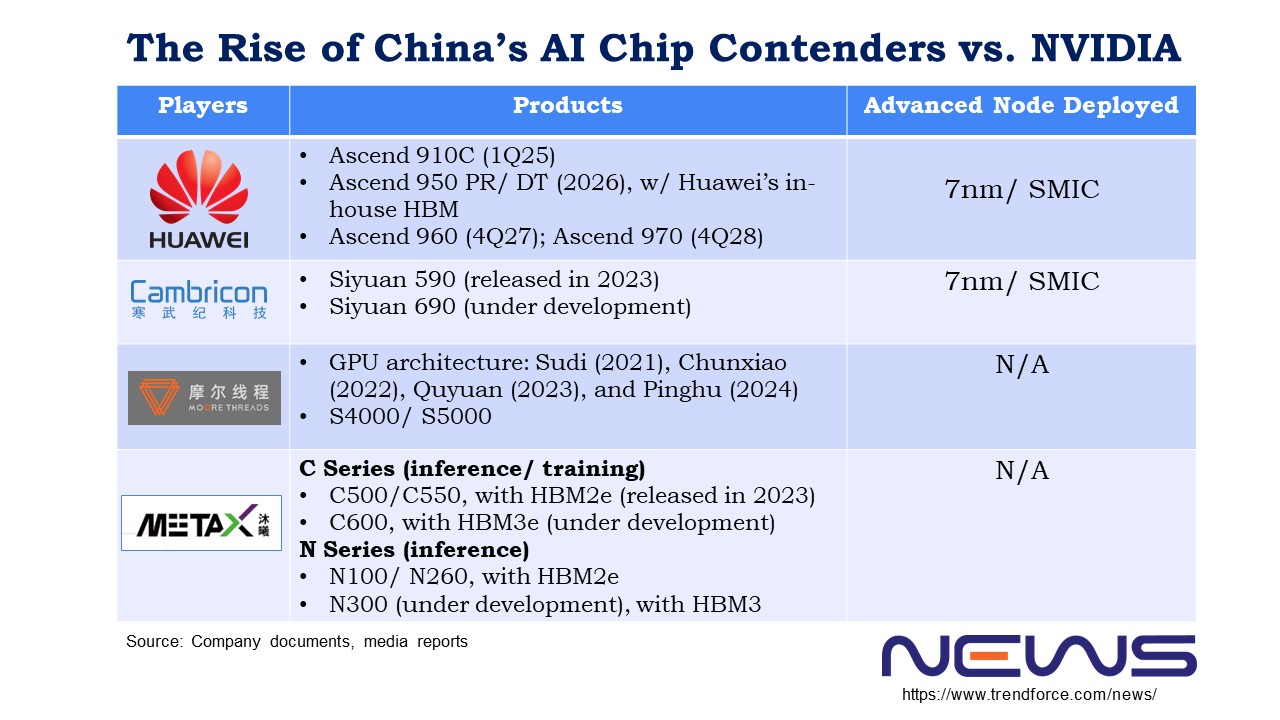

Beyond tech heavyweight Huawei and its Ascend AI chips, all eyes are now on which players will seize the opportunity to fill NVIDIA’s shrinking slice of the Chinese market. GPU standout Moore Threads, fresh off clearing the Shanghai STAR Market IPO review in late September, is attracting attention, while Cambricon and MetaX are also in the mix with their private placements and listing ambitions. Here’s a quick update on the three emerging GPU stars in the country.

Moore Threads

According to Commercial Times, in terms of chip types, Moore Threads is closer to NVIDIA. While Cambricon and Huawei HiSilicon focus more on ASIC chips, Moore Threads claims to be China’s only company currently mass-producing fully functional GPUs, the report notes.

The Security Times reports that Moore Threads has so far launched four generations of GPU architecture: Sudi (2021), Chunxiao (2022), Quyuan (2023), and Pinghu (2024). The first two, Sudi and Chunxiao, are mainly used for professional and desktop graphics acceleration, while Quyuan and Pinghu focus on AI computing products, the report adds.

These product iterations have also boosted the company’s gross margin. According to the report, Moore Threads’ consolidated gross margin jumped from -70.08% in 2022 to 25.87% in 2023, reaching 70.71% in 2024.

It is worth noting, according to the South China Morning Post, that Moore Threads’ founder and CEO James Zhang Jianzhong previously spent 14 years at NVIDIA, and reportedly served as vice president and general manager of NVIDIA’s China operations before leaving in 2020 to launch Moore Threads.

Notably, the report points out that the Beijing-based company, in late September, received approval from the Shanghai Stock Exchange for its IPO, taking just 88 days from filing in June to gain the green light—making it one of the fastest approvals for a listing on the Nasdaq-style Star Market.

Moore Threads, which expected to raise 8 billion yuan (US$1.12 billion) from its listing, said the funding would significantly speed up the large-scale commercialisation of its GPUs, according to the report.

MetaX

At the same time, GPU company MetaX is racing toward its own listing. While Moore Threads leans heavily on talent from Nvidia, MetaX traces its roots to AMD. According to the Commercial Times, founder Chen Weiliang joined AMD Shanghai as a senior director in 2007 and left in 2020 to launch MetaX. Both of the company’s CTOs, Peng Li and Yang Jian, also came from AMD.

The Security Times reports that in 2024, the company’s training-and-inference GPU series became the core revenue driver, with GPU boards accounting for 68.99% of total revenue and GPU servers 28.29%. In Q1 2025, GPU board revenue from the series surged to 97.55% of total sales, the report adds.

However, the report points out that neither MetaX nor Moore Threads has yet achieved profitability. What fuels their confidence in tapping the capital market is the strong revenue growth seen in 2024, together with rising market recognition of their AI computing products built for the era of large models, as reported by the Security Times.

Cambricon

On the flip side, Cambricon is back in the spotlight after securing regulatory approval in September for a CNY3.99 billion (USD559.6 million) private placement to bankroll AI chip and software projects, Yicai Global reports. The move comes after the company’s stock once soared nearly tenfold before later tumbling.

As per the report, Cambricon expects revenue this year to surge 317%–483% to between CNY5 billion and CNY7 billion, though the firm stressed the guidance is only preliminary and does not constitute a firm commitment.

The company reported a first-half net profit of CNY1 billion, swinging from a CNY530 million (USD74.1 million) loss a year earlier, driven by rising domestic demand, the report adds.

Unlike Moore Threads and MetaX which leverage NVIDIA and AMD talents, Cambricon was founded in 2016 by brothers Chen Yunji and Chen Tianshi, both still in their early 40s now. According to South China Morning Post, Cambricon’s next flagship, Siyuan 690, is expected to rival NVIDIA’s H100 in performance. Meanwhile, Business Today notes that its 2023-launched Siyuan 590 delivers roughly 80% of NVIDIA’s A100 performance, and is built using China’s domestic 7nm process.

According to Commercial Times, Cambricon still leads the three companies in revenue. Moore Threads, which had lagged behind MetaX, pulled ahead in the first half of 2025. With NVIDIA products restricted in China, both Cambricon and MetaX posted explosive revenue growth in the period, surpassing their combined totals of the past three years. Even so, the report adds, MetaX captured a noticeably smaller slice of the market left by NVIDIA.

Read more

(Photo credit: Moore Threads)