Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] Japan’s Power Chip Lead Reportedly Shrinks to 3 Years, Challenged by Chinese Rivals

According to TechNews, citing Nikkei, Japan has long held a leading position in power semiconductors, but the swift rise of Chinese newcomers is now posing a serious challenge. The report notes that Japan’s slow progress in industry consolidation and strategic coordination is a key factor limiting its ability to compete effectively with Chinese firms.

The report, citing an analyst, notes that the technology gap between Japanese and Chinese companies is estimated at just one to two years in silicon chips and, at most, three years in SiC chips.

Fragmented Japanese Power Semiconductor Sector Faces Rising Chinese Rivals

The report notes that Japan has five major power semiconductor manufacturers—Mitsubishi Electric, Fuji Electric, Toshiba, Rohm, and Denso—but each holds less than a 5% share of the global market.

As the report indicates, collaboration and integration among these companies have often faced obstacles. For instance, in 2023, Rohm invested 300 billion yen (about USD 2 billion) in Toshiba with the aim of complementing resources and expanding into electric vehicle and industrial applications, yet broader cooperation has yet to materialize, the report notes.

Rohm posted a net loss of 50 billion yen in the fiscal year ending March 2025, marking its first annual loss in 12 years, the report notes. The company has struggled to profit from next-generation silicon carbide (SiC) power chips amid a slowing EV market, while intensifying competition from Chinese rivals has further weighed on earnings, the report highlights.

China’s Power Semiconductor Makers: Rapid Rise and Competitive Edge

Meanwhile, the report states that emerging Chinese companies are entering the market by leveraging cost and pricing advantages.

According to TrendForce, Chinese vendors TanKeBlue and SICC have rapidly emerged as major players, claiming 17.3% and 17.1% market shares respectively, placing them in second and third place. TanKeBlue is the largest domestic SiC substrate supplier for China’s power electronics market, while SICC leads in the 8-inch SiC wafer segment.

Lower energy costs also enable Chinese firms to supply substrates at more competitive prices. Since energy accounts for as much as 30–40% of total substrate manufacturing costs, this has become a key advantage driving the rise of Chinese companies, according to the report.

The report mentions that Chinese companies often specialize in specific processes, an approach more efficient than Japan’s traditional vertically integrated (IDM) model. Meanwhile, China’s vast EV market provides strong demand, allowing manufacturers to scale production, cut costs, and refine products through customer data—further accelerating the growth of Chinese power semiconductor makers, as the report notes.

Read more

- [News] Power Semiconductor Giants amid Struggles: 8,800+ Layoffs as Market Slows and China Emerges

- Global SiC Substrate Revenue Declines 9% in 2024; Long-Term Demand Remains Strong as 8-Inch Roadmap Gains Momentum, Says TrendForce

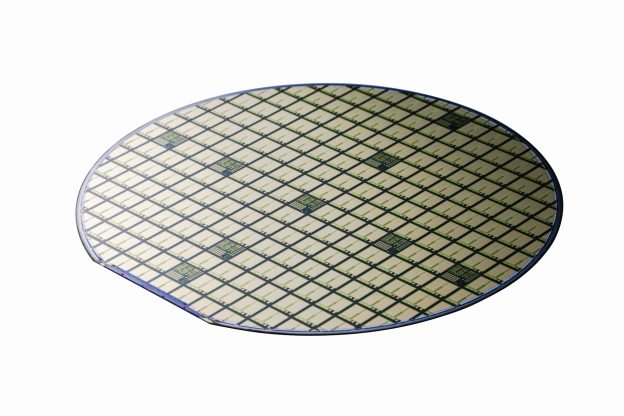

(Photo credit: Denso)