Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] 2025 China Chip IPO Surge: 30 A-Share Filings Target Nearly RMB 100B; HK Listings Accelerate

In 2025, China’s semiconductor industry has seen a new wave of IPO activity. According to ijiwei, statistics show that 30 semiconductor companies entered the A-share IPO review process during the year, with a combined fundraising target of nearly RMB 100 billion. At the same time, 19 non–A-share semiconductor firms, along with dozens of leading companies already listed on the A-share market, are actively preparing for listings in Hong Kong.

A-Share IPO Boom: Nearly RMB 100 Billion Raised Across the Semiconductor Value Chain

As the report notes, China’s chip IPO market remained active in 2025. In terms of the distribution of fundraising, leading companies showed strong financing demand, with the 30 accepted applicants collectively planning to raise RMB 98.586 billion, translating to an average fundraising target of RMB 3.286 billion per company.

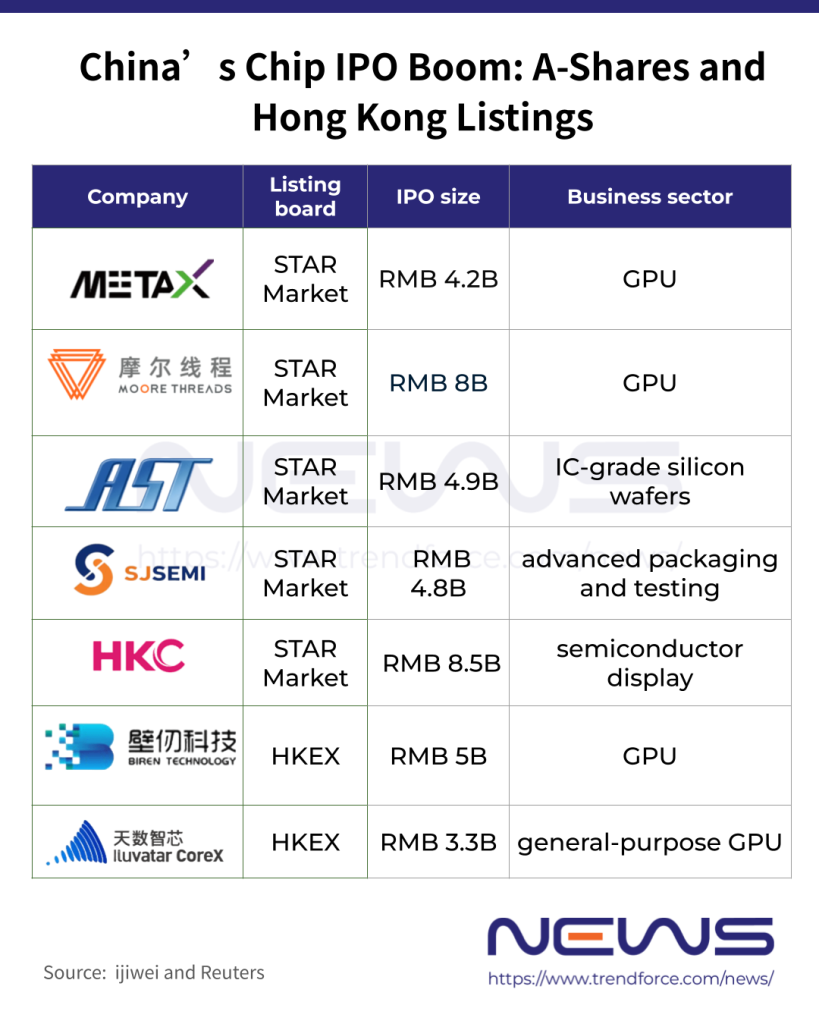

As per the report, CXMT plans to raise RMB 29.5 billion, making it the largest semiconductor IPO by fundraising size in 2025. Display maker HKC and GPU company Moore Threads follow with planned fundraising amounts of RMB 8.5 billion and RMB 8.0 billion, ranking second and third, respectively. The report adds that Shanghai Advanced Silicon (AST), Zhaoxin, and SJ Semiconductor each have proposed fundraising targets exceeding RMB 4.0 billion.

From a business-segment perspective, the lineup spans all parts of the semiconductor value chain. The report notes that chip design remains the dominant category, covering high value-added areas such as GPUs (including MetaX and Moore Threads), CPUs (such as Zhaoxin), as well as RF front-end and optical communication chips.

Chinese equipment and component suppliers were also highly active in the IPO pipeline, covering laser tools, specialized equipment, and key components. The report adds that participation from Chinese firms in the materials segments has likewise increased, highlighting the accelerating push toward self-sufficiency in semiconductor materials through capital market listings.

Hong Kong Listings Gain Traction as Chinese Semiconductor Firms Seek Global Capital

While momentum in the A-share market remained strong, a number of Chinese semiconductor companies in 2025 also began actively planning listings in Hong Kong. According to the report, based on public disclosures from the Hong Kong Stock Exchange, a total of 19 non–A-share semiconductor firms had initiated Hong Kong IPO plans during the year, spanning key segments such as GPUs, power semiconductors, sensors, packaging and testing, and equipment.

In the high-performance computing and GPU space, general-purpose GPU developers such as Iluvatar CoreX and Biren Technology have drawn significant attention, the report notes. These companies typically require substantial R&D investment and offer strong long-term growth potential, making Hong Kong listings a valuable avenue to accelerate technology iteration and ecosystem development.

Notably, the report points out that beyond the aforementioned unlisted firms, some companies already listed on the A-share market also began or advanced plans for Hong Kong listings in 2025. These include OmniVision, GigaDevice, Novosense Microelectronics, SICC, along with dozens of other well-known companies.

Regarding the motivations behind these Hong Kong listings, the report notes that Hong Kong’s appeal to Chinese chip companies rests on three main factors: access to a global investor base that enhances international visibility and attracts overseas strategic capital; a relatively flexible post-listing refinancing framework suited to the industry’s long-term, capital-intensive needs; and greater tolerance for pre-profit technology firms, making Hong Kong well suited to growth-stage companies with heavy R&D investment.

Read more

- [News] China AI Chipmakers Step Up Hong Kong IPO with Baidu Kunlunxin Filing, Biren HK$5.58B Listing

- [News] China’s GPU IPO Wave Intensifies: MetaX Surpasses Moore Threads in Retail Investor Interest

(Photo credit: FREEPIK)