Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

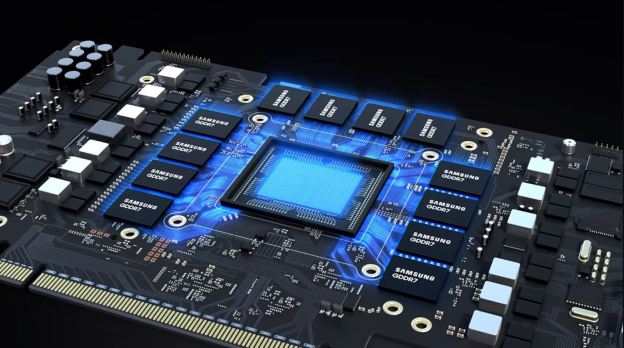

[News] AI Reportedly to Consume 20% of Global DRAM Wafer Capacity in 2026, HBM and GDDR7 Lead Demand

As AI infrastructure ramps up, memory supply tightens and prices soar. Commercial Times, citing industry experts, projects that cloud high-speed memory consumption could reach 3 exabytes (EB) by 2026. Notably, when factoring in the “equivalent wafer usage” of high-speed memory like HBM and GDDR7, the report warns AI could effectively consume nearly 20% of global DRAM supply.

According to the report, the 3EB is expected to be driven by three key components. First, core inference workloads across major platforms—Google (Gemini), AWS (Bedrock), and OpenAI (ChatGPT)—are projected to reach roughly 750PB in real-time memory demand. When factoring in necessary redundancy and safety margins for actual deployment, this figure effectively doubles to approximately 1.5EB.

Second, private cloud infrastructure from Meta and Apple, combined with China’s domestic market, contributes an additional 800PB. Finally, next-generation model training requirements—including checkpoint storage and parameter preservation—add another 500PB to the total.

HBM and GDDR7 Take Center Stage

Among these factors, the report notes that the AI race is quickly moving from raw computing power to memory capacity and inference costs. With the surge in storing massive intermediate-state data during inference—multiplying memory needs per user or AI agent—demand for HBM and GDDR7 has surged.

Behind this supply crunch lies a manufacturing reality: high-speed memory is significantly more resource-intensive—1GB of HBM consumes 4x the capacity of standard DRAM, while GDDR7 requires 1.7x. This multiplier effect means AI’s drain on manufacturing capacity vastly outpaces its share of actual memory shipped.

Commercial Times further suggests that the estimated global DRAM capacity is expected to reach 40EB in 2026, while AI-equivalent consumption would account for nearly 20% of total output. With annual DRAM capacity growth limited to just 10-15%, this surge will inevitably squeeze supply for standard DRAM products like PC, smartphone, and server DDR5, intensifying both shortage risks and upward price pressure, the report warns.

Read more

(Photo credit: Samsung)