Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] What Is Glass Fiber Fabric and Why Is T-Glass Critical for AI Servers? A Deep Dive

Amid soaring AI server demand, critical components like HBM and AI accelerators are naturally in short supply. But the race for high-speed computing has brought new challenges—especially reducing material losses. In this push, the once-understated “glass fiber fabric,” specifically T-glass, is emerging as a major winner.

Industry buzzwords like “Low-Dk,” “Low-CTE,” “T-glass,” and “glass fiber fabric” are now everywhere—but what do they really mean? And with glass fiber fabric supplies running short and prices skyrocketing, how is this affecting the AI market? Here’s the key info you need, compiled by TechNews.

Why Glass Fiber Fabric Suddenly Matters

Glass fiber fabric is a woven material made from fine glass fiber yarn, prized for its insulation, heat resistance, and exceptional strength. It is a crucial ingredient in copper-clad laminates (CCL), which form the backbone of printed circuit boards (PCBs).

CCLs are produced by pressing copper foil together with non-conductive materials—mainly glass fiber fabric and epoxy resin—under heat and pressure. At the PCB level, CCL serves as the core substrate, forming the conductive layers that connect electronic components.

Glass fiber fabric, thus, acts as a reinforcement material within these substrates, giving PCBs the structural strength and electrical insulation they need to perform reliably. This is why discussions of glass fiber fabric often naturally extend to CCLs and PCBs in industry analyses.

Notably, glass fiber fabric is not just for AI servers. Today, it is used in a broad array of electronics—from high-end PCBs and IC substrates to smartphones, servers, and network boards. In high-frequency, high-speed applications, the quality of glass fiber fabric—particularly its low dielectric constant (Low-Dk) and low dielectric loss—becomes critical.

As AI server demand accelerates, it is driving a wave of PCB material upgrades. The focus? Glass fiber fabrics with “Low-Dk” (low dielectric constant) and “Low-CTE” (low coefficient of thermal expansion)—two properties essential for next-generation computing performance.

T-Glass: What Makes It Special?

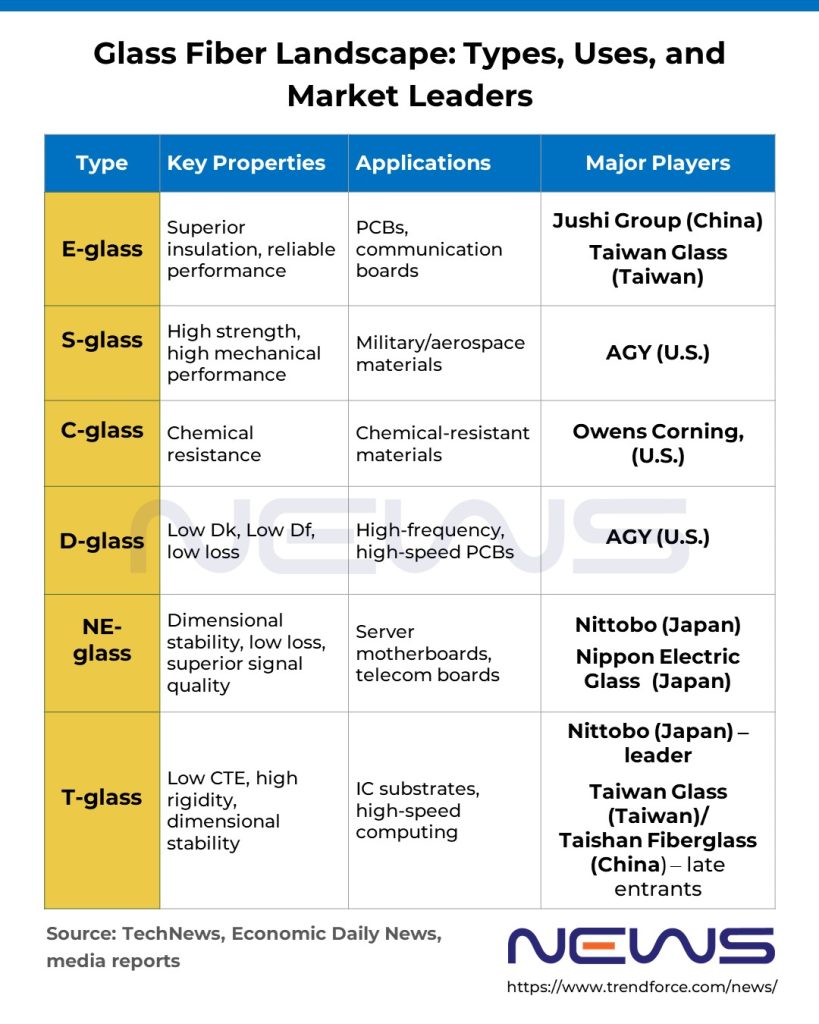

Glass fiber is not a single material— in fact, it comes in several varieties, classified by their composition and properties, as noted by TechNews—including E-glass, A-glass, C-glass, D-glass, and S-glass, among others. Here’s what sets them apart:

- E-glass (Electrical grade) is a high-grade, alkali-free glass fiber with excellent electrical insulation—keeps circuits stable.

- S-glass (Strength grade) is built for maximum mechanical strength—great for tough structural applications.

- C-glass (Chemical resistance grade) excels in acid resistance and is designed to withstand harsh chemical environments.

- D-glass (Dielectric grade) offers low dielectric properties, making it essential for high-frequency, high-speed circuit boards.

- NE-glass (NEG series) provides dimensional stability and low loss characteristics, commonly used in server motherboards and communication boards.

- T-glass—the glass fiber fabric making headlines in today’s supply crunch—is a high-tech offshoot of E-glass. Known for its superior rigidity, ultra-low thermal expansion, and dimensional stability, it keeps advanced packaging materials from warping or bending. Simply put, T-glass is what helps multi-layer substrates stay strong and precise, ensuring high-speed, high-performance electronics run reliably.

In terms of applications, T-glass (Low-CTE glass fiber fabric) is a critical material for IC substrates such as ABF (Ajinomoto Build-up Film) and BT (Bismaleimide-Triazine) substrates, as well as for cutting-edge packaging technologies like CoWoS (Chip-on-Wafer-on-Substrate) and SoIC (System-on-Integrated-Chips). These platforms handle massive volumes of high-speed signals and power, making T-glass the backbone of fast, reliable AI computing.

What Are Low-Dk, Low-Df, and Low-CTE Glass Fabrics?

Think of dielectric constant (Dk) as a material’s “electrical storage capacity”—it determines how fast signals race through and how much energy bleeds away. TechNews explains that lower Dk means signals zip through faster with less lag, slashing energy loss in high-speed transmissions. Notably, low-Dk comes in tiers as well: Low-Dk1 and Low-Dk2 glass fabrics dominate today’s market, but cutting-edge AI servers are pushing into Low-Dk3 or quartz glass (Q-glass) territory—though quartz hasn’t hit mass adoption yet.

On the other hand, dissipation factor (Df) tells how much signal energy gets burned off as heat in transit. Lower Df equals less wasted power.

Then here comes the so-called Coefficient of Thermal Expansion (CTE), which tracks how much a material swells under heat. Low-CTE materials stay rock-solid even when temperatures fluctuate—barely budging or warping at all.

TechNews, citing insights from Lin Chia-Yu, General Manager of Taiwan Glass’s Fiber Division, explains Low-CTE glass cloth is primarily used in IC substrates, while Low-Dk is deployed in the PCB layers beneath AI chips. Both are essential building blocks for AI servers.

What’s Next? The Road to Q-Glass

TechNews suggests that glass fiber materials are evolving along two paths: Low-CTE options like T-glass focus on keeping dimensions stable in multilayer IC substrates, while Low-Dk/Low-Df variants like NE-glass prioritize signal quality in copper-clad laminates, cutting transmission losses in high-speed AI servers.

Then there’s the wild card: quartz glass cloth (Q-glass), still stuck in lab trials. Q-glass allegedly crushes existing materials on all fronts—CTE, Dk, and Df—making it a next-gen hybrid that delivers both stability and speed. But, according to TechNews, two roadblocks keep it benched: it’s pricier than T-glass or NE-glass, and its extreme hardness wrecks PCB drilling and lamination yields, forcing manufacturers to overhaul equipment and fine-tune processes to the extreme.

Why T-Glass Is in Severe Shortage—and the Ripple Effect

T-glass demand is surging—and the supply can’t keep up. Here’s why: AI servers require far more computing power and bandwidth than traditional servers. As IC substrates grow larger in 2026, manufacturers need to strengthen structural rigidity—meaning they’re doubling T-glass usage in core layers and adding more layers overall. The combined effect is sending T-glass demand through the roof.

As TrendForce suggests, Japan’s Nittobo holds a near-monopoly on production-grade T-glass, supplying the following tech giants—NVIDIA, Microsoft, Google, and Amazon. However, as Nittobo’s expansion won’t hit the market until 2026, the entire industry could be scrambling for material in the meantime.

A recent Goldman Sachs report cited by TechNews highlights the ripple effect: AI customers’ deep pockets are funneling T-glass into high-end ABF substrates for AI GPUs and ASICs, starving BT substrates of the same material. Thus, Goldman reportedly projects BT substrate makers could see T-glass shortages in the double digits (percentage-wise) over the next several months to quarters.

Taiwan’s glass fiber makers stand to gain. According to TechNews, Taiwan Glass and Fulltech Fiber Glass have both earned certification from major local CCL producers. Taiwan Glass, in particular, just became the third company worldwide—after U.S. and Japanese rivals—to crack Low-Dk glass cloth production, setting itself up to ride the demand wave, the report notes.

Read more

(Photo credit: Nittobo)