Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] China’s largest STAR Market IPO of 2025, Moore Threads, Goes Public on Nov 24, Raising RMB 8B

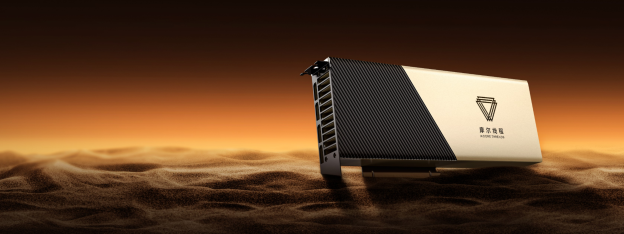

As 2025 draws to a close, China’s STAR Market sees its largest IPO of the year today (November 24). Moore Threads, dubbed “China’s NVIDIA,” is set to debut with an issue price of 114.28 yuan per share, aiming to raise 8 billion yuan, according to 21jingin.com.

China’s NVIDIA: IPO and Tech Highlights

21jinging.com explains that Moore Threads began IPO counseling in November 2024 and completed it in seven months by June 2025. Its application was accepted on June 30, cleared the STAR Market review on September 26—just 88 days from filing to approval, the fastest for 2025—and received registration approval on October 30, completing the IPO process in 122 days, the report notes.

Moore Threads, often called “China’s NVIDIA,” leverages its CUDA-compatible MUSA architecture to rival Team Green’s data center GPUs, as per 21 jingin.com. Notably, its founder and CEO, James Zhang Jianzhong, spent 14 years at NVIDIA—including VP and GM of China—before leaving in 2020 to start the company, according to the South China Morning Post.

The company has rolled out four generations of GPU architectures—Sudi, Chunxiao, Quyuan, and Pinghu, South China Morning Post reports. Its latest 2024 generation supports AI model training and inference at the trillion-parameter scale, enabling pre-training for advanced large language models like those from DeepSeek, the report adds.

Growing Fast but Still in the Red

However, as 21jingin.com points out, Moore Threads has grown rapidly but remains unprofitable due to heavy early-stage investments. Revenue jumped from 124 million yuan in 2023 to 438 million yuan in 2024—year-on-year growth of 169% and 254%, respectively—and reached 785 million yuan in the first three quarters of 2025, up 182% from a year earlier, the report notes.

According to the report, the company posted net losses of 1.703 billion yuan in 2023, 1.618 billion in 2024, and 724 million in the first three quarters of 2025, totaling 5.939 billion yuan over nearly four years. Moore Threads expects to reach consolidated profitability as early as 2027, as per 21 jingin.com.

Meanwhile, 21jingin.com highlights that like other domestic players such as Huawei and Cambricon, Moore Threads has faced U.S. sanctions. In October 2023, it was added to Washington’s Entity List alongside fellow Chinese AI chip start-up Biren Technology, highlighting the geopolitical hurdles for China’s semiconductor ambitions, the report says.

Read more

- [News] China’s GPU Trio Rise as NVIDIA Retreats — Decoding Moore Threads, MetaX, and Cambricon

- [News] Is Cambricon the Next NVIDIA or Unsustainable Growth Story? Three Key Risks Behind the Epic Rally

(Photo credit: Moore Threads)