Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] NVIDIA Posts Record Q3 on Blackwell Ultra, Eyes Strong Q4 — H20 Sales Stall at $50M

Defying fresh warnings of an AI bubble, NVIDIA delivered strong results for its October quarter and projected fourth-quarter revenue above Wall Street estimates, buoyed by soaring demand from cloud providers. The company’s data-center business hit a record high last quarter, with CFO Colette Kress, cited by CRN and CNBC, pointing out that the Blackwell Ultra GPU, launched earlier this year, has already become Team Green’s leading architecture across all customer segments.

Cloud GPUs Sold out

In its third-quarter earnings report, NVIDIA posted record revenue of $57.0 billion, up 22% from the prior quarter and 62% year over year. Net income rose 59% from a year earlier and 23% sequentially to $31.9 billion, while non-GAAP earnings per share increased 60% year over year and 24% sequentially to $1.30.

Reuters adds that data-center revenue — NVIDIA’s largest business — rose to $51.2 billion in the quarter ended Oct. 26, beating the $48.62 billion estimate from analysts.

Looking forward, the world’s most valuable company at this moment projects fiscal fourth-quarter revenue of $65 billion, ±2%, topping analysts’ average forecast of $61.66 billion, Reuters reports.

According to Reuters, CEO Jensen Huang said that “Blackwell sales are off the charts, and cloud GPUs are sold out.” He also pushed back against AI bubble concerns, noting that “the AI ecosystem is scaling rapidly — with more model makers, more startups, across more industries and countries. AI is spreading everywhere, doing everything, all at once.”

CRN, citing Kress at the earnings call, points out that as demand for AI infrastructure continues to surpass NVIDIA’s expectations, cloud capacity is sold out. Notably, its GPU fleet—spanning Blackwell, Hopper, and Ampere—is running at full utilization.

It is also worth noting that NVIDIA has also pointed to robotics as a key future growth driver, according to CNBC. Revenue from automotive and robotics reached $592 million in the third quarter, a 32% increase from a year earlier.

(Credit: NVIDIA)

China Risks and Rising Rival Threats

China, however, remains NVIDIA’s Achilles’ heel. CNBC reports that the company is “disappointed” it cannot ship its current-generation Blackwell chips to the country. While export licenses were granted for the H20 model, CFO Colette Kress to, cited by CNBC, noted that the chip brought in only $50 million in sales for the quarter.

According to Kress, large purchase orders never materialized, weighed down by geopolitical tensions and intensifying competition in the Chinese market.

On the other hand, Investing.com, citing remarks from an analyst, highlights emerging chips from major tech rivals as a potential threat to NVIDIA. The report notes that the real risk may not be the AI cycle itself, but the products—Google and Amazon are developing their own chips, a trend the market will be watching closely in 2026.

Reuters also reports that NVIDIA’s revenue became more concentrated in the third quarter, with four customers accounting for 61% of sales. The company more than doubled spending on agreements to lease back its own chips from cloud partners unable to rent them out, raising those commitments to $26 billion from $12.6 billion in the prior quarter, the report says.

Read more

- [News] NVIDIA Reportedly Preparing to Sell Full AI Server Systems in 2026, Raising Margin Risks for Partners

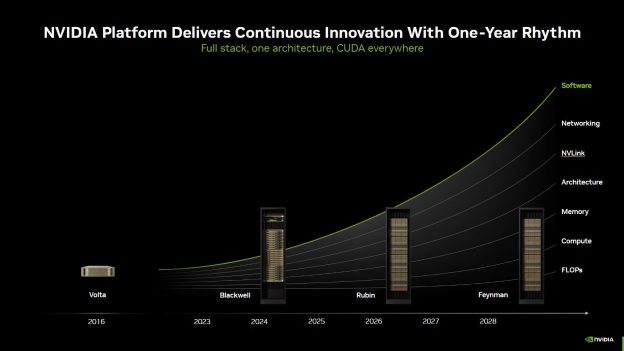

- [News] NVIDIA Dismisses AI Bubble Concerns, Reportedly Projects $500B in GPU Sales from Blackwell and Rubin

(Photo credit: NVIDIA’s X)