Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] Kioxia Quarterly Profit Tumbles 62% YoY, But Signals Bottom with Record 3QFY25 Sales Forecast

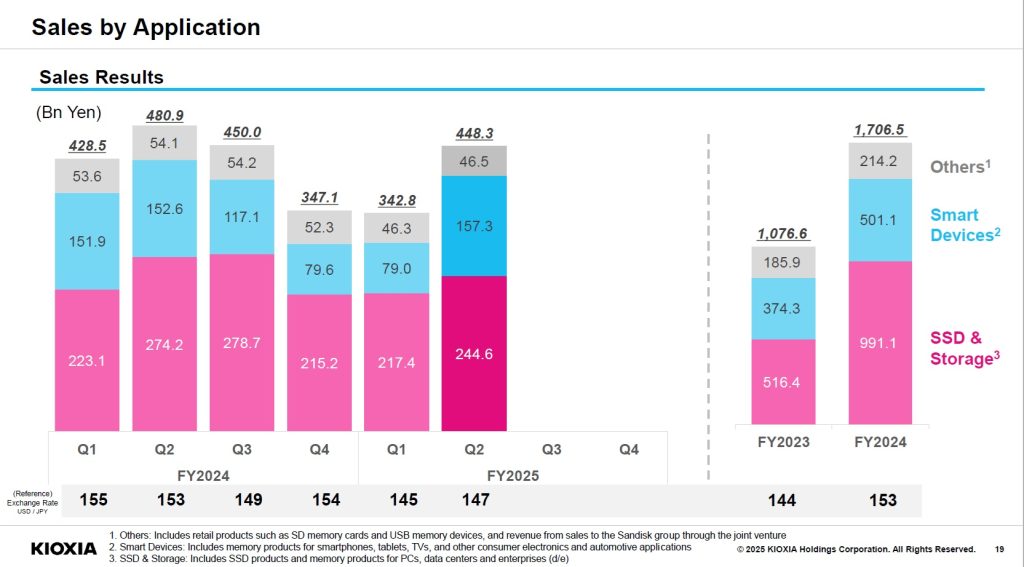

While other memory giants are riding high on soaring AI-driven prices, Japan’s Kioxia appears to still be waiting for a turnaround. In its latest earnings report released on November 13, the company posted a net profit of ¥40.7 billion for Q2 FY2025 (July–September), marking a 62% drop compared to the same period last year.

Nikkei points out that despite surging AI data center demand for memory, Kioxia’s quarterly profit fell short of market expectations, missing the consensus of ¥47.4 billion. Still, the report suggests the company may have hit bottom after Q2’s 74% profit plunge.

Industry sources attribute the earnings miss primarily to product mix shifts, noting that seasonal smartphone demand drove lower-margin smart device products to 35% of sales. However, as supply tightens and the mix shifts back toward higher-margin server and PC SSDs, profitability is expected to rebound.

Despite the profitability headwinds in the short term, Kioxia struck an optimistic tone for the quarters ahead. The company projects record quarterly revenue and a strong profit recovery in 3QFY25, driven by rising ASPs and robust AI-driven NAND demand. Revenue is forecast to climb 12-23% sequentially to ¥500-550 billion from ¥448.3 billion, while Non-GAAP net income is expected to surge 46-113% to ¥61-89 billion.

Future Momentum

Looking at the NAND market outlook, Kioxia projects demand will outpace supply in 2025, pushing bit growth into the mid-teens percentage range. That growth is expected to accelerate into the high teens by 2026 amid deepening supply constraints, the company notes.

Looking ahead, Kioxia says its Gen 8 BiCS Flash will drive AI demand from early 2026, while mass production of 245TB QLC SSDs and the launch of Gen 10 BiCS Flash are also on the horizon.

As Bloomberg reported earlier, Kioxia expects NAND storage demand to grow by about 20% annually, fueled by rising AI data center demand. To address this growth, the company announced the start of operations at Fab2 (K2) in the Kitakami Plant, Iwate Prefecture, Japan. As its press release highlights, Fab2’s production capacity will ramp up gradually in line with market trends, with meaningful output expected in the first half of 2026.

(Credit: Kioxia)

Read more

(Photo credit: Kioxia)