Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] SoftBank Reportedly Explored Marvell Deal; Talks Fell Through but Interest Might Resurface

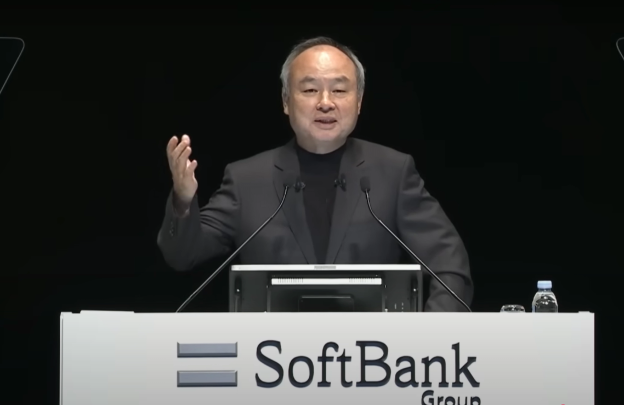

SoftBank is pressing ahead with its AI ambitions and may look to strengthen its hardware foothold. In a striking reveal, Bloomberg reports that founder Masayoshi Son has long eyed Marvell as a potential target and reportedly explored acquiring the US chipmaker earlier this year—a move that would have marked the largest deal ever in the semiconductor industry.

The report adds that SoftBank reportedly reached out to Marvell several months ago, but the two companies were unable to settle on terms. However, while no active negotiations are underway, some sources cited by Bloomberg suggest the interest could resurface.

SoftBank has been steadily building its AI infrastructure empire. After acquiring Arm Holdings in 2016, the Japanese conglomerate moved again in March this year, snapping up Ampere Computing, a company known for its data center processors. In August, SoftBank unveiled a $2 billion investment in Intel, a bold move that ramps up the Japanese tech investor’s ambitious push into AI and the chip industry.

Bloomberg notes that Son and Arm CEO Rene Haas are working on their own AI chips, which they aim to launch next year.

As highlighted by the report, Marvell’s expertise lies in integrating chip design components—such as those from Arm. According to TrendForce, AWS’s Trainium v3, developed jointly with Alchip and Marvell, is planned for mass production in early 2026.

Meanwhile, Marvell has been moving to streamline its operations by divesting non-core assets. In April, the company signed a definitive agreement to sell its Automotive Ethernet business to Infineon Technologies in an all-cash deal worth $2.5 billion, which officially closed in August.

Hurdles ahead

However, as Bloomberg points out, acquiring Marvell faces significant hurdles beyond a potential price tag approaching $100 billion. With the US government pushing to bolster its domestic semiconductor industry, it remains uncertain whether a sale to a Japanese company would gain approval, the report notes.

The report also flags potential antitrust hurdles, citing NVIDIA’s failed 2020 attempt to acquire Arm and Qualcomm’s 2018 bid for NXP Semiconductors, which was blocked by China’s antitrust authority. According to TrendForce, in 2024, Marvell ranked sixth in IC design revenue, trailing only industry giants NVIDIA, Qualcomm, Broadcom, AMD, and Taiwan’s MediaTek.

Read more

- [News] Decoding SoftBank’s Intel Gamble: Son’s Bold Move to Connect ARM and Chip Manufacturing

- [News] Intel Gets Twin Lifelines: SoftBank’s $2B Backing and Potential 10% Stake from U.S. Government

(Photo credit: )