Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

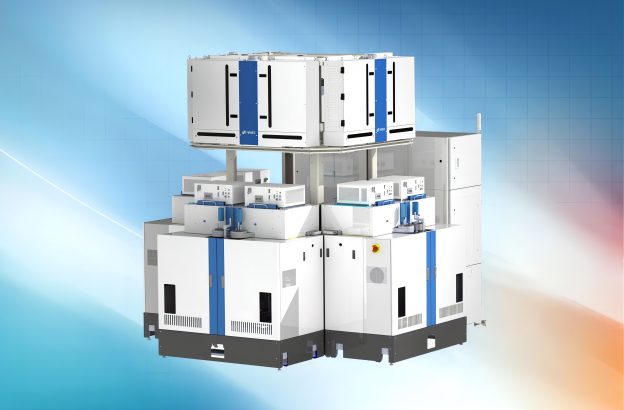

[News] Chinese Chip Tool Maker AMEC Thin-Film Revenue Soars Nearly 1,300% YoY — What’s Behind It?

China’s chip equipment makers are surging despite U.S. export curbs, with AMEC posting rapid growth. According to ijiwei, the company’s recently released third-quarter 2025 report shows strong results: revenue for the first three quarters reached 8.063 billion yuan, up 46.40% year on year. Notably, the report highlights explosive growth in AMEC’s thin-film equipment business, which includes revenue from LPCVD and ALD tools, soaring to 403 million yuan, a surge of about 1,332.69% year on year.

Thin-film deposition equipment is a core component in chip manufacturing, crucial to chip performance and reliability, particularly in advanced logic nodes below 10nm and high-end memory processes such as 3D NAND and TLC, as ijiwei notes. The sector has long been dominated by global giants such as Applied Materials and Lam Research.

As the report points out, since entering the thin-film deposition field in 2010, AMEC has developed nearly 40 tools for advanced logic, 3D memory, and power chip applications. Six of its nine core products have been validated by leading customers and have achieved over a year of stable, large-scale mass production. The report adds that several key factors have fueled AMEC’s rapid growth in thin-film equipment.

Behind the Breakthrough: Heavy R&D Investment

As the report notes, AMEC’s breakthroughs are backed by R&D spending far above the industry average. According to its financial results for the first three quarters of 2025, the company’s R&D expenditure reached 2.523 billion yuan, up 63.44% year on year, while its R&D-to-revenue ratio climbed to 31.29%.

This ratio not only far exceeds the 15–20% average for semiconductor firms listed on China’s STAR Market, but also ranks among the highest globally — even compared with leading equipment makers such as Applied Materials and Tokyo Electron, whose R&D ratios typically range between 18% and 25%, the report points out.

R&D Efficiency and Ecosystem Integration Driving AMEC’s Equipment Growth

Another key factor lies in R&D cycle efficiency. As the report highlights, AMEC has shortened the typical development cycle for high-end thin-film deposition equipment, enabling it to respond quickly to equipment demand from leading foundries such as SMIC and NAND giant YMTC in advanced logic and 3D NAND processes.

The report also notes that AMEC’s market expansion hinges on building trust and aligning with the broader industrial ecosystem. By the end of 2024, its etching tools had been deployed across more than 100 production lines worldwide, covering logic, memory, and power semiconductor applications. Citing industry sources, the report adds that by 2025, Chinese wafer fabs’ procurement priority for domestically made thin-film equipment had risen by around 40% compared with 2023, further boosting AMEC’s market penetration.

Read more

- [Insights] Multi-Billion Boost Powers China’s 2025 Chip Equipment Drive, Led by Piotech and AMEC

- [Insights] China’s Chip Equipment Sector Lands ¥13B in Jan–Oct 2025: 7 Deals That Defined the Surge

(Photo credit: AMEC)