Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[Insights] China’s Chip Equipment Sector Lands ¥13B in Jan–Oct 2025: 7 Deals That Defined the Surge

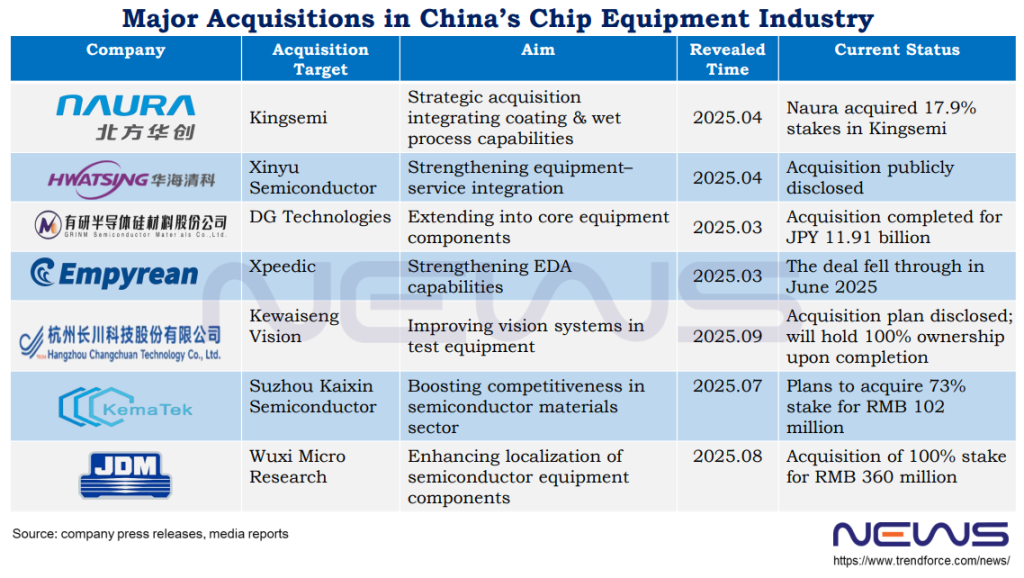

From January to October, China’s semiconductor equipment industry has shifted from pursuing “single-point breakthroughs” to achieving “system-level integration.” Major industry alliances have fueled this transformation, with leading companies raising over 13 billion yuan through private placements, capital increases, and industrial funds, according to TrendForce.

Such key acquisitions and strategic investments are no longer simple asset transfers but instead reflect deep vertical and horizontal integration across the industry chain—centered on “yield assurance” and “ecosystem enhancement.” Below is TrendForce’s summary of seven major deals shaping China’s chipmaking equipment sector so far this year.

Platform-Based Integration in Action

One significant aspect of this wave of deals is that leading companies aimed at delivering solutions spanning multiple key process steps, rather than offering isolated pieces of equipment. As TrendForce notes, this approach enables merged entities to ensure process compatibility across their toolsets within fabs, secure yield performance during high-volume production, and provide customers with a dependable, risk-controlled domestic alternative in China.

This year, NAURA’s strategic acquisition of a controlling stake in Kingsemi serves as a prime example. NAURA holds a leading position in etching, PVD/CVD, and cleaning equipment. By acquiring a 17.87% stake in Kingsemi—a company specializing in coating, developing, and wet process equipment—NAURA has effectively expanded its coverage across key process chains before and after lithography.

Another example is Hwatsing, whose strategy focuses on deepening its “equipment + services” model. A leading player in chemical mechanical polishing (CMP) equipment, Hwatsing completed the full acquisition of Xinyu Semiconductor’s remaining equity in April 2025. This integration allows Hwatsing to move beyond hardware sales and offer comprehensive packages combining equipment, high-precision services, and specialized consumables.

Vertical Integration and Ecosystem Reinforcement

In addition to horizontal integration along the main equipment line, TrendForce notes that a key trend in China’s semiconductor equipment sector in 2025 is vertical integration across the supply chain, aimed at strengthening the domestic industrial ecosystem by gaining control over critical components and toolchains.

One example is Grinm Semiconductor, a materials-focused company that acquired a 70% stake in DG Technologies, marking an upstream player’s expansion into downstream key components, as TrendForce indicates.

Read more

- [News] China’s A-Share Chip M&A Boom: 73+ Applications Reportedly in 18 Months, $55B Deal Value in 2024

- [News] China’s Naura Posts 8x SEMES Profit in 1H25, Shaking Korea’s Chip Equipment Sector

(Photo credit: NAURA)