Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] China’s NAND Giant YMTC Reportedly Moves into HBM Using TSV, Following CXMT and Huawei

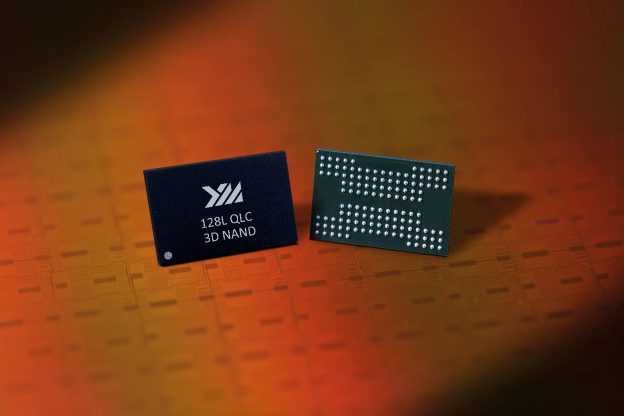

With HBM turning into a scarce resource in the AI boom and imports effectively off-limits, China is racing to develop its own supply, with major tech firms joining the push. Reuters reports that Yangtze Memory Technologies Co. (YMTC), the country’s leading NAND maker, is gearing up to enter the DRAM market, targeting advanced versions built for AI processors.

According to Reuters, YMTC is working on an advanced packaging technology called through-silicon via (TSV), which enables DRAM stacking to produce HBM chips. The effort underscores Beijing’s increasing urgency to boost its advanced chipmaking capabilities after Washington tightened export controls last December, restricting China’s access to HBM, the report adds.

Although the move caught some by surprise, Chinese tech giants have been steadily ramping up efforts on HBM. As MyDrivers reported in mid- September, Huawei unveiled a multi-year roadmap for its Ascend AI chips, with planned releases running through 2028. The rollout reportedly begins with the Ascend 950PR in Q1 2026, notable for its in-house developed HBM.

Wuhan Could Become YMTC’s Next DRAM Hub

It is interesting to note that YMTC could face domestic competition from CXMT, which is already working on HBM chips.

As Chosun Biz reported in August, Changxin Memory Technologies (CXMT) has restarted its large-scale capital investments that were previously paused, moving to expand its production of DDR5 DRAM and advance fourth-generation HBM (HBM3). The report noted that CXMT plans to set up a new production line at its Hefei, Anhui facility and bring in the necessary equipment.

A source familiar with the matter told Reuters that YMTC is considering dedicating part of its forthcoming Wuhan facility to DRAM production. Corporate filings from Qichacha cited by Reuters reveal that earlier this month, YMTC set up a new company to construct a third fab in Wuhan with registered capital of 20.7 billion yuan ($2.9 billion).

As Wccftech explains, China is grappling with a severe HBM shortage, driven by surging demand for AI chips. For now, Beijing has been leaning on stockpiled HBM, which is nearly exhausted, the report suggests.

Citing data from analyst reports, Reuters notes that YMTC’s two existing Wuhan fabs—currently focused on NAND—had a combined capacity of 160,000 12-inch wafers per month at the end of 2024, with an additional 65,000 wafers set to be added in 2025.

According to YiCai Global, YMTC’s parent company—Yangtze Memory Technologies Holdings—recently held a shareholders’ meeting to formally establish a joint-stock company and elect its first board of directors, marking the completion of its restructuring.

As the sole domestic producer of 3D NAND, YMTC is valued at 160 billion yuan, ranking ninth among China’s top 10 unicorns in the latest Hurun Global Unicorn Index, according to the report.

Read more

(Photo credit: YMTC)