Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] AMEC Co-Founds RMB 1.5B VC Fund, Contributing RMB 735M amid China’s Semiconductor Push

AMEC, one of China’s leading chip equipment makers, is stepping up its investment efforts. According to ESM China, AMEC announced that its subsidiary, AMEC Semiconductor (Shanghai), plans to jointly establish Shanghai Zhiwei Panfeng Venture Capital Partnership together with Shanghai Zhiwei Private Equity Fund Management and other investors.

The fund has a target size of RMB 1.5 billion, with AMEC, as a limited partner, planning to contribute up to RMB 735 million of its own capital, representing 49% of the total. AMEC stated that the fund will focus on semiconductors, broader semiconductor-related industries, and strategic emerging sectors, as the report notes. According to the announcement, Zhiwei Private Equity Fund will serve as the fund’s manager, committing RMB 15 million, or 1% of the total.

As of the disclosure date, partners of Shanghai Zhiwei Panfeng Venture Capital Partnership had committed a total capital contribution of RMB 1.5 billion, with the first tranche of RMB 600 million already paid in.

Industry sources indicate that this move represents both a key step for AMEC to integrate upstream and downstream resources in the industry chain through capital means, and an effort to leverage the investment and research capabilities of professional fund managers to identify high-quality unlisted companies in the semiconductor field, as noted by PJTime.

Zhiwei Private Equity Fund Management was jointly established by AMEC, its former board secretary Xiaoyu Liu, and Jiaxing Furenheng Enterprise Management Partnership, according to an announcement released by AMEC in January 2025. The three parties hold shareholdings of 45%, 45%, and 10%, respectively.

The report highlights that in this investment, Xiaoyu Liu is particularly noteworthy. He previously held positions at both SMIC and AMEC, where he gained extensive experience at two of China’s leading semiconductor companies and built wide-ranging connections across the industry. As the report indicates, Liu has worked at AMEC for more than 20 years, serving as board secretary, deputy general manager, and in other roles, where he was responsible for the company’s investment business. He has participated in more than 30 investment projects with a total value exceeding RMB 2 billion, including cases involving Piotech, SMIC, SICC, and Hua Hong.

AMEC’s Etching Leadership and Growth

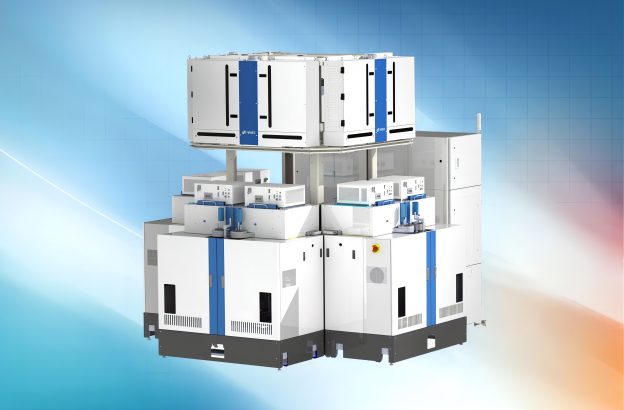

As noted on its website, AMEC is a micro-fabrication equipment company serving the semiconductor industry. It is a leading player in etching equipment, and according to STAR Market Daily, its plasma etching revenue grew at a CAGR of over 50% from 2019 to 2024.

Read more

- [News] Three Semiconductor Makers Accelerate the Development of HBM & Advanced Packaging Equipment

- [News] China’s AMEC Reportedly Saw Plasma Etching Grow at 50% CAGR, Backs 5nm Without EUV

(Photo credit: AMEC)