Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] Chinese Memory Industry in High Gear as Manufactures Gather Steam

Recently, China’s memory industry has shown burgeoning growth, with companies strengthening their competitiveness through capital operations, technological upgrades, and industrial chain integration.

Zentel to Go Public in HongKong

On May 28, Zentel submitted an application to the Hong Kong Stock Exchange for the issuance and listing of H-shares. According to the prospectus, the proceeds from the IPO will be used to expand its R&D team for high-bandwidth and DRAM products and to enhance production capabilities.

Zentel has established a long-term partnership with foundry service provider PSMC and collaborates with global top 10 DRAM module makers like ADATA and Memory Technology Corporation to build a stable production supply chain. Its “Zentel” memory brand, inherited from the 20-year-old Zentel Japan, is backed by an international R&D team and has penetrated the global premium client network.

UniIC Entered NEEQ Innovation Tier

On May 20, UniIC announced that it had officially entered the Innovation Tier of the National Equities Exchange and Quotations (NEEQ), becoming the only semiconductor company among the third batch of entrants to qualify under the “R&D investment standard”. This upgrade provides more financing channels such as private placements and preferred stock issuance, supporting its development of automotive-grade memory chips.

UniIC has announced plans to launch high-capacity LPDDR4x/5x products in the second half of 2025 and is advancing the development of next-generation products with higher speed, greater bandwidth, and lower power consumption to meet the increasing demands of applications like smart cockpits and advanced driver-assistance systems.

GigaDevice Launched IPO Plan

On May 20, GigaDevice officially announced its plan to issue overseas-listed foreign shares (H-shares) and list them on the main board of the Hong Kong Stock Exchange. The issuance aims to strengthen its global strategic deployment, accelerate overseas business expansion, and enhance its international brand image and core competitiveness.

The IPO proceeds will mainly be used for upgrading R&D capabilities, strategic mergers and acquisitions across the supply chain, and global marketing network development. The company will focus on sub-17nm DRAM processes, UFS 4.0 NAND chips, and RISC-V-based MCUs, as well as strategic M&A in automotive storage and industrial control fields. Plans also include establishing technical service centers in Singapore, Germany, and other regions.

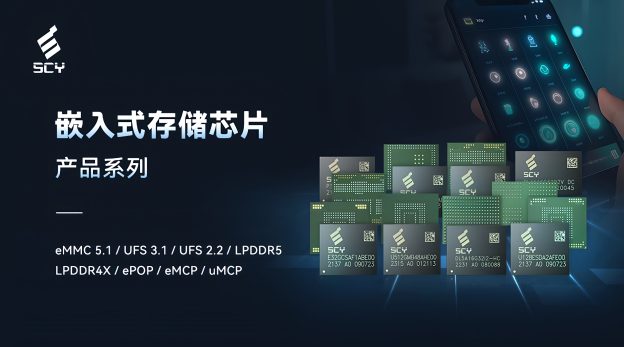

SCY: New Headquarters to Boost Capacity by 300%

On May 25, SCY held a grand opening ceremony for its new headquarters building and a global partners conference. The SCY headquarters is a comprehensive technology building integrating R&D, manufacturing, and marketing, with a total floor area of 66,000 square meters and 19 floors at 99 meters high. Designed with “green, clean, and energy-efficient” principles, it integrates a “standardized, digital, and intelligent” operating system. The intelligent manufacturing center includes a Class 1,000/100 cleanroom, equipped with world-class equipment. With the synergy of smart production lines and digital management systems, production capacity is expected to increase by 300%—over 500 million die packaged annually, more than 150 million chips produced, and over 20 million memory modules manufactured per year.

Yangyuan Invested Yangtze Memory’s Parent Company with RMB 1.6 Billion

On April 25, Hebei Yangyuan announced an external investment. Its controlled fund, Wuhu Wenming Quan Hong Investment Management Partnership (Limited Partnership), plans to inject RMB 1.6 billion into Yangtze Memory Technologies Holding Co., Ltd. (YMTC Holding), the parent company of China’s leading memory manufacturer Yangtze Memory. YMTC Holding is also the parent company of multiple entities, including Wuhan Yangtze Memory Technology Services, XMC, Unimos, and Changcun Capital.

It is reported that YMTC Holding has received investments from China’s National Integrated Circuit Industry Investment Fund (known as the “Big Fund”) in both Phase I and Phase II. Following this investment, the shareholding ratio of Phase I fell from 12.88% to 12.13%, and Phase II dropped slightly from 12.24% to 11.53%, although they remain the third and fourth largest shareholders, respectively.

Quanxing Continues to Upgrade AI Memory Technologies

On May 28, Quanxing held a “Memory Foundation, AI Empowerment” technical and product exchange conference, highlighting its 122.88TB PCIe 5.0 QLC eSSD enterprise-grade solid-state drive. This breakthrough in storage capacity redefines performance benchmarks for AI storage, supporting the full lifecycle of 100-billion-parameter models with localized data storage, providing efficient support for AI training and inference.

At the 2025 Global AI Terminal Expo on May 22, Quanxing presented its “AI Training & Inference All-in-One Solution.” Utilizing compute-in-memory technology, it expands GPU memory by 10–20 times and enables local deployment of 72B-parameter models under 2KW low power consumption, reducing training costs by 95% compared to industry averages. This solution has been recognized by Futian District government of Shenzhen and is advancing AI applications in verticals such as smart cities and intelligent factories.

Kowin Made Progresses in Projects in Yangzhou and Xuzhou

On May 16, the memory module smart manufacturing base at Kowin’s industrial park in Yangzhou was officially put into operation. With a total investment of RMB 500 million (RMB 150 million in the first phase), the base covers 6,600 square meters and focuses on SSD/PSSD/USB storage module product lines. Equipped with thousands of square meters of Class 100,000 cleanrooms, it features advanced automated production lines and cutting-edge SMT and testing equipment. The site produces high-reliability modules with a 99.9% yield rate, targeting high-end markets.

Previously, on March 25, Kowin announced that its Xuzhou testing facility had officially commenced operations, completing the company’s full memory industry chain covering R&D, design, packaging, testing, and manufacturing. Located in the second industrial park of the Xuzhou Economic and Technological Development Zone, the project is planned in two phases. Once Phase I is completed in 2025, annual capacity will reach 20 million units with output value exceeding RMB 300 million. Phase II, scheduled for 2026, will focus on advanced product testing and scale up to 50 million units annually.

Currently, Kowin is building a complete memory supply chain with facilities in Hangzhou, Xuzhou, and Yangzhou, integrating R&D, design, packaging, testing, and manufacturing.

Biwin Loans to Subsidiaries to Support Two Major Packaging and Testing Projects

On May 13, Biwin held board and supervisory meetings, approving a proposal to provide loans to its subsidiaries using raised capital. The company will lend RMB 851 million to its wholly-owned subsidiary Guangdong Tailai Packaging Technology Co., Ltd., and RMB 1.02 billion to its majority-owned subsidiary Guangdong Xincheng Hanqi Semiconductor Technology Co., Ltd. The loans will fund expansion projects for Biwin’s advanced packaging and memory manufacturing base in Huizhou and a wafer-level advanced packaging manufacturing project.

(Photo credit: SCY)