Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] NVIDIA’s Earnings Preview: H20 Fallout Impact, New China GPU, and GB200/300 Push

With NVIDIA’s earnings call just 24 hours away, the spotlight is on how the U.S. AI chip powerhouse will steer through looming tariff threats and the H20 bans. Here’s a comprehensive snapshot of the key issues on what the market needs to watch as NVIDIA reveals its outlook.

H20 Restrictions and Its Impact

As per CNBC, the H20 ban hit NVIDIA hard—forcing a $5.5 billion inventory write-off, possibly the largest ever in chip industry history. CEO Jensen Huang also revealed that the company had to give up $15 billion in potential sales.

The report shows NVIDIA is on track to hit $43.28 billion in revenue for the quarter ending in April, closely matching its $43 billion forecast—a 66% jump year-over-year. Though still well ahead of most rivals, CNBC highlights this growth slows sharply from last year’s explosive 250% surge.

For the current quarter, CNBC reports analysts expect 53% growth, with a similar increase projected for the full fiscal year ending in January.

Meanwhile, another report from Financial Times notes that NVIDIA’s China sales hit could slash gross margins this quarter from 71% to around 58%.

However, a quicker-than-expected Blackwell rollout—thanks to a shift back to Bianca boards—might soften the blow in the second half, the report adds.

New Chip Tailored for China in the Works

In response to the H20 ban, the U.S. chip giant has been reportedly working on a new chipset targeting the market. According to Reuters, the Blackwell-based chip could debut as early as June and cost over 30% less than the H20.

Reuters points to NVIDIA’s choice of memory and packaging as key reasons for the chip’s lower price. The new model will reportedly forgo TSMC’s advanced CoWoS packaging. In addition, it is expected to be based on the RTX Pro 6000D—a server-grade GPU—paired with standard GDDR7 memory rather than the more expensive HBM, the report adds.

Notably, ijiwei suggests that NVIDIA’s upcoming China-focused GPU may use Samsung’s GDDR7, benefiting the South Korean memory giant. Samsung launched the industry’s first 24Gb GDDR7 in late 2024, offering 50% higher cell density in the same package, as per Samsung’s press release.

According to ijiwei, the new GPU—likely named 6000D or B40—will be downgraded to comply with U.S. export controls, with cuts to NVLink bandwidth, FP64 computing, and Tensor Core performance.

GB200/ GB300: Early Hiccups, Strong Momentum

Rumors of NVIDIA’s GB200 shipment struggles have been swirling for months. But according to the Financial Times, Taiwanese partners like Foxconn, Inventec, Dell, and Wistron have cleared the technical hurdles and began shipping GB200 AI server racks with Blackwell architecture in late Q1.

Each GB200 AI rack packs 36 Grace CPUs and 72 Blackwell GPUs connected via NVIDIA’s NVLink—a massive feat that posed big challenges. According to the report, supply chain partners spent months tackling GPU overheating, cooling leaks, software bugs, and complex chip synchronization, delays that once threatened production but are now resolved.

Financial Times also notes that NVIDIA is gearing up to launch its next-gen GB300 AI rack in Q3, featuring improved memory and support for complex models like OpenAI’s 01. To speed rollout, the U.S. chip giant reportedly scrapped the planned “Cordelia” chip board—allowing GPU swaps—in favor of the proven “Bianca” design from GB200 due to installation issues.

As per Financial Times, NVIDIA still plans to adopt the Cordelia design in future AI chips, aiming for better margins and easier maintenance, the report suggests. ZDNet suggests SOCAMM will now debut with NVIDIA’s next-gen Rubin.

Read more

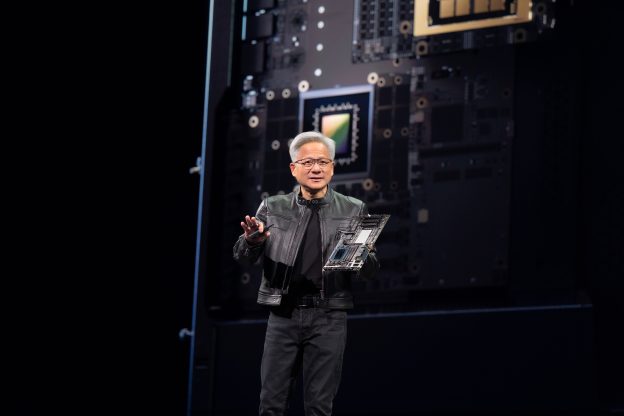

(Photo credit: NVIDIA)