Micro LED Backplane Technologies Are Diverging

Micro LED applications are gradually diverging into two distinct paths, and the key differentiation comes from the choice of substrate. These two approaches show significant differences in technical characteristics, application scenarios, and supply chain maturity.

Glass-based Micro LED is primarily used in medium to large display applications, including commercial video walls, automotive displays, and transparent displays. It is driven by major brands, and the supply chain is mature enough to support mass production. Silicon-based Micro LED, also known as LEDoS, targets small form factor and high resolution applications. Its primary use case is AR glasses, and the technology is still in an exploratory stage and early commercialization phase, although its potential is substantial.

Table 1. Comparison Between Glass-based and Silicon-based Micro LED

| Item | Glass-based Micro LED | Silicon-based Micro LED (LEDoS) |

|---|---|---|

| Application Spec | Medium to large displays, automotive displays, transparent displays | Microdisplays, near-eye displays |

| Application Products | Transparent commercial display walls, tiled video walls, high-end TVs | AR/VR devices, HUDs, smart wearables |

| Leading Companies | Samsung, LG, AUO | JBD |

| Technical Focus | High brightness, high image quality, splicing screen | High pixel density, low power consumption, semiconductor process integration |

| Maturity Level | Already scalable, led by major brands, mature supply chain | Still in a breakthrough stage, led by a single company, incomplete supply chain |

2H25 Micro LED Display and Non-Display Application Market Analysis

Micro LED is expanding from large and automotive displays to wearables, AR glasses, and AI optical interconnects. High brightness and compact size open new opportunities—will it define the next generation of displays?

In-Depth InsightsGlass-Based Micro LED: Brand-Led Diversified Deployment

Glass substrates feature high light transmittance, high thermal conductivity, excellent flatness, and scalability, which help Micro LED achieve better brightness and color saturation while maintaining wide viewing angles and color consistency. This is particularly critical for large-sized displays.

The glass-based market shows a clear brand-led and segmented structure, primarily driven by major international companies such as Samsung, LG, and AUO, which continue to invest in large-area, high-resolution, and seamless display technologies while advancing mass production.

The year 2025 is regarded as the first year of full commercial adoption for Micro LED technology. The following will introduce the Micro LED strategies of major manufacturers.

Samsung: Supply Chain Leadership and Cost-Reduction Strategy

Samsung continues to advance high-end products in the glass-based Micro LED field, from large TVs to transparent displays, demonstrating advantages in high brightness, high resolution, and seamless splicing, while highlighting its leading position in the supply chain.

The following two are Samsung's representative solutions, showing the potential of glass-based Micro LED for future transparent and commercial applications:

Samsung 114-Inch Micro LED Display

It adopts AUO's LTPS backplane, assembled from 81 pieces of 12.7-inch P0.51 modules, driven by AM-TFT glass-based backplanes, reaching a resolution of 4968×2808, balancing high brightness with stability in large-size splicing.

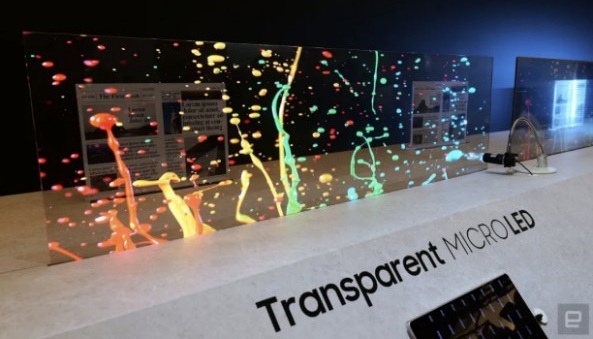

Samsung Micro LED Transparent Display Prototype

It features three transparency designs, two using tinted glass and one using transparent glass, presented with a frameless design.

According to TrendForce, this display uses AUO 16.1-inch modules paired with 20×40 µm Micro LED chips, with a pixel pitch of P0.69 mm, brightness of 600 nits, and a transmittance of 67%.

Samsung currently relies on PlayNitride as its main chip supplier, while also looking for a second supplier to ensure steady supply and reduce costs. Because of limits in process maturity and yield, Samsung focuses on 34×58 µm chips and has temporarily paused developing smaller chips. For PlayNitride, even though it holds a key position, it needs to show clearer technological advantages and better yield to stay strong as Samsung diversifies its supply chain.

LG: Responsive Strategy and OLED Priority

LG, as a branded display supplier, faces pressure from the market and customers, requiring product specifications to align with Samsung. Recently, LG has invested in achieving similar glass-based Micro LED products through low-cost and low-resource approaches, demonstrating a clear responsive strategy.

In October 2025, LG unveiled a TV using next-generation Micro LED display technology:

LG 136-inch 4K Micro LED Display

It is composed of 64 units of 22.3-inch LTPS backplane modules, using 16×27μm Micro LED chips with a pixel pitch of P0.78mm.

The display adopts an active AM glass-based driving mode, providing clear image quality and uniform display performance.

Compared with competitors, LG’s Micro LED market strategy is more defensive. Its resource focus remains on OLED, and it lacks stable upstream and downstream partnerships like Samsung, PlayNitride, and AUO.

Overall, LG has not yet established a complete ecosystem integration. For the next few years, it is expected to maintain a defensive and cautious approach, with strategic adjustments likely only once Micro LED market demand and business models become clearer.

AUO: Focus on Automotive Displays and Innovative Applications

AUO’s Micro LED strategy centers on differentiated applications and gradual supply chain mastery. Its approach does not aim to directly compete in the large TV market, but instead builds mid- to long-term competitiveness through two pathways.

For large-size displays, AUO continues to strengthen underlying technologies, enabling it to create a technical moat in niche and high-reliability applications. AUO launched a 127-inch Micro LED solution, demonstrating maturity in module splicing stability and backplane design.

AUO 127-Inch Micro LED TV

It is composed of eight 41.6-inch backplane modules, achieving a brightness of up to 1,000 nits. AUO improves side wiring yield through PAM circuit design and adopts a 2×N backplane splicing strategy, effectively reducing process yield and cost risks.

In the automotive market, AUO accelerated its commercial deployment after acquiring Germany’s BHTC. Automotive displays require high brightness, reliability, operating temperature tolerance, and form flexibility, which align well with Micro LED characteristics. This has enabled AUO to quickly establish supply-side bargaining power in emerging applications. AUO has collaborated with Sony Honda Mobility to launch a 30-inch Micro LED display for the AFEELA electric vehicle. Additionally, it introduced human-machine interactive solutions for smart cockpit innovation:

Virtual Sky Canopy

A large-size transparent Micro LED display is applied to the sunroof, using 20×40µm RGB chips and 14 units of 16.1-inch backplane modules seamlessly spliced, providing an immersive display experience.

XR Interactive Window

On the rear side window, 20×40µm RGB Micro LED chips are used, with four 16.1-inch backplane modules spliced. Paired with an in-vehicle computing platform, it enables interactive XR functionality.

In its supply chain, AUO adopts a phased integration strategy. From the COW to COC1 stage, it purchases PlayNitride products; from COC1 to COC2, it leases PlayNitride production capacity; later-stage processing is carried out on AUO’s own production lines. This approach reduces early-stage capital pressure while allowing AUO to master key processes gradually. On the chip supply side, as Ennostar’s capacity increases, AUO may eventually integrate chips, backplane design, and mass transfer, evolving from a panel manufacturer to a complete Micro LED solution provider.

Looking at AUO’s Micro LED business strategy, TrendForce suggests it can be analyzed from two perspectives. On one hand, AUO continues to expand application possibilities. On the other hand, it accumulates key know-how in specialized applications, positioning itself to become a distinctive major supplier when emerging applications rise in the future.

BOE P0.3 Micro LED COG automotive display

To reduce process precision requirements and cost while improving yield, it uses HC Semi 0202 MPD (Micro Pixel Device) solution, with a brightness of 2,000 nits and resolution of 1280×270.

BOE 6.2-inch P0.2 high-brightness RGB Micro LED HUD

With 0.2 mm pitch and brightness of 30,000 nits, according to TrendForce research, this product uses chips approximately 20×40µm, transferred via laser onto an LTPS backplane.

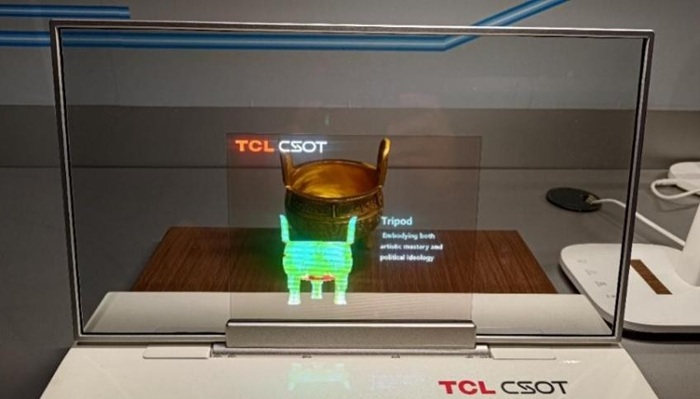

TCL CSOT, with its R&D center in Wuhan, focuses on transparent and innovative form-factor displays, launching a transparent display:

TCL CSOT 8.42-inch Micro LED transparent display

Featuring a 0.2 mm pitch, brightness up to 5,000 nits, resolution of 850×650, and 60% transparency with a borderless design. This product also serves as the basis for a floating 3D display.

Hisense rapidly commercialized large-size transparent displays, launching:

Hisense 30-inch Micro LED transparent display

Using four 16.1-inch glass-based modules from AUO, and PlayNitride 20×40 μm chips, with brightness of 600 nits and 67% transmittance.

Tianma focuses on low-reflection and reflective technologies, targeting automotive HUDs, smart cockpits, and commercial displays. Chinese players in the Micro LED industry act more as “late-stage rapid expanders,” quickly capturing market share as demand accelerates.

Micro LED Market Turning Point: Automotive Lighting and Optical Interconnects

Unlock the key insights shaping Micro LED automotive lighting and optical interconnects. See the 2025 trends, 2026 outlook, and breakthrough technologies revealed at Micro LEDforum 2025.

Get Trend IntelligenceSilicon-Based Micro LED: Key Battlefield for AR Applications

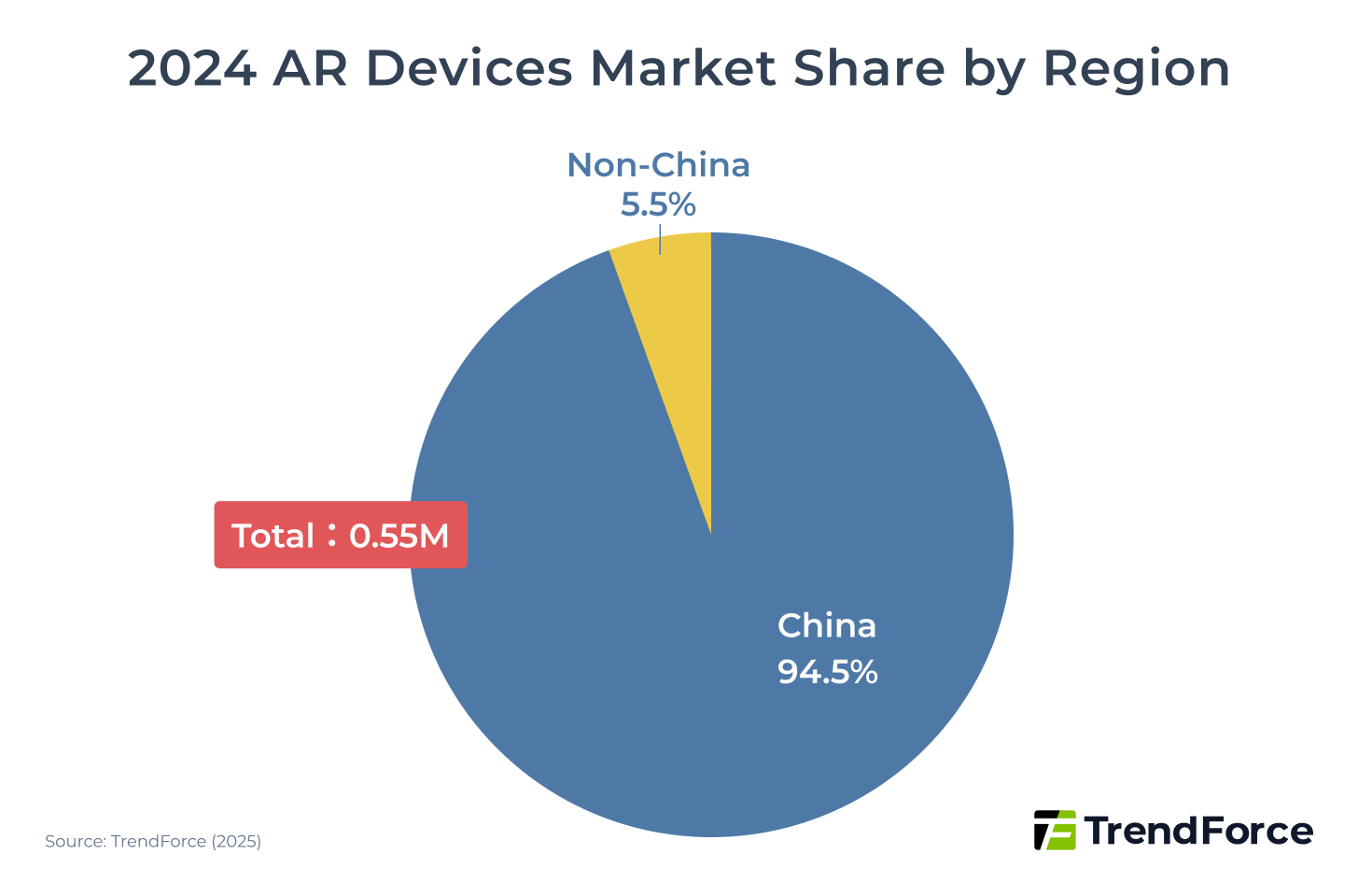

Silicon-based Micro LED (LEDoS) is mainly applied in microdisplays and AR glasses. According to TrendForce research, Chinese brands’ AR glasses shipments are still primarily concentrated in the Chinese market, with mainstream products priced between 2,000 and 4,000 RMB. In contrast, full-color LEDoS products remain positioned as high-end, creating a price gap with mainstream market offerings.

Figure 1. Regional Market Share of AR Devices in 2024

LEDoS technology has a high technical threshold, and the requirements for product miniaturization, high brightness, and long lifespan further increase development difficulty. Currently, the supply of LEDoS panels and light engines is almost monopolized by JBD, and most Chinese brands rely on JBD for LEDoS light engines. Examples include:

- StarV Air2: Equipped with JBD Hummingbird MiniⅡ single-color light engine and self-developed StarVision waveguide.

- INMO GO 2 / Rokid Glasses: Use JBD Hummingbird MiniⅡ combined with Guangzhou Semiconductor diffraction waveguide.

- RayNeo X3 Pro Full-Color Device: Self-developed 0.36cc light engine (JBD provides three-color panels) combined with Nanoimprint Lithography (NIL) diffraction waveguide.

- Vuzix Z100: Uses JBD single-color light engine, self-developed waveguide, and Qualcomm XR1.

- Halliday: Single-color light engine, discards waveguide design in favor of retinal projection technology.

In addition, to reduce the risk of a single-source supply chain, Chinese manufacturers are imitating or challenging JBD while seeking the most suitable full-color and miniaturization technologies. The main development strategies can be divided into two routes:

- Vertical Stacking: Imitating JBD technology, such as Nuoxi; Hongshi Smart combines vertical stacking with QD quantum dots.

- QD Quantum Dot Improvement: Manufacturers with certain existing development technologies aim for rapid financing to enter the market, such as Leiyu, Sitian, and Saifules. However, considering LEDoS lifespan and technical challenges, most ultimately still use JBD products.

Chinese manufacturers pursue rapid mass production, while foreign startups such as Aledia, Porotech, and Polar Light focus more on forward-looking technologies, developing LEDoS technologies with unique characteristics and imaginative designs. However, substantial resources are still required before mass production.

JBD’s market dominance has also caused international companies like Meta and Apple to face supply chain risks when adopting LEDoS Optical Engines. In 2024, Meta used JBD Optical Engines for Orion prototype designs, but the project was paused due to cost or insufficient technological maturity. In 2025, Meta shifted to a more mature LCoS Optical Engine solution. As LEDoS technology gradually matures, it is expected to occupy a stronger position in AR glasses in the future.

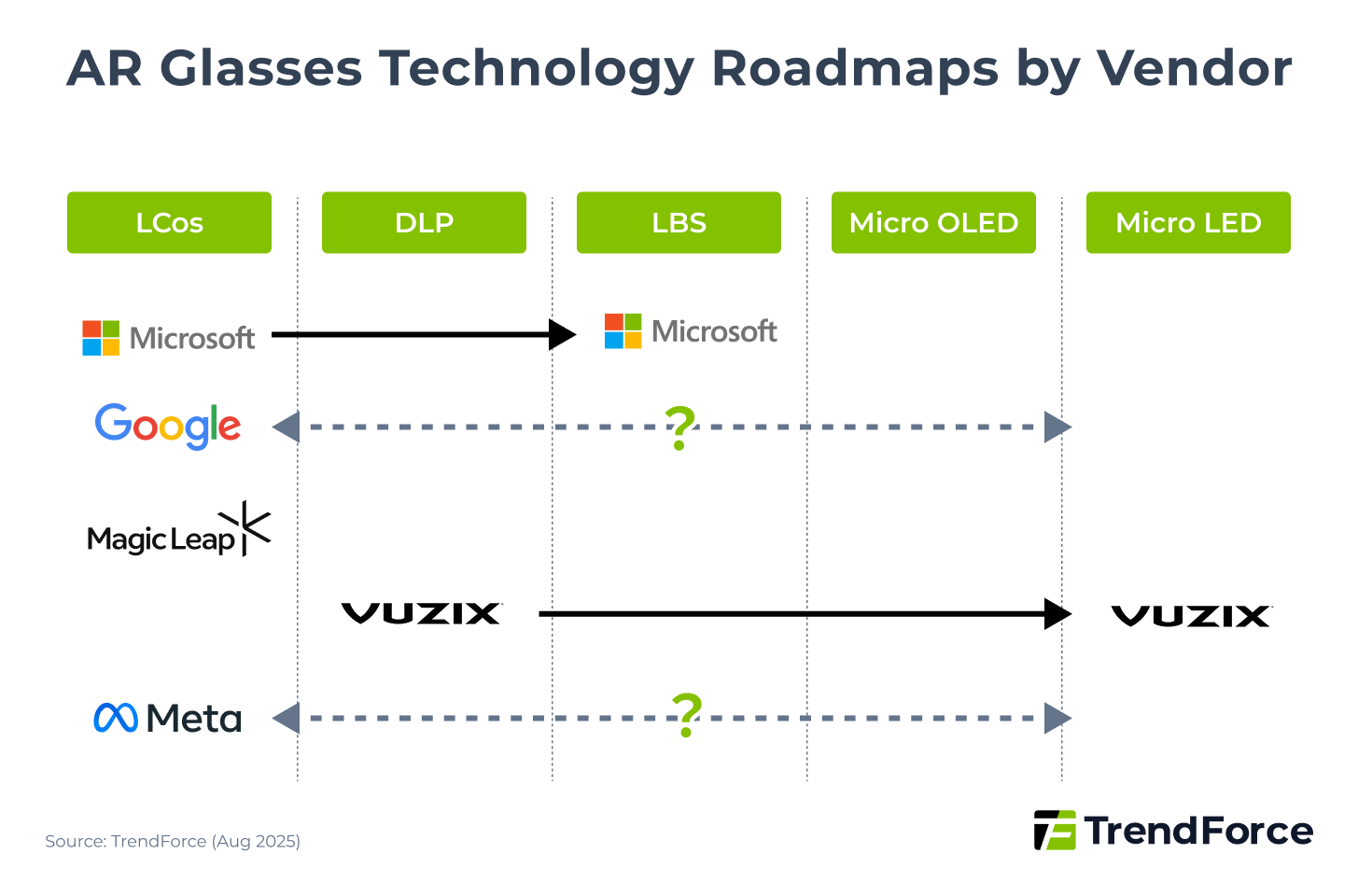

Figure 2. AR Glasses Technology Development by Various Manufacturers

Market Potential of LEDoS Technology

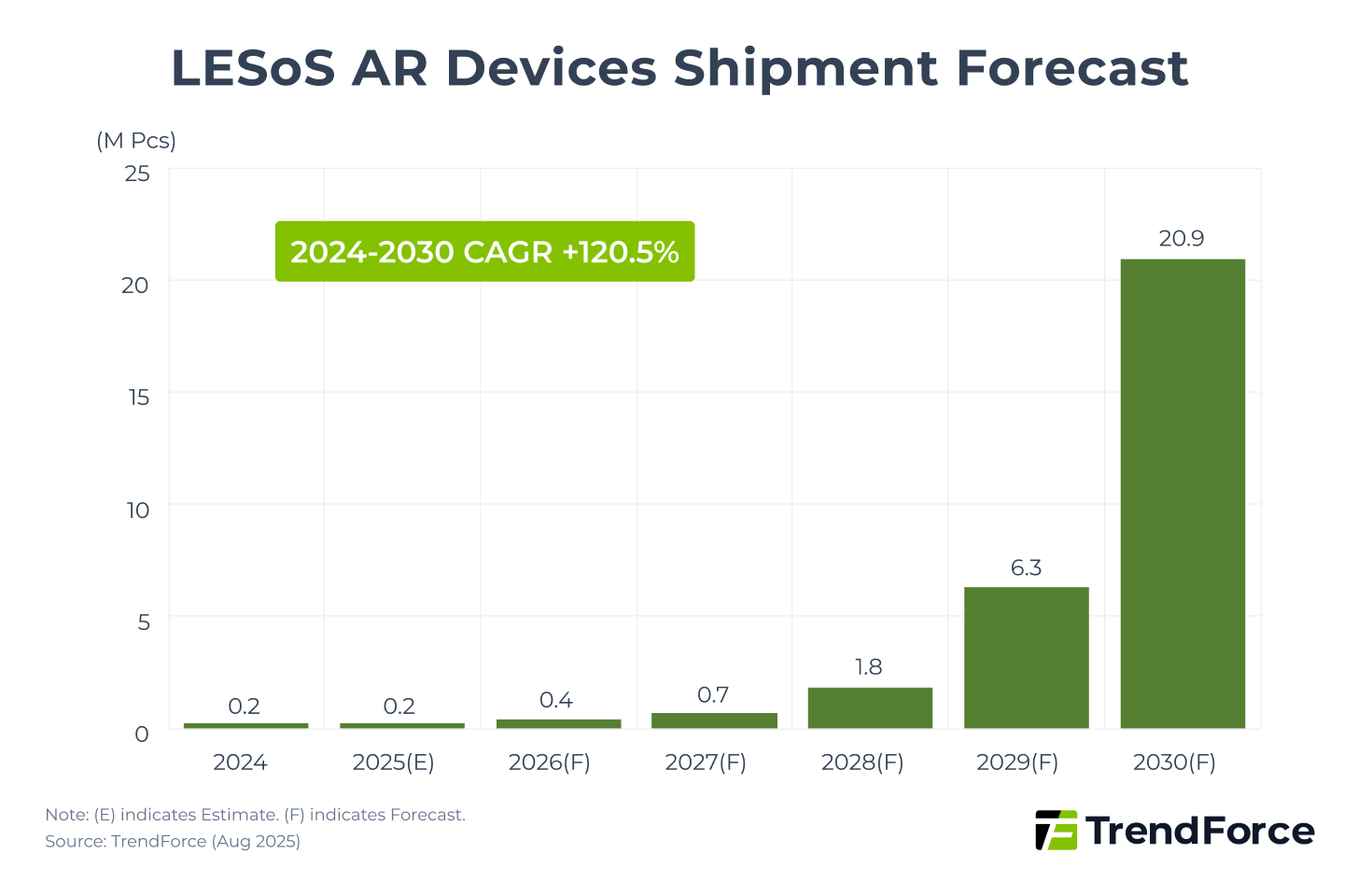

In 2025, AR devices equipped with LEDoS technology reached shipments of 0.2 million units, representing a 22.3% YoY increase. TrendForce believes that in the medium to long term, the industry will remain highly sensitive to LEDoS Optical Engine costs. As the technology matures, mainstream solutions are expected to shift from X-cube to single-chip full-color technology, reducing Optical Engine module costs by decreasing the number of light sources.

In addition, international brands remain cautious in adopting new technologies, usually selecting the optimal solution only after market validation, typically using LEDoS combined with a waveguide architecture. TrendForce predicts that by 2030, AR devices equipped with LEDoS are expected to reach 20.9 million units, with a compound annual growth rate (CAGR) of 120.5% from 2024 to 2030.

Figure 3. LEDoS AR Device Shipment Forecast

Commercialization Progress and Prospects of Micro LED Display Products

Micro LEDforum 2025 brings together industry leaders to unveil 2025 trends, 2026 outlooks, and the latest breakthroughs in Micro LED glass substrates, SPEC cost reduction, and AR glasses technologies.

Get Trend IntelligenceMicro LED Substrate Ecosystem Comparison and Outlook

Currently, the development of glass-based Micro LED is mainly driven by major brands, resulting in a relatively healthy industry ecosystem. Companies are integrating resources according to their positions within the display industry and planning long-term development strategies.

In contrast, LEDoS supply is currently highly concentrated with JBD, limiting industry development. Cost and technological breakthroughs progress relatively slowly. However, as LEDoS technology gradually matures, costs are optimized, and the AR glasses market potential is realized, LEDoS is expected to drive Micro LED technology toward broader applications, potentially becoming one of the mainstream display technologies.