- About Us

-

Research Report

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- AI Agent

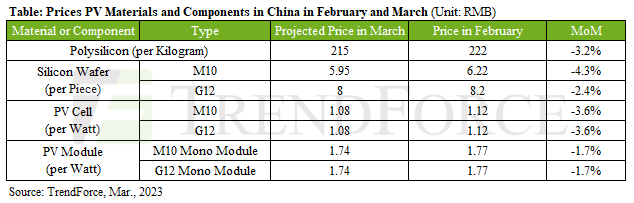

According to TrendForce’s research, polysilicon prices began to plummet in December last year, so the major polysilicon suppliers started to limit market supply. Subsequently, polysilicon prices in China started to rally before the Lunar New Year holiday this January, rising rapidly to the current range of RMB 220~240 per kilogram. However, suppliers did not significantly lower their capacity utilization (operating) rates even as they were holding back supply. Hence, inventory pressure has built up again, and prices have stopped climbing lately. Moving into this March, polysilicon prices are projected to shift down with the MoM decline reaching around 3.2%.

Regarding the market for PV wafers, prices started to rise in February. Early in the year, wafer suppliers maintained a low capacity utilization rate as polysilicon suppliers were controlling their supply. However, customers in the downstream did not scale back their production during the Lunar New Year holiday. As a result, there was a tightening of wafer supply that led to a price hike in the short term. Then, in the second half of February, wafer suppliers significantly raised their capacity utilization rates because polysilicon supply was expanding again. Therefore, wafer prices will not be able to maintain their upward momentum as supply becomes more plentiful. Moreover, wafer suppliers are expected to release a large amount of new production capacity this year. Hence, wafer prices will come back down following the temporary hike.

In the market for PV cells, the major suppliers significantly raised prices in February. Subsequently, cell prices in China returned to an average of RMB 1.1 per watt. As mentioned earlier, polysilicon prices rebounded for a while, thereby raising costs of PV cells. Furthermore, the temporary tightening of wafer supply also put pressure on cell supply. Nevertheless, there was already widespread anticipation for this round of hikes, so cell buyers mostly accepted higher prices.

On the other hand, the rise in prices of materials in the upstream has eased lately. Given that suppliers for PV modules are working hard to lower their costs, TrendForce believes the cell section of the PV industry chain will be constrained from pushing prices upward even as its overall production capacity is tighter compared with the other sections of the industry chain. With prices stabilizing or falling in the other sections, the cell section will have a lot of difficulties in insisting on price hikes. TrendForce projects that cell prices will drop marginally by 3.6% MoM for March. When prices of materials in the upstream show substantial declines, cell prices will again return to a more reasonable range.

Turning to the market for PV modules, prices will also come back down to the usual range following the drop in prices of materials and components. Falling module prices will effectively spur installation demand, and the peak season for installations is expected to arrive earlier compared with the preceding years. Therefore, module suppliers are mostly optimistic about the market situation from this March onward. However, China’s PV industry chain is going to experience sharp price fluctuations in the short term. Besides China, the other major regional markets will also be affected by government policies. In sum, there is still a considerable degree of uncertainty in the development of the global PV market this year.

For more information on reports and market data from TrendForce’s Department of Green Energy Research, please click here, or email Ms. Grace Li from the Sales Department at graceli@trendforce.com

For additional insights from TrendForce analysts on the latest tech industry news, trends, and forecasts, please visit our blog at https://insider.trendforce.com/