- About Us

-

Research Report

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- AI Agent

Leveraging the superior conversion efficiency of N-type cells, the rise of cost-effective TOPCon cell technology in 2022 has seen N-type cell technology rapidly expand, inviting many solar industry participants into the competition. Currently, PERC cell technology (for producing P-type cells) stands as the market's mainstay. However, with the step-by-step realization of large-scale N-type cell capacities, there looms a risk that a substantial part of PERC cell technology capacities may be phased out within the forthcoming two to three years. Concurrently, based on TrendForce’s analysis, as N-type cell capacities incrementally come online, there might be a sporadic shortage of high-quality silicon materials and wafers tailored for N-type cells. This could further establish a noticeable price disparity between N-type silicon and wafers, and their P-type counterparts.

Silicon supply remains abundant, but the price gap between P-type and N-type continues to widen

By 2023's end, it is projected that the total production capacity of polysilicon will reach 2.072 million tons, an increase of 68.6% YoY. The actual output of silicon materials is expected to be about 1.483 million tons, sufficient to support over 600 GW of solar panel consumption (given a silicon consumption rate of 0.245 tons/GW). This aligns with an annual installation demand of approximately 370-390 GW, indicating a clear oversupply of silicon. As the market leans towards N-type cell technology, P-type silicon may face oversupply, causing its price to drop faster. Conversely, robust demand and limited output for N-type silicon might create periodic shortages, stabilizing its price. For silicon firms, N-type silicon offers better profitability.

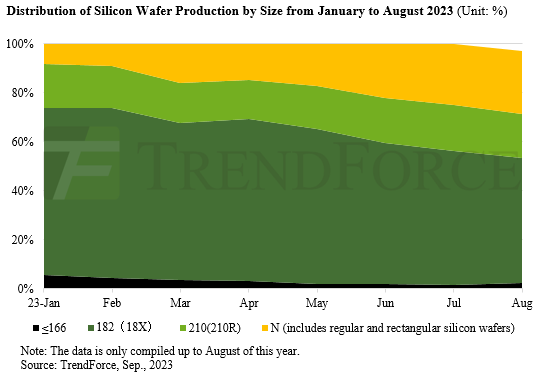

Surging demand for N-type cell slices drives silicon wafer makers to swiftly pivot

By the end of 2023, silicon wafer production capacity is projected to reach approximately 921.6 GW, reflecting a 64.2% year-on-year growth. Driven by the increasing demand for N-type cell wafers, silicon wafer manufacturers are rapidly transitioning to N-type production and ramping up their output. With the inclusion of rectangular silicon wafers occupying a portion of this capacity, certain dimensions of P-type wafers might experience short-term supply shortages, potentially failing to meet immediate demands. If the N-type cell rollout falls short of expectations, there remains a risk of N-type wafer oversupply. Additionally, amid intensified industry competition and considering factors such as technological prowess, availability of high-purity quartz sand, and consistent supply of top-quality silicon wafers, leading companies like Longi and CMC are set to further elevate their competitive edge.

N-cell capacity deployment sees delays; PERC tech likely to remain dominant this year

The projected total cell capacity by 2023's end is estimated to reach around 1,172 GW, marking a 106% increase year-on-year. The majority of this newly added capacity is attributed to N-type TOPCon cell technology. By the end of the year, N-type wafer capacity is expected to reach 676 GW, accounting for 57.7% of the total. However, TrendForce has observed some delays in the actual deployment of N-type cell capacity. Given the existing price difference between N-P type wafers, PERC technology is anticipated to retain its leading position in the market this year, although the penetration rate of TOPCon cells will accelerate.

China expected to hold 80–85% of global solar panel capacity in 2023

Estimations for 2023 indicate that the worldwide solar panel capacity could reach an astounding 1,034 GW, marking a 64.7% increase year-on-year. Of this, approximately 335.4 GW represents newly added capacity, predominantly driven by Chinese enterprises. With Western countries and India progressively launching policies supporting local manufacturing, a growing number of Chinese firms are contemplating setting up production capacities overseas to sidestep trade barriers. TrendForce reports leading Chinese solar panel manufacturers like Longi, JinkoSolar, JA Solar, and TrinaSolar have successively expanded their operations to areas including the US, Europe, and the Middle East. Given the matured technology and cost-effective production of Chinese manufacturers and considering the nascent state of the solar supply chains overseas and the elevated costs of expansion, it remains challenging for enterprises from other regions to join the competition. As such, TrendForce believes that the global competitive landscape for solar panels won't see any marked changes in the near term, maintaining China's dominant position with an anticipated 80-85% capacity share in 2023.

For more information on reports and market data from TrendForce’s Department of Green Energy Research, please click here, or email Ms. Grace Li from the Sales Department at graceli@trendforce.com

For additional insights from TrendForce analysts on the latest tech industry news, trends, and forecasts, please visit our blog at https://insider.trendforce.com/