- About Us

-

Research Report

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- AI Agent

The Li-ion (lithium-ion) battery industry was still in the process of consuming existing inventory during February, and prices of materials in the upstream sections of the industry chain kept falling. According to TrendForce’s research, the average prices of battery-grade lithium carbonate and lithium hydroxide in China registered MoM drops of 9% and 8% respectively for February. The lowest price for battery-grade lithium carbonate dipped below the level of RMB 400,000 per metric ton. In the same month, prices of other cathode-related upstream materials such as cobalt(II,III) oxide and cobalt(II) sulfate reached a trough as well. Lately, prices of cobalt(II,III) oxide and cobalt(II) sulfate have begun to rebound slightly, but there is still insufficient demand to maintain the upward momentum. Moreover, buyers in the downstream sections of the industry chain are currently cautious about stocking up. Besides cathode-related upstream materials, other kinds of battery materials also experienced a price decline simultaneously in February. Prices of artificial graphite products fell by 8~14% MoM, prices of electrolytes went down by 5~8%, and prices of precursors for LFP batteries dropped by more than 15% MoM.

TrendForce points out that the growth of China’s NEV (new energy vehicle) market has decelerated. Even though NEV sales in China rebounded in February after experiencing a slide in January, the demand momentum was not particularly strong. NEV sales in China are estimated to have increased by around 20% MoM for February. Since the level of downstream demand was below expectation, suppliers for NEV power batteries were mainly focusing on reducing existing inventory. They also kept their procurement quantities low for battery materials. As for the present, the market for NEV power batteries is temporarily in oversupply as production continues to expand in the upstream sections, while the downstream sections exhibit sluggish growth.

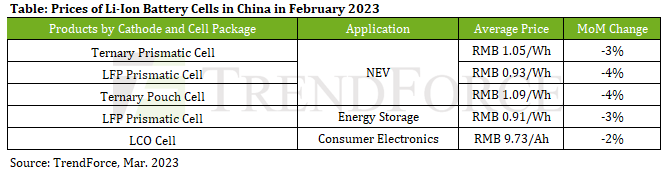

Prices of Li-ion battery cells fell further in February due to the slide in prices of upstream materials. Looking at price trends of NEV power battery cells in China for February, ternary prismatic cells and LFP (lithium iron phosphate) prismatic cells both experienced a MoM drop of around 3~4% in their average prices. The average price of ternary pouch cells for NEV power batteries fell by around 4% MoM. Turning to battery cells used in energy storage equipment, the average price of LFP cells in China fell by 3% MoM to around RMB 0.91 per watt-hour. As for battery cells used in consumer electronics, the average price of LCO (lithium cobalt oxide) cells in China dipped by 2% MoM to RMB 9.7 per amp-hour. The overall demand for electronic devices continued to slump, so the demand for consumer batteries remained weak.

Leading Chinese battery supplier CATL has recently been promoting a “discount scheme for lithium” to downstream customers. Specifically, customers that have signed up to the scheme will get CATL’s batteries at a price that reflects a lock-in cost of RMB 200,000 per metric ton for lithium carbonate. However, those who signed up will have to allocate a significant percentage of their battery demand to CATL over a certain period. This scheme offers a huge cost saving given that the average price of lithium carbonate still exceeds RMB 370,000 per metric ton at this moment. Due to CATL’s bold initiative, other Chinese battery suppliers are following suit by launching their discount plans. This also means that they are going to lean on suppliers for battery materials in the upstream sections to cooperate and cut prices as well. TrendForce believes that currently, downstream demand is still returning at a fairly slow pace. Therefore, as material costs go down, prices of NEV power batteries are expected to slide further in March.

For more information on reports and market data from TrendForce’s Department of Green Energy Research, please click here, or email Ms. Grace Li from the Sales Department at graceli@trendforce.com

For additional insights from TrendForce analysts on the latest tech industry news, trends, and forecasts, please visit our blog at https://insider.trendforce.com/